- Wall Street opens slightly higher

- The dollar strengthens, and yields gain slightly

- Quarterly results from Coca Cola (KO.US), General Electric (GE.US), and General Motors (GM.US)

Futures contracts gain slightly today, but these increases are more of a reaction to recent declines rather than a decisive rebound. In the broader market, the dollar is gaining again and remains one of the strongest currencies. EURUSD is down 0.51%. Yields on 10-year bonds gain 0.41% and are around 4.85%. The market shows mixed sentiments after the PMI data from Europe and from the USA.

PMI data

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appPreliminary PMI readings from the Eurozone were mixed, and values still remain significantly below the 50-point level. PMI manufacturing from the US came much better, also from the expectation.

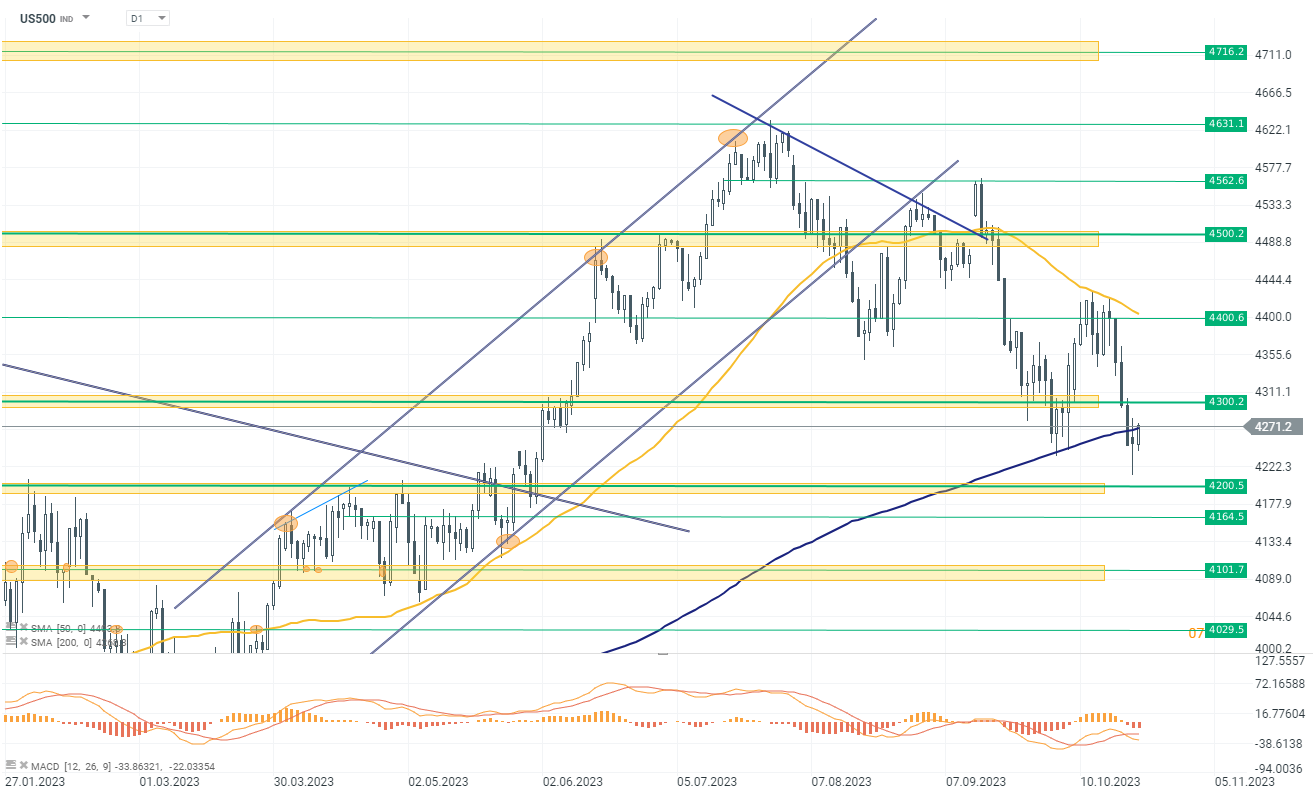

US500

The US500 has rebounded decisively from the support line at 4200, showing a 0.40% gain today. It's noteworthy that the index is currently testing the 200-session Simple Moving Average (SMA) from below, which could act as a significant resistance level. As we navigate through the quarterly earnings season, the performance of key market giants like Microsoft (MSFT.US) and Alphabet (GOOGL.US), who are set to release their results today, will likely play a crucial role in determining the overall direction of the index. Investors will be closely monitoring these earnings reports for insights into market sentiment and potential market-moving developments.

Company news

Coca-Cola's (KO.US) shares rose in premarket trading after the company reported third-quarter results that exceeded expectations and subsequently raised its annual sales forecast. The beverage giant now anticipates an adjusted organic revenue growth of 10% to 11% for the full year, up from its previous projection of 8% to 9%. The third-quarter results showcased a revenue of $12.0 billion, beating the $11.5 billion estimate. The company's price mix increased by 9%, outperforming the anticipated 6.2% rise, and its volume grew by 2%, also surpassing estimates. Despite the price hikes, consumers continue to show a willingness to pay for beverages, leading Coca-Cola to enhance its full-year outlook. CEO James Quincey acknowledged the company's strong quarterly performance in a statement.

Nvidia (NVDA.US) is entering into the personal computer processor market, leveraging Arm Holdings Plc technology to create chips that could rival Intel Corp. processors. While Nvidia is renowned for its dominance in artificial intelligence accelerator chips, it is now reportedly developing central processing units (CPUs) for PCs that would be compatible with Microsoft Corp.’s Windows operating system, aiming for a release by 2025. Intel, a pioneer in PC processors, is already grappling with competition from Advanced Micro Devices Inc. (AMD.US) and Qualcomm Inc. Notably, AMD is also said to be working on PC chips using Arm technology.

General Electric Co. (GE.US) reported a 20% year-over-year increase in Q3 FY23 revenues, reaching $17.3 billion, with adjusted earnings per share (EPS) of $0.82, surpassing the consensus estimate of $0.56. The company witnessed a surge in orders across various sectors, including a 25% jump in Aerospace’s Q3 revenues and a 15% rise in GE Vernova Renewable Energy revenues. GE's operating cash flow for the quarter was $1.89 billion, and free cash flow stood at $1.67 billion. The company also repurchased approximately 2.2 million shares for $0.3 billion. GE announced plans to spin off GE Vernova and launch GE Aerospace in Q2 2024. CEO H. Lawrence Culp, Jr. expressed confidence in the company's trajectory and raised the full-year 2023 guidance.

source: xStation 5

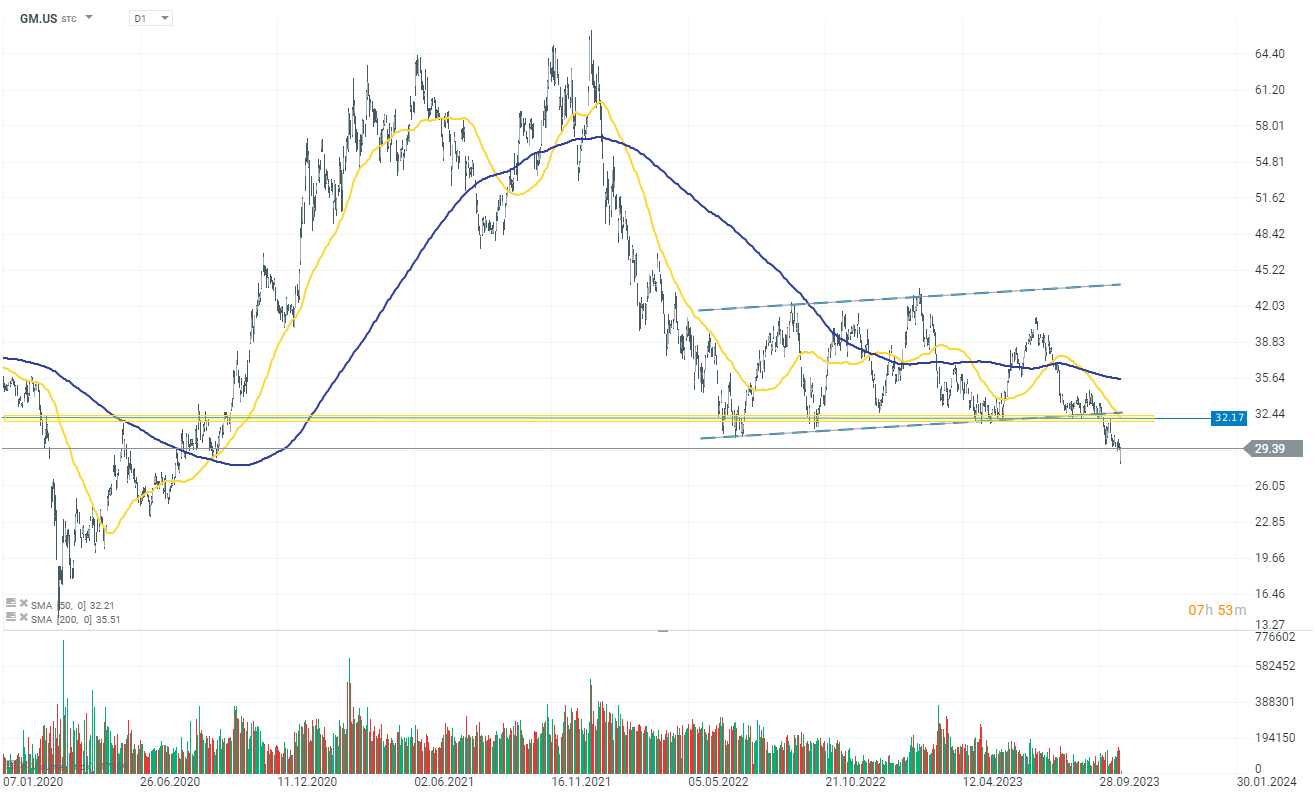

General Motors (GM.US) gains over 1.30% after reporting a third-quarter profit that surpassed analysts' expectations. The automaker's adjusted EPS was $2.28, compared to an estimate of $1.84, with net sales and revenue reaching $44.13 billion, marking a 5.4% increase year-over-year. Despite the positive results, GM withdrew its earnings guidance for the year due to the uncertainty caused by an ongoing workers' strike. The strike, which began on September 15, is expected to reduce GM's pretax earnings by $800 million this year, with further losses of $200 million per week. CFO Paul Jacobson noted that the strike had already impacted the company's Q3 net income, which was down 7% from the same period last year. CEO Mary Barra emphasized that while GM has made a significant offer to the union.

source: xStation 5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.