- Asia-Pacific market indices are trading lower, reflecting the negative sentiment seen on Wall Street yesterday.

- Shares of Meta Platforms (META.US) fell 3.4% in the market after the close of the U.S. session, although initial reaction to better quarterly results lifted the stock as much as 5% higher.

- Mark Zuckerberg's company reported better-than-expected third-quarter results, with revenue rising 23%, the fastest pace of growth since 2021.

- European futures pointed to a sharply lower opening of the cash session on the Old Continent. Contracts based on the German Dax are losing 0.37%, while those based on the US Nasdaq index are down more than 1.1%.

- WSJ reports that the US Auto Workers union and Ford are expected to announce an agreement.

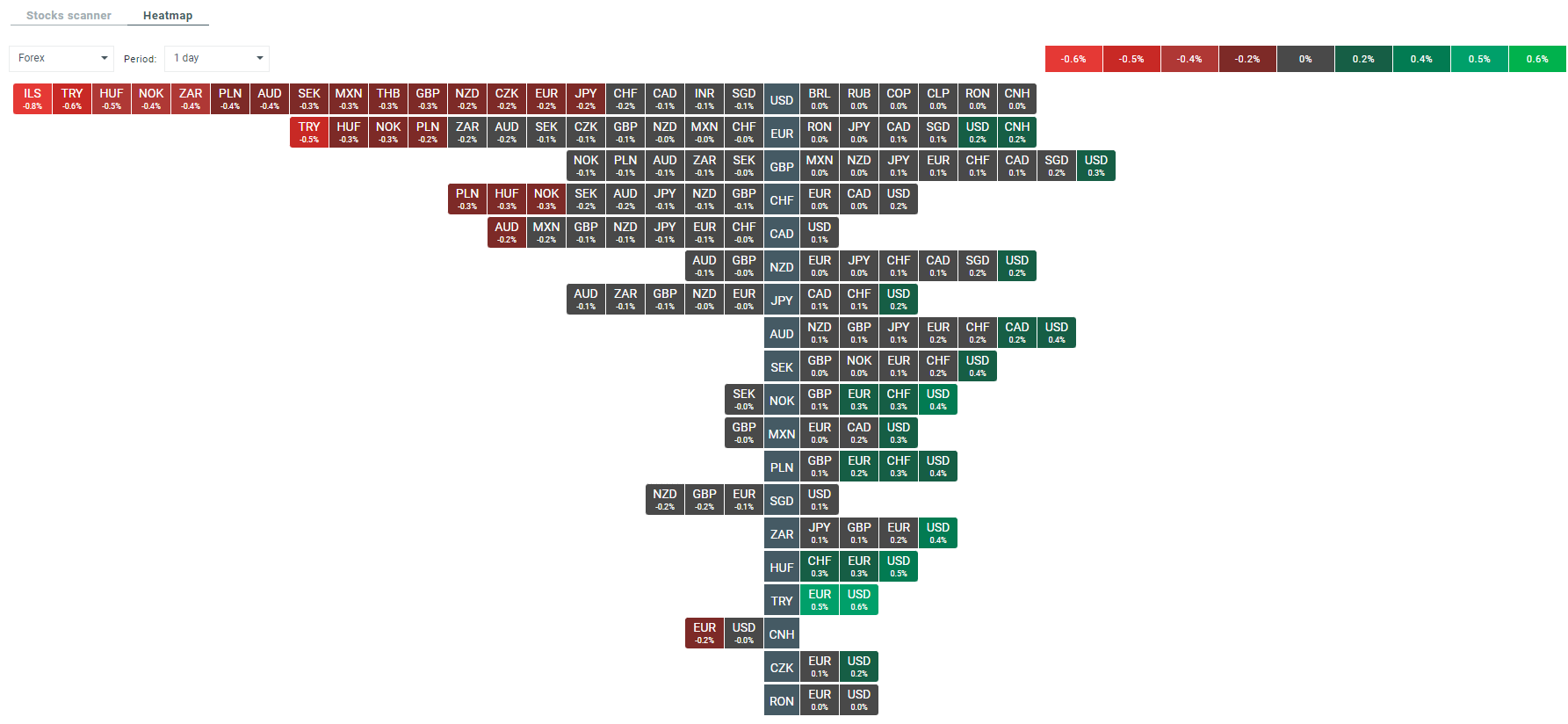

- The strongest currencies in the FX market today are the US dollar and the Canadian dollar. The Australian dollar and the New Zealand dollar are the weakest performers.

- The USDJPY pair broke above the psychological barrier of 150.00 yesterday evening and is currently trading in the 150.44 zone (the highest level since October 2022.

- Japanese Finance Minister Suzuki says he is sticking to the previous monetary policy, thus keeping a close eye on JPY exchange rate movements.

- The Australian dollar lost on an intraday basis against the strength of the US dollar and comments by Bullock, who somewhat softened her narrative regarding future interest rate hikes. On the other hand, however, the governor admonished that the fight against inflation may not be over yet. Investment banks are forecasting further interest rate hikes for Australia.

- Key macro events today include: the U.S. GDP report, the PCE ratio, and interest rate decisions by the ECB and CBRT.

Heatmap of the FX market, which illustrates the volatility on individual currency pairs at the moment. Source: xStation 5

Heatmap of the FX market, which illustrates the volatility on individual currency pairs at the moment. Source: xStation 5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.