Alphabet Inc. (GOOGL.US) experienced a decline in its share price, dropping 6.0% in premarket trading, following its third-quarter earnings report which revealed a slowdown in its cloud business growth. Despite overall revenue exceeding analysts' expectations, Alphabet's cloud computing unit reported an operating income of $266 million, falling short of the estimated $434 million. This shortfall raised concerns about Alphabet's competitive position in the crucial cloud market, where it already lags behind Amazon and Microsoft. The cloud unit, which turned a profit for the first time earlier this year, has been gaining traction with AI startups, but its recent performance didn't meet expectations, leading to worries about an increasing gap with its competitors.

- Alphabet’s profit was pressured by multiple one-time costs and slower cloud growth

- Cloud growth decelerated and management indicates that “optimizations remain ongoing”

- Alphabet’s cloud unit missed estimates and that is tied to IT spending

Key metrics:

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app-

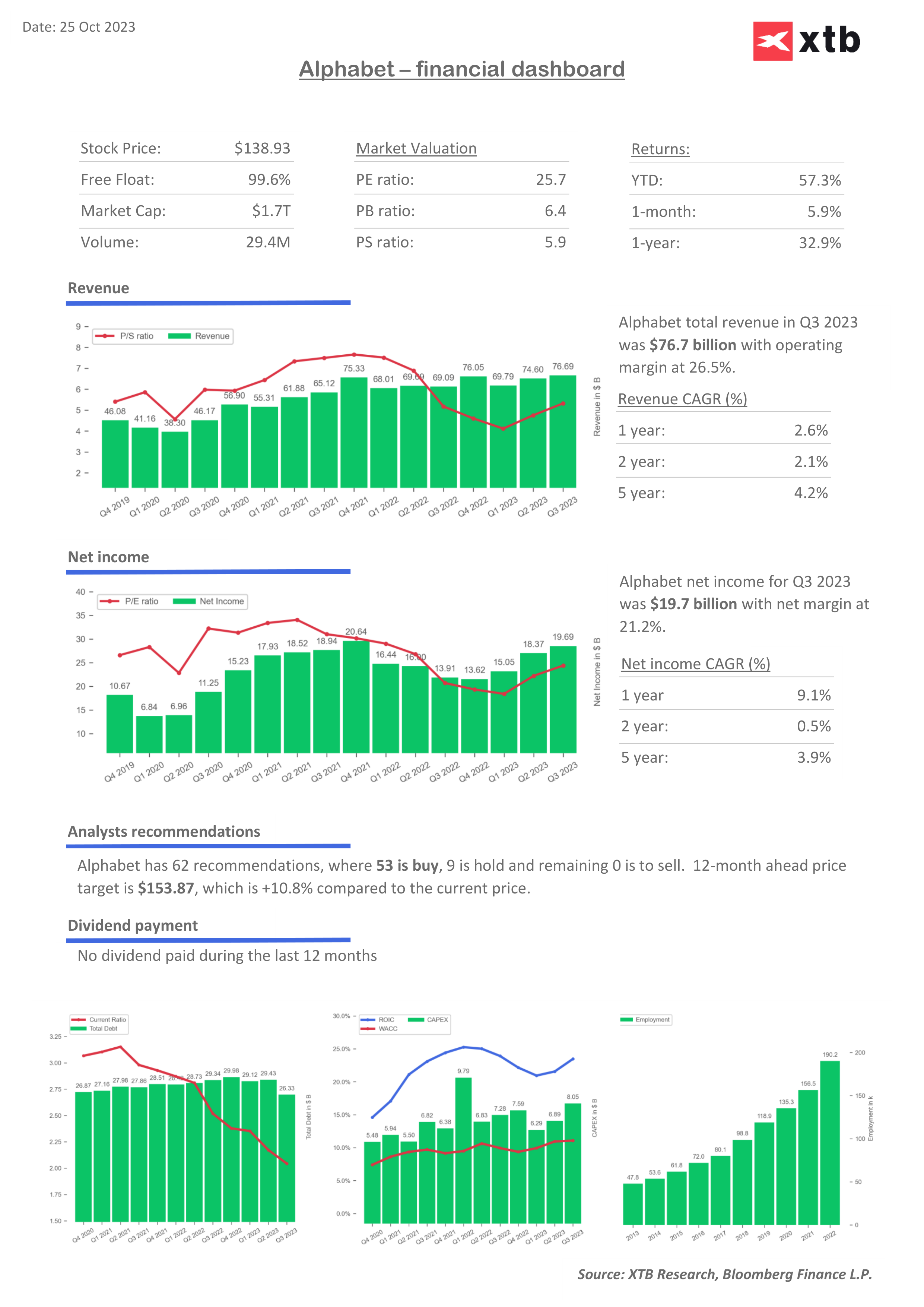

Total Revenue: $76.69 billion, surpassing the estimate of $75.54 billion

- Google Advertising Revenue: $59.65 billion, higher than the estimate of $58.94 billion

- YouTube Ads Revenue: $7.95 billion, exceeding the estimate of $7.8 billion

- Google Other Revenue: $8.34 billion, above the estimate of $7.94 billion

- Google Services Revenue: $67.99 billion, higher than the estimate of $66.89 billion

- Google Cloud Revenue: $8.41 billion, below the estimate of $8.6 billion

- Other Bets Revenue: $297 million, surpassing the estimate of $258.8 million

-

Earnings Per Share (EPS): $1.55, higher than the estimate of $1.45

-

Operating Income: $21.34 billion, slightly below the estimate of $21.44 billion

- Google Services: $23.94 billion, exceeding the estimate of $22.89 billion

- Google Cloud: $266 million, significantly below the estimate of $433.6 million

- Other Bets: loss of $1.19 billion, slightly better than the estimated loss of $1.2 billion

-

Operating Margin: 28%, marginally below the estimate of 28.1%

Financially, Alphabet reported third-quarter sales and net income slightly better than forecasted. However, the company is facing new challenges in the search market due to the rise of generative AI chatbots, like those backed by Microsoft's Open AI Inc.’s ChatGPT. Alphabet CEO Sundar Pichai and Porat emphasized their commitment to operating more efficiently, including maintaining a slower pace of headcount growth, to maximize investment in areas like AI. Despite these efforts, Alphabet's ongoing legal challenges and the performance of its other startups investments continue to influence investor sentiment.

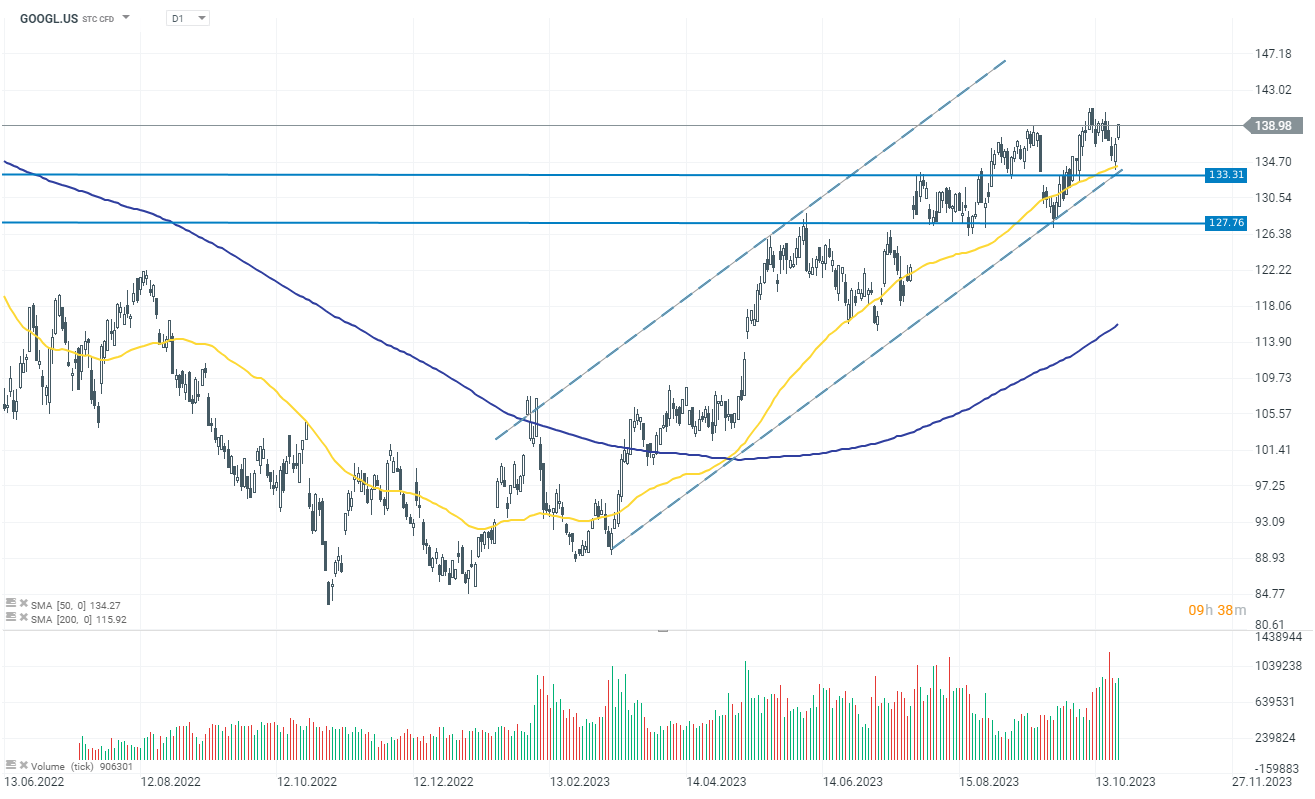

The stock lost about 6.0% in pre-session trading after the quarterly results and is currently trading at about $130. However, the results were not significantly worse, and in most sectors were even better than analysts' expectations. Therefore, the intitial panic may prove to be temporary, and the beginning of the cash session will bring a rebound in the price. Source: xStation 5

The stock lost about 6.0% in pre-session trading after the quarterly results and is currently trading at about $130. However, the results were not significantly worse, and in most sectors were even better than analysts' expectations. Therefore, the intitial panic may prove to be temporary, and the beginning of the cash session will bring a rebound in the price. Source: xStation 5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.