A flight to safety can be spotted on the global financial markets ahead of the weekend. Risk of escalation in the Middle East remains real and investors seem to be positioning for it, or at least are reducing their bets in riskier assets. Stock market indices from Europe and the United States traded lower today with US100 being down over 1% today. At the same time, we can see rather strong gains on the precious metals market, even as yields keep climbing. Gold is up 0.7% on the day while silver rallies almost 2%. Meanwhile, oil is defying pullback in risky assets and is flat on the day what further supports the narrative that moves on the global markets today are driven by fears of Middle East escalation.

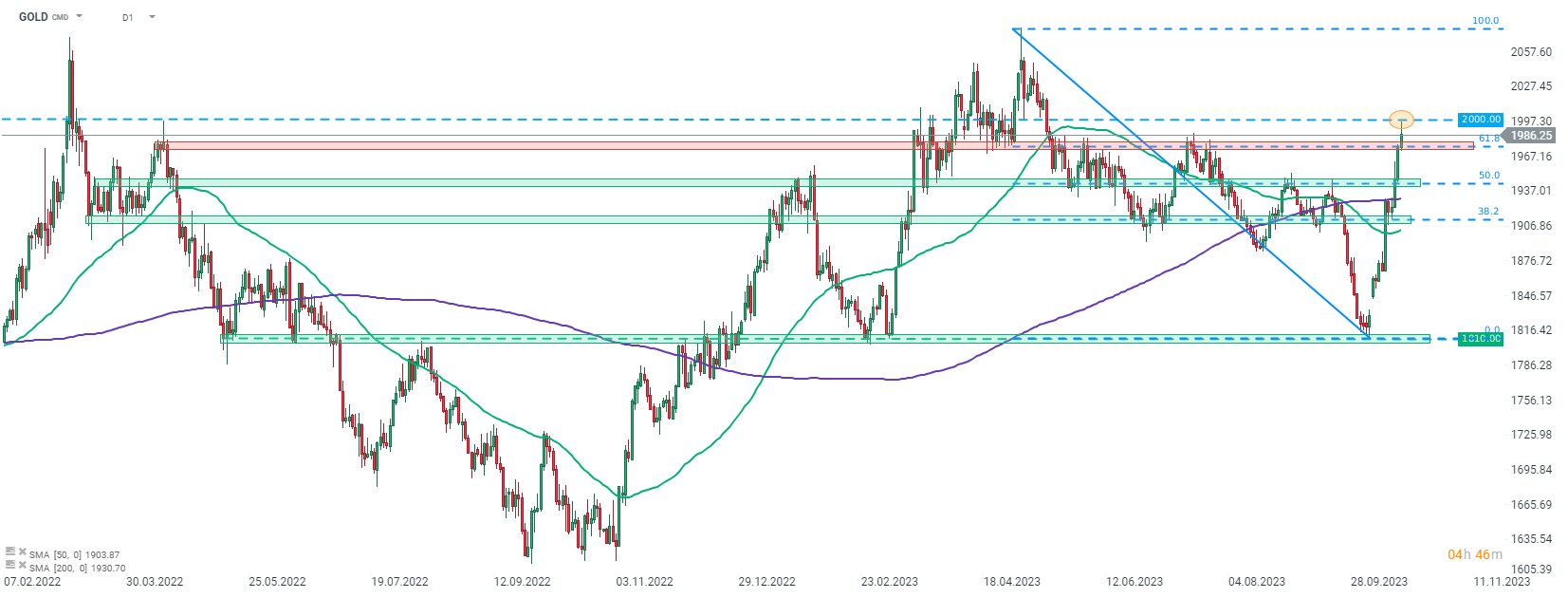

Taking a look at GOLD chart at D1 interval, we can see that the price of this precious metal has almost reached a psychological $2,000 per ounce level earlier today and trades at the highest level since mid-May 2023. Gold price has already jumped around 10% since the beginning of Israel-Hamas war and bulls do not seem to be bothered by today's pick-up in yields. However, around half of today's gains has been erased already and should gold swing to negative by the end of the day, a bearish pin bar pattern would be painted in a important resistance area, marked with 61.8% retracement of the May-October downward move.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app GOLD has almost reached a psychological $2,000 per ounce level earlier today. Source: xStation5

GOLD has almost reached a psychological $2,000 per ounce level earlier today. Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.