Despite the radical move by the CBRT, which that week raised rates from 17.5 to 25 percent (versus 20 percent expectations by Reuters analysts), the Turkish lira quickly resumed its downward trajectory. Speculators have been steadily playing out the scenario of further depreciation of the Turkish currency, and the radical move by the Central Bank of the Republic of Turkey ultimately failed to cause a sharp reversal of the trend. EURTRY rose above 29 points today, which makes a test of 30 points in the past and a possible complete erasure of last week's abject downward movement on the currency pair likely.

Looking at EURTRY on the H1. interval, we see that the price rose slightly above the SMA200 (red line) signaling the strength of the sell-off on TRY. After a sizable drop to the area of 27 points, the bulls managed to stop the movement and failed to test the 38.2 Fibonacci retracement of the May 2023 upward wave (before the Turkish elections). As a result, the price again defeated the SMA50, which could potentially herald a momentum advantage on the buyers' side. At the same time, the RSI indicator has risen to near overbought territory. In the current situation, the base scenario in the horizon of the coming hours seems to be consolidation at the current levels around 29 points, which may precede an upward movement and cool the relative strength index.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appSource: xStation5

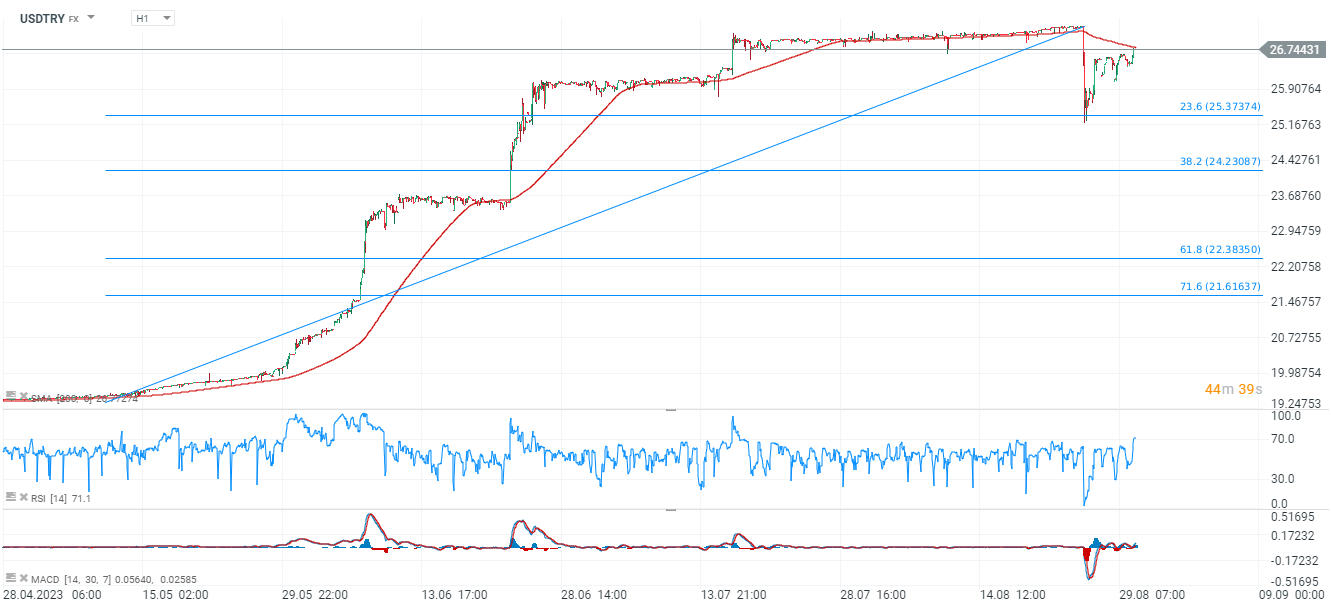

Of course, a similar situation is taking place on the USDTRY pair, where the price is still struggling with the SMA200 (red line) at 26,744 points. The 23,6 Fibonacci near 23.6 level of the upward wave from May proved to be strong support, from where speculators again saw a risk premium.

Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.