Cryptocurrency and blockchain-related stocks, including Riot Blockchain (RIOT.US), Microstrategy (MSTR.US) and Coinbase (COIN.US), plunged over 10.0% as bitcoin tumbled more than 15% amid a wider market selloff. Also several industry related news weigh on investors moods. Major cryptocurrency lender Celsius announced on Sunday it would pause "all withdrawals, Swap, and transfers between accounts," citing "extreme market conditions," without specifying further. Today Binance, the world's largest cryptocurrency exchange, has temporarily suspended client withdrawals of Bitcoin due to a "stuck transaction,"Chief Executive Changpeng Zhao informed via Twitter. Additionally Binance received a lawsuit from a U.S. investor who claims the company falsely marketed Terra USD as a safe asset ahead of the so-called stablecoin's collapse in value last month. The sentiment is extremely bearish towards the sector, which on the one hand may lead to further declines. On the other hand, such negative attitudes of investors in the past often created interesting investment opportunities for long-term buyers.

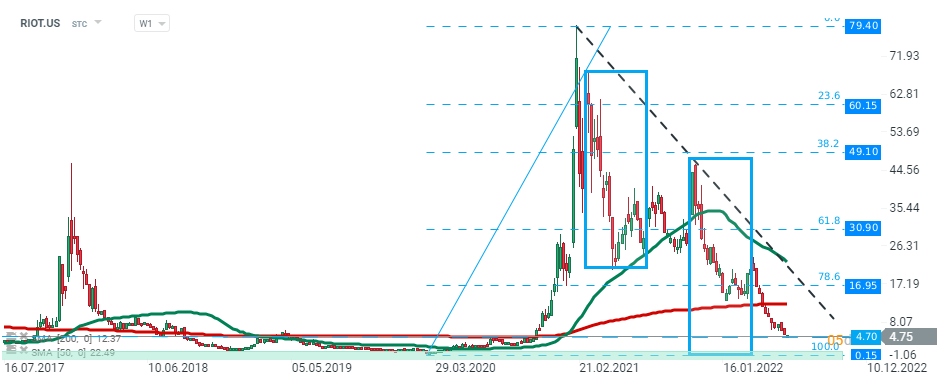

Riot Blockchain (RIOT.US) stock fell nearly 95.0% from 2021 high and is currently testing local support at $4.70. However if sellers manage to uphold current momentum, support at $0.15 may be at risk. This level is marked with previous price reactions and lower limit of the 1:1 structure. Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appThe content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.