Supply and transport concerns are driving the price of coffee higher

Within the last two weeks coffee has resumed its uptrend, after the price of Arabic broke above the 200 cents per pound level. There are several factors contributing to the rise in coffee prices, however concerns regarding coffee production in the next season play the major role. The coffee-growing areas in Brazil have experienced low temperatures this year, which have had a negative impact on the coffee crops. In addition, farmers had to deal with periodic droughts, which also lowered production prospects for next year. While we should still experience oversupply in the coffee market this year, the situation may change in 2022 and we may witness a deficit. However, the ICO, an institution which analyzes the global coffee market, did not provide any estimates so far, but according to some analysts’ in the worst case scenario, the deficit could reach as much as 5-10 million bags of coffee. The current level of coffee stocks in Brazil is around 3.5 million bags.

In addition, some delivery issues emerge. Currently, deliveries can take up to 100 days compared to 30 before the pandemic period. Production problems are also seen in other countries around the world, such as India and Ethiopia. Finally, it is also worth paying attention to the La Ninca weather phenomenon, which could lead to a further lowering of production prospects in South America.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app

Coffee price broke above 230 cents per pound and is trading above the 61.8% Fibonacci retracement of the last major downward wave launched back in 2011 around all-time high. Currently, the price of coffee is about 30% below its record level of 330 cents a pound. Source: xStation5

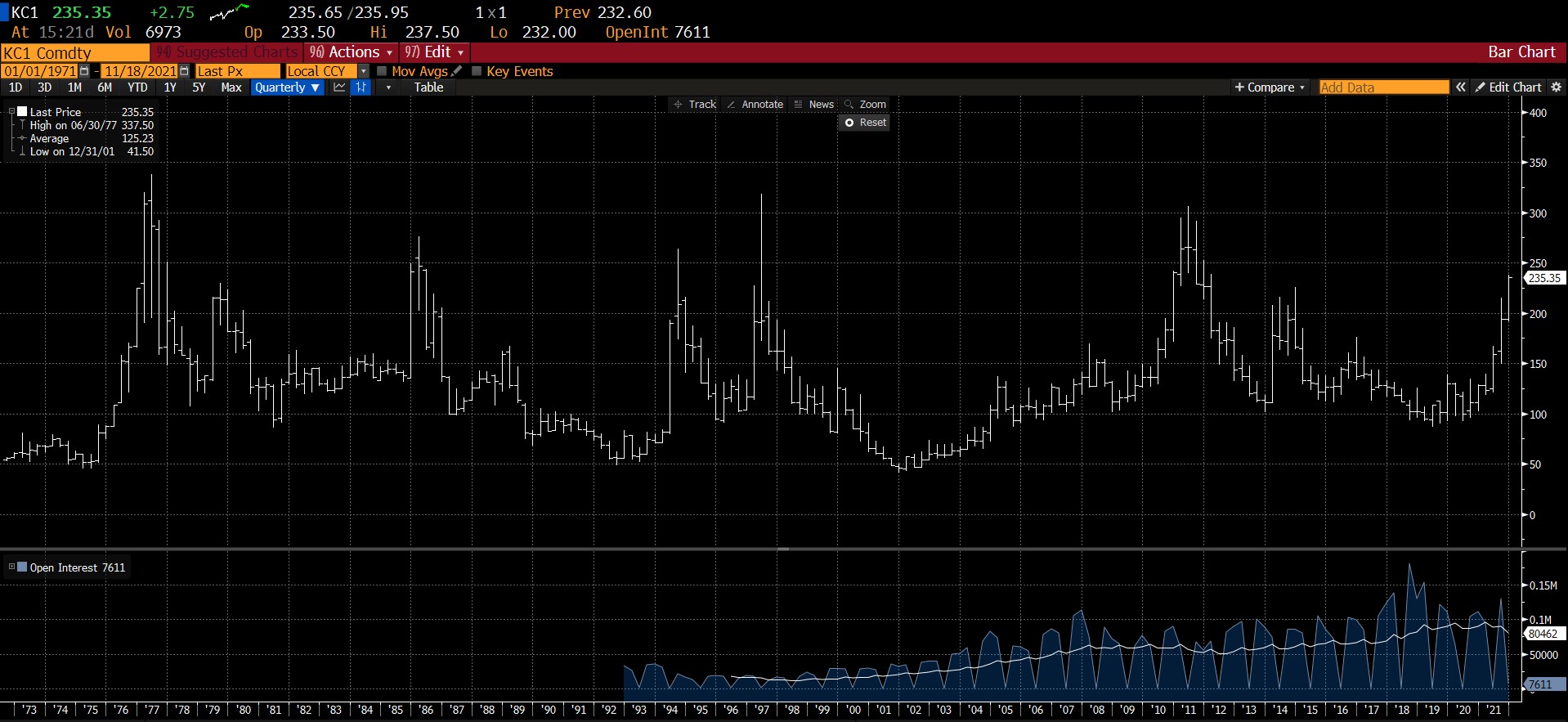

The price of coffee since the 1970s. As one can see, coffee is approaching its ATH, which has often led to price decline. Nevertheless, prices could have remained at high levels even for several quarters. Source: Bloomberg

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.