Antipodean currencies AUD and NZD are among the best performing G10 currencies today. Gains on the base metals markets are providing support for the Australian dollar while New Zealand dollar is advancing following general elections in New Zealand that saw right-wing parties win. The pair may also remain somewhat more active this evening and overnight as there are 2 important releases scheduled - New Zealand Q3 CPI report (10:45 pm BST) and RBA minutes (1:30 am BST).

New Zealand inflation data is expected to show a CPI acceleration from 5.9% YoY in Q2 2023 to 6.0% YoY in Q3 2023. On a quarterly basis, inflation is seen reaching 2.0% QoQ, up from 1.1% QoQ in Q2 2023. When it comes to RBA minutes, the document is related to a meeting held 2 weeks ago at which central bankers decided to keep rates unchanged.

Start investing today or test a free demo

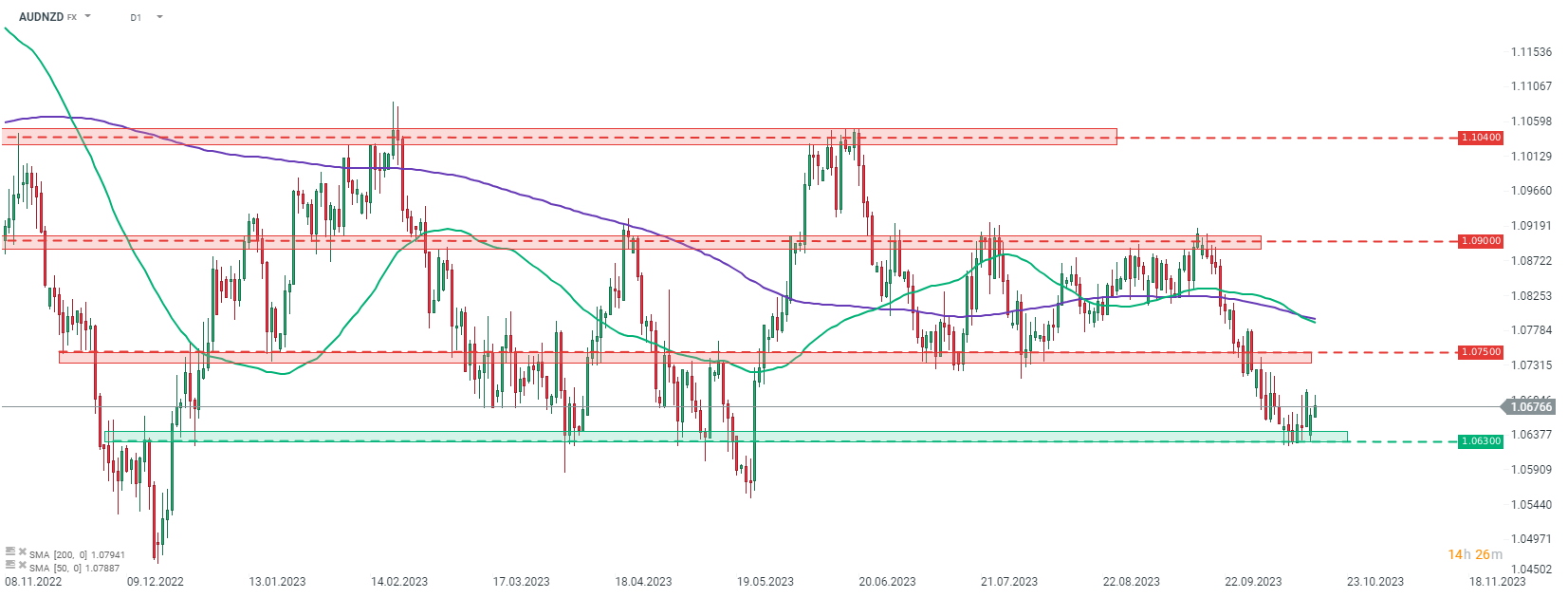

Open real account TRY DEMO Download mobile app Download mobile appTaking a look at AUDNZD chart at D1 interval, we can see that the pair halted recent decline at the 1.0630 support zone and launched a recovery move. However, bulls struggle to maintain momentum with the pair pulling back from daily highs. Should we see the recovery gain traction, the near-term resistance zone to watch can be found in the 1.0750 area.

Source: xStation5

Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.