The European Central Bank (ECB) left interest rates unchanged at a meeting today, in-line with market expectations. ECB is largely seen as done hiking rates already. Statement released along with the decision showed that current level of rates is consistent with reaching the 2% inflation goal and that rates may need to be kept at elevated levels for an extended period of time.

ECB President Lagarde began a post-meeting press conference at 1:45 pm BST today. Below are key takeaways from the presser:

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile app- The economy remains weak

- Subdued demand and tighter financing damp consumption

- The economy is likely to remain weak in the coming months

- Economy should strengthen over the coming years

- There are signs that the labour market is weakening

- Governments should roll back energy support measures

- Structural reforms can help reduce inflation pressures

- Inflation is expected to come down further in the near term

- Energy prices are less predictable due to conflicts

- Domestic price pressures remain strong

- Most measures of longer-term inflation expectations currently stand at around 2%

- Risks to growth skewed to the downside

- Credit dynamics have weakened further

- PEPP was not discussed

- We did not discuss the remuneration of reserves

- Now is not the time for forward guidance, its time for data-dependancy

- Debate on rate cuts is premature

- ECB has to be steady and has to hold

- Rise in yields is a spillover we take into account and helps bring inflation down

- More tightening is in pipeline for real economy

- Hold doesn't mean we won't ever hike again

- Growth has weakened and PMI data is not indicative of vigour

- Today's decision was unanimous

- I am not going to say we are at peak rates

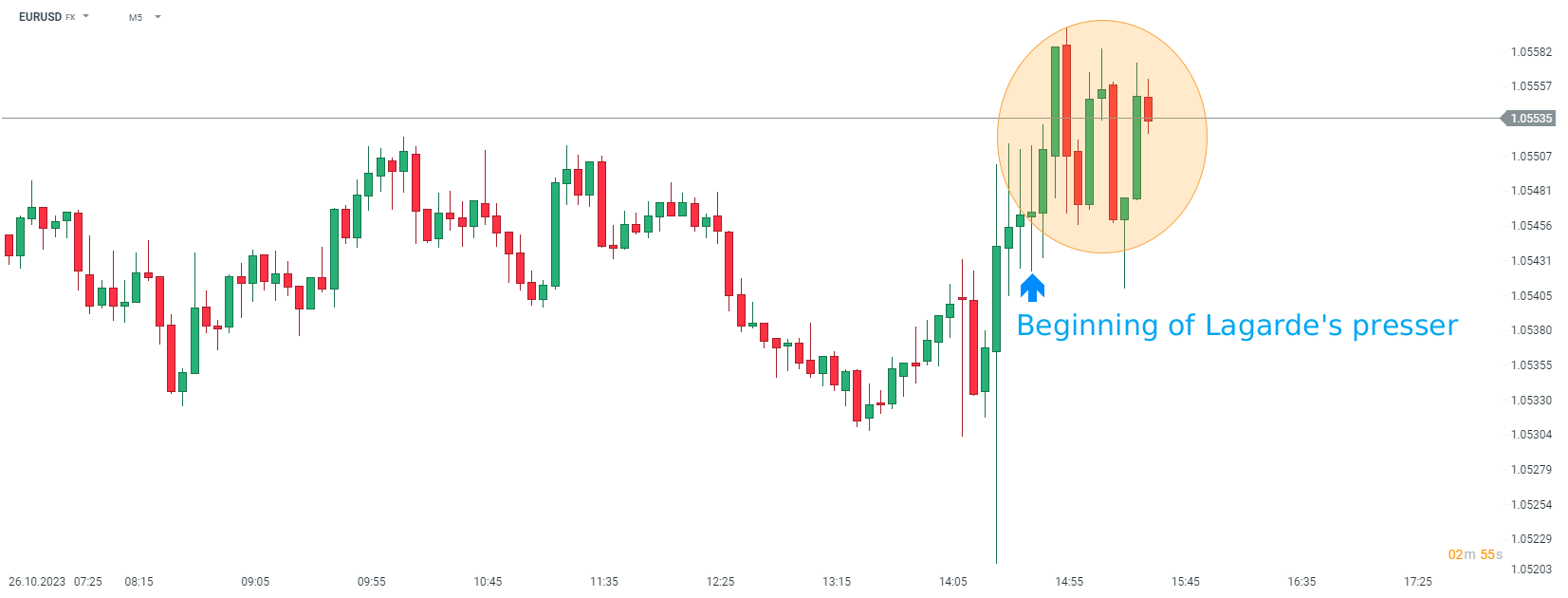

EURUSD gained at the start of Lagarde's presser but has began to swing later on. The pair is up around 0.1% over the course of the press conference. European indices are also trading slightly higher compared to pre-conference levels.

Source: xStation5

Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.