GBPUSD pair and UK100 futures contracts which are tied to the British FTSE100 index fell sharply today as investors dumped riskier assets amid ongoing concerns over the European banking system. Also traders digested UK finance minister Hunt's budget. The Chancellor pledged to halve inflation, lower debt and get the economy growing, saying the UK would not enter a technical recession this year and inflation will likely fall to 2.9% by the end of 2023. Hunt sees economic contraction of 0.2% in 2023, significantly lower compared to earlier forecasts of 1.4% contraction. Expects unemployment rate to rise to 4.4%.

Start investing today or test a free demo

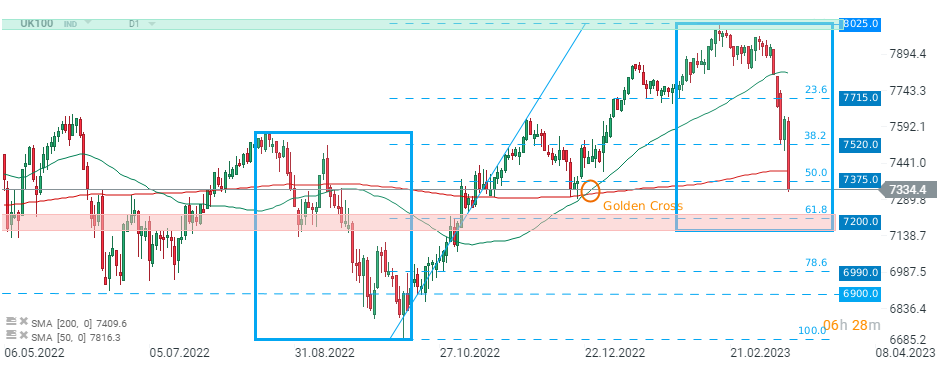

Open real account TRY DEMO Download mobile app Download mobile appUK100 plunged over 3.7% on Wednesday and broke below major support at 7375 pts, which coincides with 200 SMA (red line) and 50.0% Fibonacci retracement of the last upward wave. If current sentiment prevails, sell-off may deepen towards the next major support zone around 7200 pts which is marked with lower limit of the 1:1 structure and 61.8% retracement. Source: xStation5

GBPUSD fell more than 1.0% as buyers failed to break above major resistance at 1.2215, which is marked with previous price reactions. Current pair approaches the earlier broken upper limit of the descending channel. Should break lower occur, next support to watch is located around 1.1850 and is marked with lower limit of the local 1:1 structure and 38.2% Fibonacci retracement of the downward wave started in June 2021. Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.