- US indices finished yesterday's trading lower - S&P 500 dropped 1.18%, Dow Jones moved 0.76% lower while Nasdaq slumped 1.76%

- US index futures recovered some losses after close of the Wall Street session following release of solid quarterly results by Amazon

- Amazon shares gained over 5% in the after-hours trading after company Q3 reported revenue at $143.1 billion (exp. $141.4 billion) and EPS at $0.94 (exp. $0.58). Company's AWS grew by 12% as growth in cloud business continued to stabilize

- The US military struck two targets used by Iranian-backed groups in Syria overnight. Facilities struck are weapon and ammunition storages

- Pentagon explained that this was a retaliation for strikes against US troops in the region and was not directly linked to Hamas-Israel war

- Indices from Asia-Pacific traded higher today - Nikkei gained 1.2%, S&P/ASX 200 moved 0.2% higher, Kospi added 0,1% and Nifty 50 jumped 0.8%. Indices from China traded 0.5-1.5% higher

- DAX futures point to a more or less flat opening of today's European cash session

- Goldman Sachs expects ECB to begin cutting rates in Q3 2024. Meanwhile, UBS said its too early to consider ECB rate cuts

- According to Chinese state media, People's Bank of China may decide to cut reserve requirement ratio before year's end in order to support economy and government bond issuance

- Australian PPI inflation accelerated from 0.5% QoQ in Q2 2023 to 1.8% QoQ in Q3 2023. On an annual basis, PPI inflation slowed from 3.9% to 3.8% YoY

- CPI inflation in the Japanese Tokyo area accelerated from 2.5 to 2.7% YoY in October (exp. 2.5% YoY)

- Cryptocurrencies are trading lower today - Bitcoin drops 0.4%, Ethereum trades 0.7% lower and Dogecoin slumps 1.5%

- Precious metals trade higher - gold gains 0.1%, silver adds 0.3% and platinum moves 0.5% higher

- Energy commodities trade higher - oil gains 1.1% while US natural gas prices are 0.9% up

- AUD and CAD are the best performing major currencies while CHF and USD lag the most

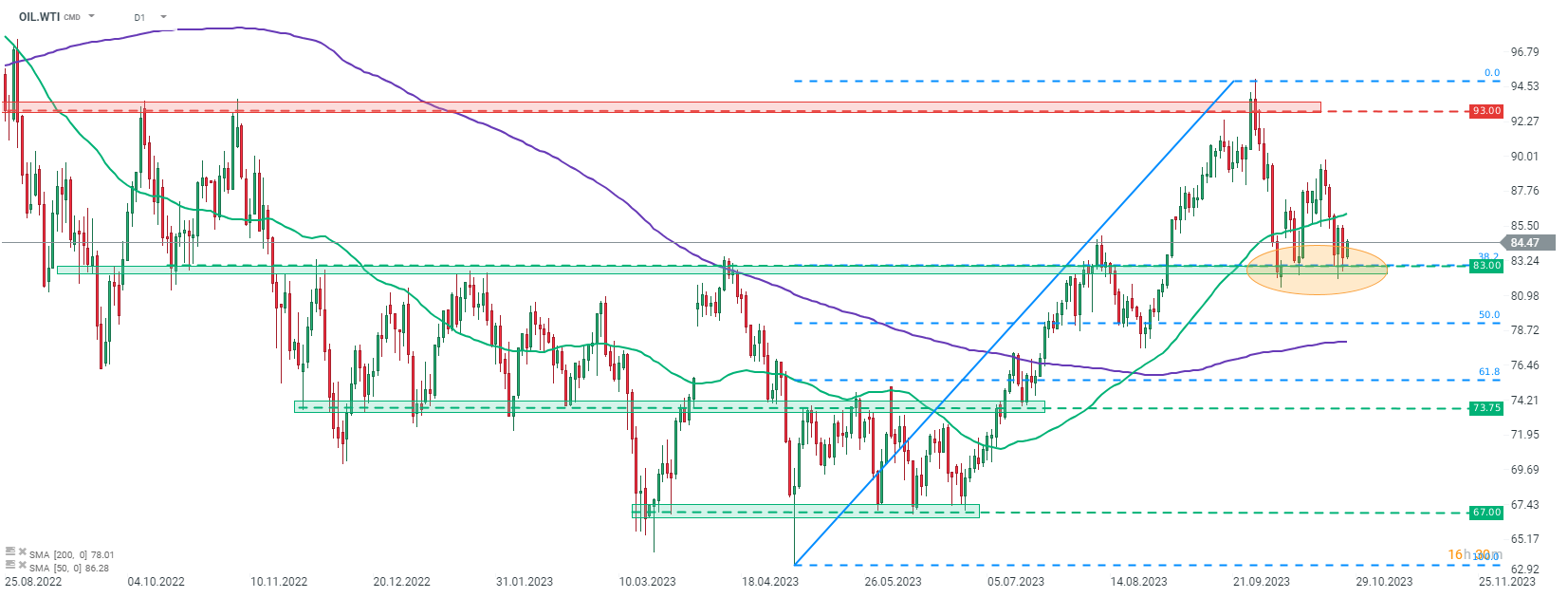

Bulls on WTI (OIL.WTI) managed to once again defend the $83 area, marked with the 38.2% retracement of a recent upward move. However, price remains nearby and another test of this support cannot be ruled out. Source: xStation5

Bulls on WTI (OIL.WTI) managed to once again defend the $83 area, marked with the 38.2% retracement of a recent upward move. However, price remains nearby and another test of this support cannot be ruled out. Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.