Oil

-

WTI breaks above key resistance, paving the way for a test of $72.50 mark

-

Bank of America expects oil price to reach $100 per barrel over the next 6 months (under the assumption of severe winter)

-

Oil also gains as another hurricane hits US Gulf coast, this time in Texas

-

Weather outlook start to impact natural gas prices and may also begin to influence oil prices

-

Oil bulls do not seem to be concerned about lower demand forecasts from OPEC. This creates a basis for halting OPEC+ output increases, what should have a positive impact on prices over the medium term

-

Strengthening of the US dollar remains one of the key risks for oil price gains

OIL.WTI broke above the downward trendline, paving the way for a test of the resistance near $72.50 mark. Source: xStation5

OIL.WTI broke above the downward trendline, paving the way for a test of the resistance near $72.50 mark. Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appNatural Gas

-

Natural gas prices in the United States jumped above 5 USD per MMBTU

-

Natural gas prices increased in October during the past 4 years

-

Concerns mount ahead of the start of US heating season. On the other hand, this September is the hottest one since 1950, leading to a jump in demand for electricity for air conditioning

-

Around half of the US natural gas production in the Gulf of Mexico remains suspended

-

Concerns over Democrats actions against US fracking. Should ban of fracking go through and high export demand is maintained, natural gas prices may increase further

-

According to American Energy Alliance research, United States may import up to 30% of needed natural gas should Democrats' plans go through. US is net exporter currently

Ban on fracking may have a massive impact on the US economy. Source: AEA

Ban on fracking may have a massive impact on the US economy. Source: AEA

Palladium

-

Palladium drops amid significant slowdown in demand from automotive sector

-

Interestingly, lower demand for palladium is not a result of lower auto demand but rather lack of available chips for production. As a result, unit production is limited and therefore demand for car catalytic converters

-

drops as well

-

Toyota announced that it will cut production by 330 thousand units in October, meaning a 40% reduction compared to initial plan

-

It is also said that a new technology is being developed that will allow to substitute palladium with platinum in car catalytic converters production

Palladium price dropped to around $2,050 per ounce, where the upward trendline can be found. On the other hand, palladium dropped below the $2,300 area marked with the lower limit of the overbalance structure and the lower limit of the downward channel, suggesting that bears' are in advantage. Source: xStation5

Palladium price dropped to around $2,050 per ounce, where the upward trendline can be found. On the other hand, palladium dropped below the $2,300 area marked with the lower limit of the overbalance structure and the lower limit of the downward channel, suggesting that bears' are in advantage. Source: xStation5

Soybean

-

Declines on the soybean market decelerate recently in spite of WASDE report turning out to be not so positive for agricultural goods

-

WASDE report showed much higher end stocks (although still very low in historical terms), higher production and high yields

-

On the other hand, crop quality remains very low, what may put high yield estimates under question

Latest WASDE report was rather negative for prices but actual data on harvest may turn out to be weaker. Source: Bloomberg

Latest WASDE report was rather negative for prices but actual data on harvest may turn out to be weaker. Source: Bloomberg

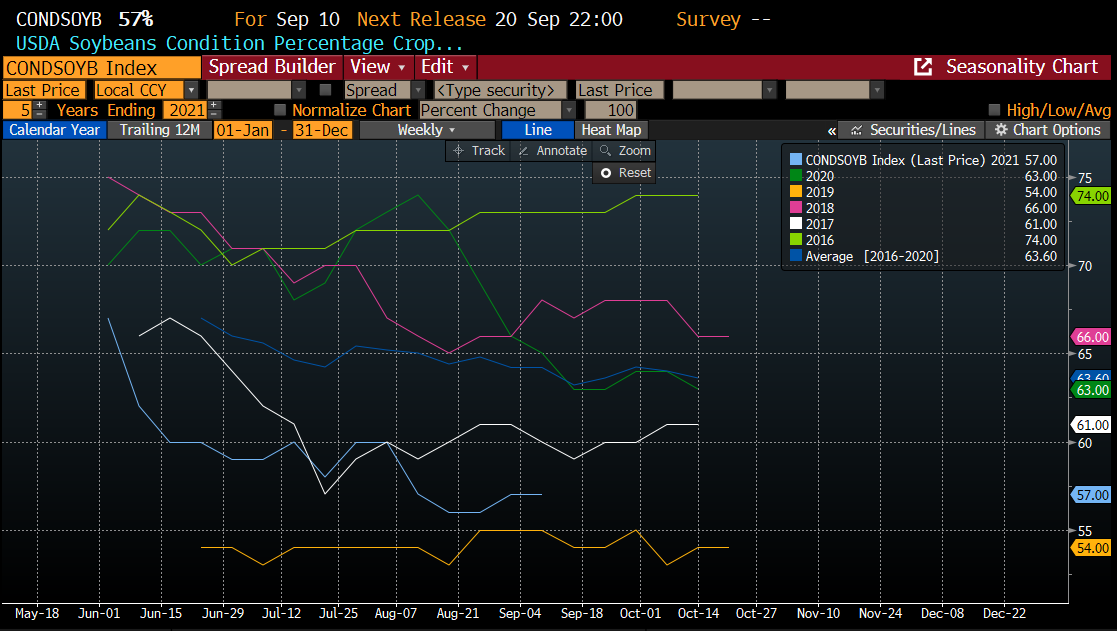

Crop quality in the US is low compared to the previous 5 years. The United States needs rainfall and current September is the hottest one since 1950. October may also turn out to be warm and dry. Source: Bloomberg

Crop quality in the US is low compared to the previous 5 years. The United States needs rainfall and current September is the hottest one since 1950. October may also turn out to be warm and dry. Source: Bloomberg

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.