Microsoft (MSFT.US), a major US tech company, is scheduled to report its fiscal-Q1 2024 (calendar Q3 2023) today after the close of the Wall Street session. Company is expected to report the fourth consecutive quarter of below-10% growth in total revenue. However, revenue growth in the Intelligent Cloud business is expected to pick up compared to fiscal-Q4 2023. Let's take a quick look at what to expect from Microsoft's results.

Fiscal-Q1 2024 expectations

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app- Revenue: $54.54 billion (+8.7% YoY)

- Productivity & Business Processes: $18.29 billion (+10.8% YoY)

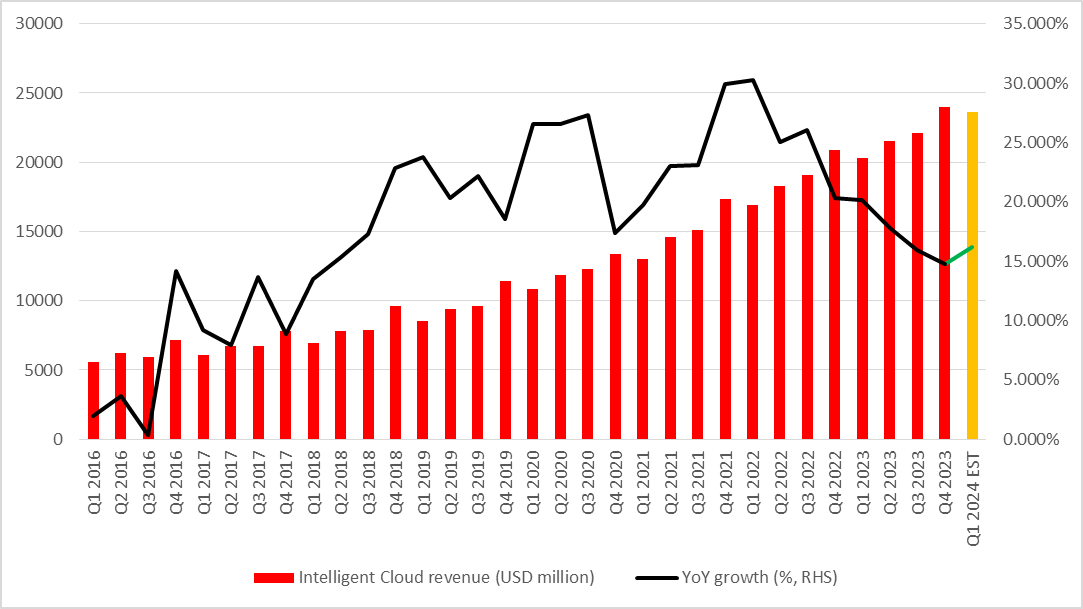

- Intelligent Cloud: $23.61 billion (+15% YoY)

- More Personal Computing: $12.89 billion (-4.1% YoY)

- Adjusted Gross Profit: $38.02 billion (+9.7%)

- Adjusted Gross Margin: 69.3% (69.2% a year ago)

- Adjusted Operating Income: $24.12 billion (+12.1% YoY)

- Productivity & Business Processes: $9.23 billion

- Intelligent Cloud: $10.31 billion

- More Personal Computing: $4.41 billion

- Adjusted Operating Margin: 44.3% (42.9% a year ago)

- Productivity & Business Processes: 50.5%

- Intelligent Cloud: 43.7%

- More Personal Computing: 34.2%

- Adjusted Net Income: $19.74 billion (+12.4% YoY)

- Adjusted EPS: $2.66 ($2.35 a year ago)

- Cash Expenditures: $9.25 billion

Growth in cloud segment expected to pick-up

Microsoft is expected to report higher sales and profits for the quarter ended on September 30, 2023. However, there are some concerns about the pace of the growth, especially when it comes to the key cloud segment. Analysts expect sales growth in the Intelligent Cloud segment to reach 15-16% YoY. While this would be slightly higher growth than the one achieved in fiscal-Q4 2023 (calendar Q2 2023), it would be lower than 26% achieved in fiscal-Q1 2023 (a year ago quarter). Performance of the cloud segment will be closely watched as demand for generative AI is strong and Microsoft has invested heavily in the field. Forecasts for fiscal-Q2 2024 as well as full fiscal-2024 may be a key point in the upcoming earnings release from Microsoft.

Source: Bloomberg Finance LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

Will AI bring turnaround?

If analysts' expectations are met and Microsoft indeed reports 8.7% YoY growth in total revenue in fiscal-Q1 2024, it would mark the fourth consecutive quarter of below-10% revenue growth for the company. There is a lot of promise in AI, and it is already supporting Microsoft's Azure results. However, it remains unknown how much AI will impact a company's overall results. Analysts will look for hints - qualitative or quantitative - on how big this impact may be. Microsoft has recently announced a 5 billion AUD investment in AI in Australia and analysts are likely to press management on the earnings call about more details. Apart from AI, traders will also look at how the company view's impact of its recent acquisition of Activision Blizzard on its business.

Source: Bloomberg Finance LP, XTB

Source: Bloomberg Finance LP, XTB

A look at the chart

Taking a look at Microsoft (MSFT.US) chart at D1 interval, we can see that the stock has recently pulled back from all-time highs reached in mid-July 2023. Stock has been trading sideways between 23.6% and 38.2% retracements of the upward move launched in October 2022. An attempt was made recently to break above the upper limit of the range but bulls failed to do so. A small pullback was launched later on and it looks to have been halted at the 50-session moving average (green line). Stock continues to trade near the upper limit of the range and should Microsoft earnings report surprise positively, an upside breakout may be a matter of time.

Source: xStation5

Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.