🥝 "Kiwi" loses today to "Aussie" due to low inflation reading in Australia

The New Zealand dollar is today a victim of low inflation in Australia. Inflation in Australia fell today for May to 5.6% year-on-year (YoY) with an expected 6.1% YoY and a previous level of 6.8% YoY. The Australian Bureau of Statistics has been publishing monthly data for over a year, but from a market perspective, the quarterly index still seems to be more important. This index for Q1 was 7.0%. Why is the NZD falling harder today than the AUD?

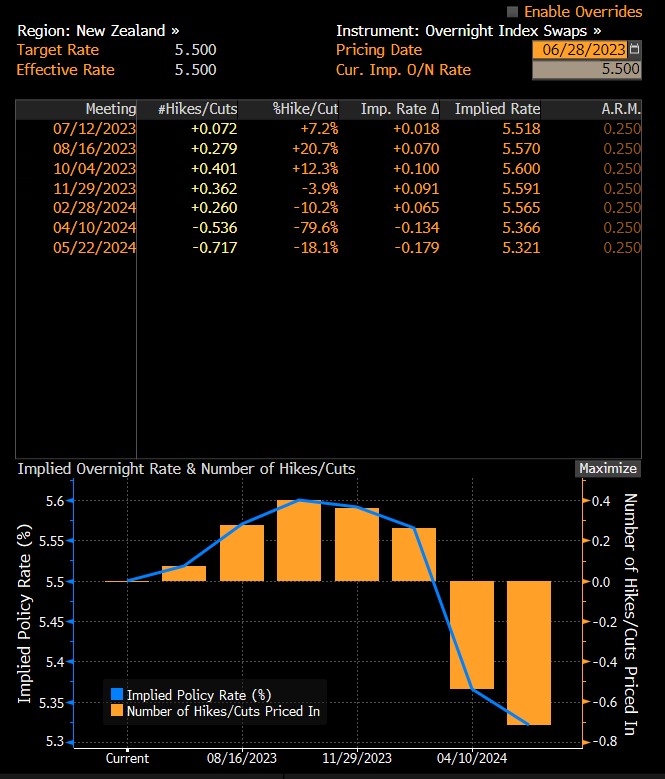

The CPI index for Q1 in New Zealand was 6.7% YoY, which may indicate that inflation for Q2 in this country will fall even more. Of course, it's worth remembering that the RBNZ has already announced that it will not raise rates, but the market indicated that after the recent surprise from the RBA, BoC, BoE or Norges Bank, the RBNZ could also return to rate hikes. However, inflationary trends suggest that the RBNZ will likely keep rates unchanged at 5% during the decision on July 12. Currently, the market sees only a 7% probability of a hike, and by the end of this year, it values a maximum of 10 basis points increase. Meanwhile, despite a clear drop in inflation in Australia or Canada, there the valuations of rate hikes are significantly higher.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appNZDUSD is falling today to its lowest level since June 8. It is rare for a daily change in a G10 currency pair to exceed 1%. Meanwhile, AUDNZD recently fell to 1.0800, but the pair is currently recovering losses. Stronger declines in NZDUSD can be seen as a delayed movement compared to the fairly strong shock of AUDUSD at the end of last week. The NZDUSD pair is currently testing around 0.6000 and may be planning to test the 50.0 retracement of the last major upward wave. The pair remains within a rather weakly inclined downward trend channel.

Expectations for RBNZ rate movements. Source: Bloomberg

Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.