NZDUSD loses 1.6% and bond yields slide to 6-month lows in the face of the decision to end the hike cycle 🏛

In the FX market, in addition to the pound reacting to higher-than-expected inflation data from the UK, the New Zealand dollar played a dominant role today, sinking under the strain of today's RBNZ decision and comments from central bankers. A key view throughout the meeting was that rate hikes would no longer be necessary to combat inflation, so the RBNZ was the first of the world's major central banks to halt the rate hike cycle.

New Zealand's central bank raised interest rates by a quarter of a percentage point to 5.5% (as expected). The central bank's forecasts show that the OFR has already peaked, with reductions starting in the third quarter of 2024. Following the news, two-year NZD yields fell by the most in six months.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app"The committee is confident that, with interest rates held at restrictive levels for some time, consumer price inflation will return to the target range of 1-3% per annum," the - The RBNZ said. "Inflation is expected to continue to decline from its peak, and with it inflation expectations indicators." Inflation slowed to 6.7% in the first quarter, and the central bank expects it to return to the target range by the third quarter of next year. Today's decision was voted in a 5-2 structure (5 members in favour of a hike; 2 in favour of maintaining rates). The commentary following the decision added that the Committee is confident. that the hike cycle has captured inflationary pressures.

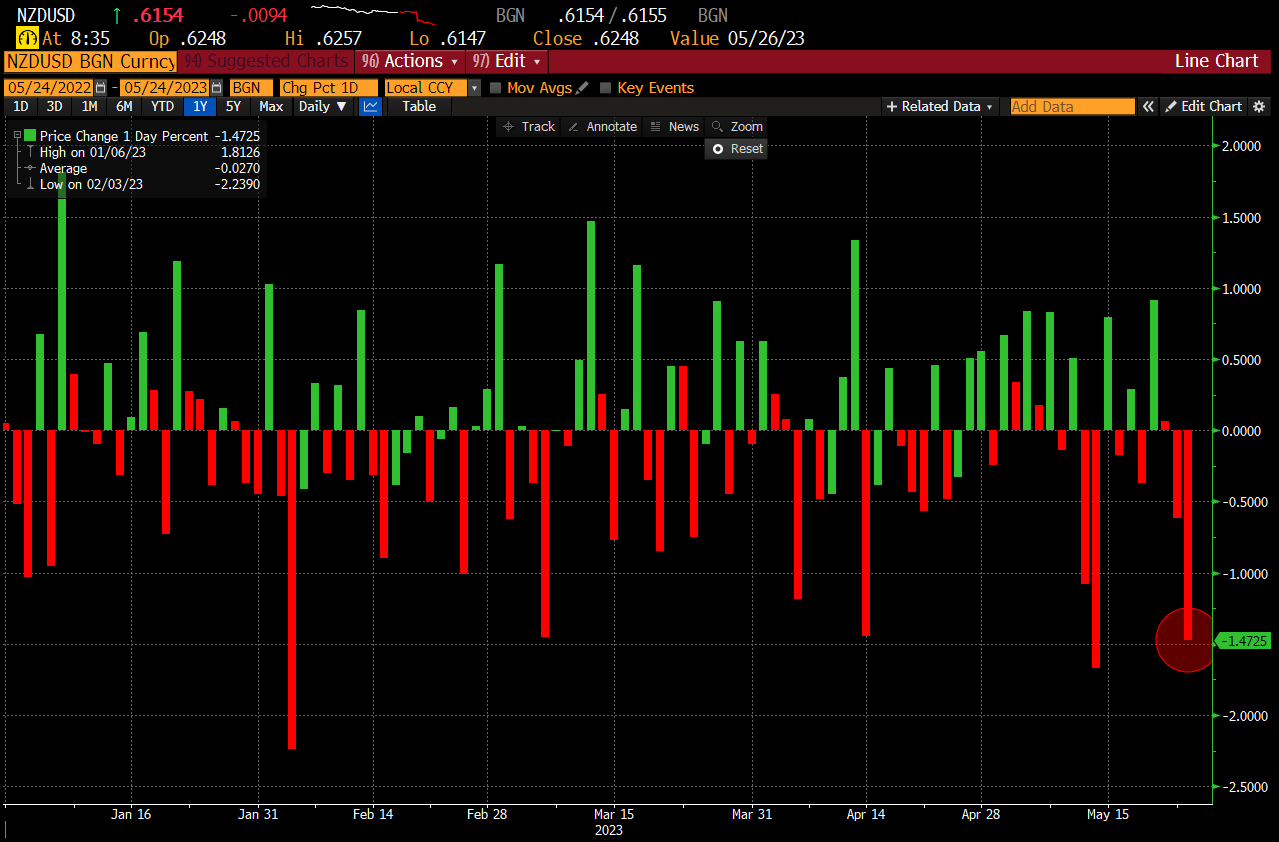

The magnitude of today's sell-off is huge, nevertheless declines of similar magnitude have already been recorded in this one. Source: Bloomberg

The magnitude of today's sell-off is huge, nevertheless declines of similar magnitude have already been recorded in this one. Source: Bloomberg The NZDUSD pair is currently losing more than 1.7% amid news of the end of New Zealand's rate hike cycle. The pair is currently testing support set by the March and April 2023 minima, which is further reinforced by the 50-day exponential moving average (blue curve). Source: xStation5

The NZDUSD pair is currently losing more than 1.7% amid news of the end of New Zealand's rate hike cycle. The pair is currently testing support set by the March and April 2023 minima, which is further reinforced by the 50-day exponential moving average (blue curve). Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.