- Bitcoin gained even more than 7.0% in yesterday's session

- Why is Grayscale's win over the SEC so important?

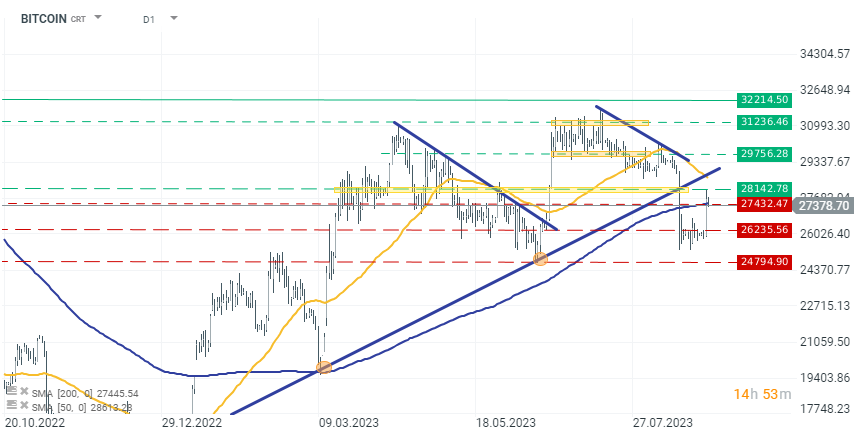

- Technically, BTC rebounded from a significant resistance zone

Bitcoin gained even more than 7.0% after Grayscale's legal victory over the SEC yesterday. The case concerned a decision by the U.S. Securities and Exchange Commission (SEC) to reject Grayscale's application to convert its over-the-counter Grayscale Bitcoin Trust (GBTC) into a listed Bitcoin exchange-traded fund (ETF). Grayscale had filed a lawsuit against the SEC, arguing that the denial was arbitrary and lacked sufficient explanation for why the SEC treated Bitcoin futures ETFs differently than spot Bitcoin ETFs. U.S. Court of Appeals Circuit Judge Neomi Rao sided with Grayscale, ordering that their petition for review be granted and the SEC's denial be vacated. The judge stated that the SEC failed to "offer any explanation" for its decision, thereby raising questions about the regulatory body's treatment of Grayscale's application. However, the judge's ruling doesn't automatically guarantee that a Grayscale spot Bitcoin ETF will be listed.

Both parties now have 45 days to appeal the court's decision, which could potentially escalate the case to the U.S. Supreme Court or lead to an en banc panel review. The SEC has not yet indicated whether it plans to challenge the ruling, but industry experts believe that the arrival of spot Bitcoin ETFs in the U.S. is imminent, possibly as early as the first quarter of 2024.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appGrayscale's CEO, Michael Sonnenshein, has stated that their legal team is "actively reviewing" the court's decision. With the court ruling in hand, Grayscale is likely to continue pushing for its spot Bitcoin and possibly Ethereum ETF applications, considering that it views this as a watershed moment for the crypto industry. If no appeals are made within the 45-day period, this case could pave the way for Grayscale and other companies to bring crypto-based financial products to a broader market.

After this decision, the cryptocurrency market exploded. BTC gained over 7.0%, ETH over 5.0%, and some altcoins even more. However, sentiment towards BTC remains either negative or neutral, as evidenced by the significant pullback in the cryptocurrency today, rather than a continuation of gains. The price reacted to key support around $28,000, and since then, selling pressure has been pushing the price downward. Currently, BTC is trading at $27,400, and if the trend continues, a return below $27,000 is possible.

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.