Apple (AAPL.US) shares surged this year but the company has so far not indicated where it sees a place for itself in terms of AI technology development. What's more, Q2 results showed that the company is stagnating in device sales although it continues to post record net profits and improve margins. Today, Apple will unveil the latest flagship iPhone version 15. This event is always widely reported in the technology industry and if the company, along with the presentation, provides more clues about, for example, the potential development of Apple AI so called Siri. The stock price may also react to it.

Context of the iPhone15 premiere

- Apple continues its strategy of monotizing most of the improvements to 'Pro' models - more expensive than the base versions of iPhones. In times of economic 'prosperity' and consumption, this worked well and quite a few buyers agreed to pay more for the premium versions - their sales outstripped the base versions, supporting margins;

- LVMH recently warned that spending on luxury goods in the U.S. is falling sharply. Although they are different industries, Apple's products are in the premium segment among technology, and LVMH's warning raises a question mark over whether Apple will do as well in a time of expensive credit, high debt costs, tightening credit standards at banks and a potential recession in an environment of elevated inflation;

- 75% of the time to date, Apple's stock price has fallen after the release of new iPhones.

- With officials in China banning the iPhone - the market has begun to fear a potential extension of this 'ban'. China accounts for about 20% of Apple's revenue, and Morgan Stanley estimates lower sales by 4% this year - precisely because of China's move;

- According to Counterpoint Research, smartphone shipments in the global market in Q2 totaled 294.5 million vs. 268 million in Q1 but Apple held its strongest ground against the competition, iPhone shipments totaled 45.3 million vs. 46.5 million previously (but still a lower figure)

- Geopolitics is an additional factor; the company has a manufacturing chain almost entirely in Asia, including much of it in China. Tensions between Washington and Beijing have been rising recently

- Apple estimated that profits this year will fall by roughly 2% through currency effects, indicating that the company potentially expects a weaker dollar (most of its costs are in local currencies, in Asia)

- Potential stagnation in sales could mean that the market will change perceptions of Apple's valuation, which still enjoys the designation of a growth company - driven not only by Apple but also by powerful share buyback programs, high-margin services or the dynamic development of Apple Pay. However, without continued positive growth in device sales, the market may begin to question how much of a valuation premium the company deserves.

Technical analysis

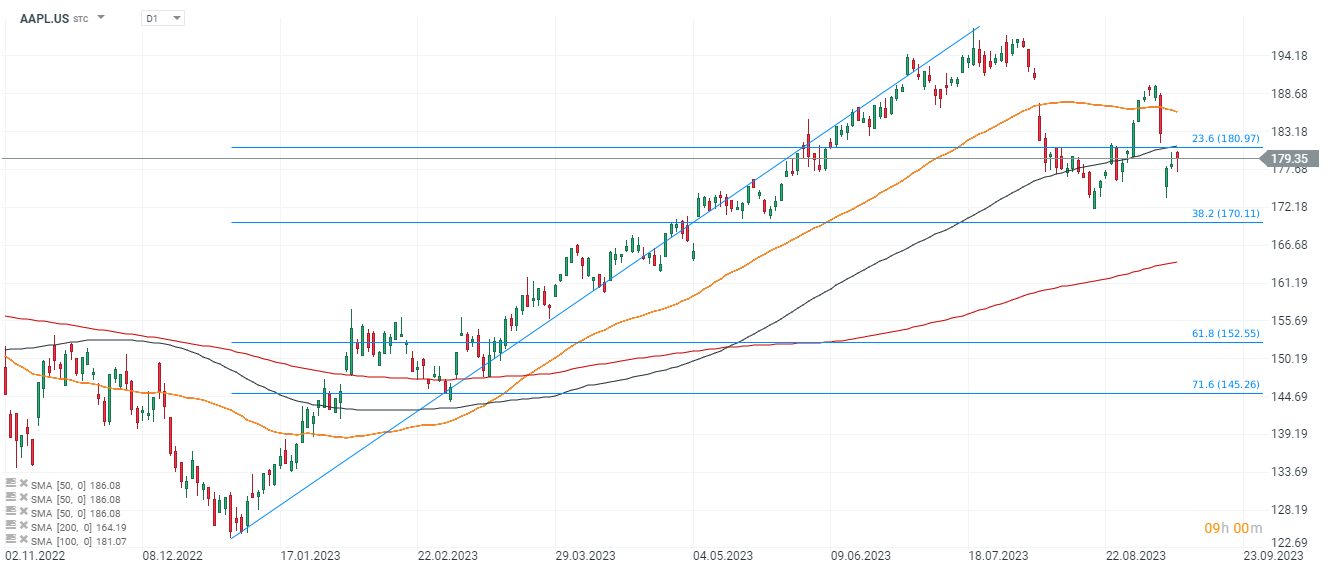

Looking at the chart of Apple (AAPL.US), we see that the price has settled below the SMA50 and SMA100, and the last time it traded below both of them was at the beginning of the year. The main resistance level is set by the 23.6 Fibonacci retracement of the upward wave from January. A potential lower oversold range is at $170, where we see the 38.2 Fibo, and just below at $165 runs the long-term trend-setting SMA200 (red line).

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appSource: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.