American Airlines (AAL.US) stock surged more than 70% in premarket trading after the company posted upbeat quarterly results. The airline $3.86 per share for its latest quarter, smaller than the $4.11 loss that Wall Street analysts had anticipated. Total operating revenue fell to $4.03 billion while the market expected a drop to $3.86 billion. Daily cash burn fell to $30 million in Q4. American did post an $8.9 billion annual loss for 2020 as the pandemic severely cut travel demand. The company expects that revenue in the first quarter will be 60%-65% lower compared to last year.

American Airlines (AAL.US) shares jumped 27% to 21.80 on the stock market today after soaring 70% in premarket trading. However price quickly pulled back and is currently testing support at $18.47. Today's wild swings come as heavily shorted stocks have become a battleground between retail investors and Wall Street hedge funds. Amateurs are betting those stocks will rise, resulting in massive spikes for AMC Entertainment (AMC.US) and GameStop (GME.US) recently. However, institutional investors gained advantage at the beginning of the US session, as various online brokerages made it harder to buy the heavily-shorted stocks that have been squeezed hardest in recent sessions. As a result, stock prices of the above companies fell sharply.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app American Airlines (AAL.US), D1 interval. Source: xStation5

American Airlines (AAL.US), D1 interval. Source: xStation5

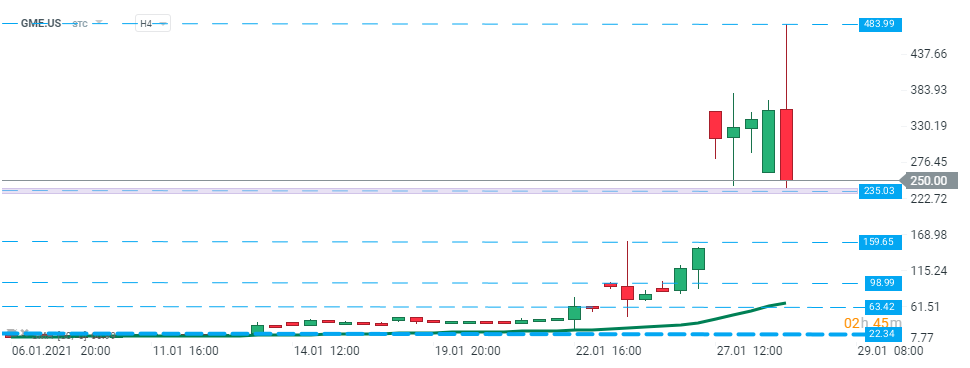

GameStop (GME.US), H4 interval. Source: xStation5

GameStop (GME.US), H4 interval. Source: xStation5

AMC Entertainment (AMC.US), H4 interval. Source: xStation5

AMC Entertainment (AMC.US), H4 interval. Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.