- Wall Street starts Friday session with moderate gains

- Apple (AAPL.US) remains under pressure from China restrictions; JP Morgan lowers target price for company shares

- Planet Labs (PL.US) delivers weaker-than-expected quarterly report

The final session on Wall Street this week begins with moderate gains in the major stock market benchmarks, thus negating part of the week's sell-off. The number 1 themes in the market continue to be the Apple/China tensions and the uncertainty surrounding the FED and ECB interest rate decisions.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appAt the moment, the market is assuming an almost 93% probability that the FED will keep rates unchanged at its 20 September meeting. Source: CME

In his early comments, the FED's Barr did not touch on US monetary policy, only mentioning the CBDC implementation process and the dues of oversight of the issuance and operation of the stablecoin sector.

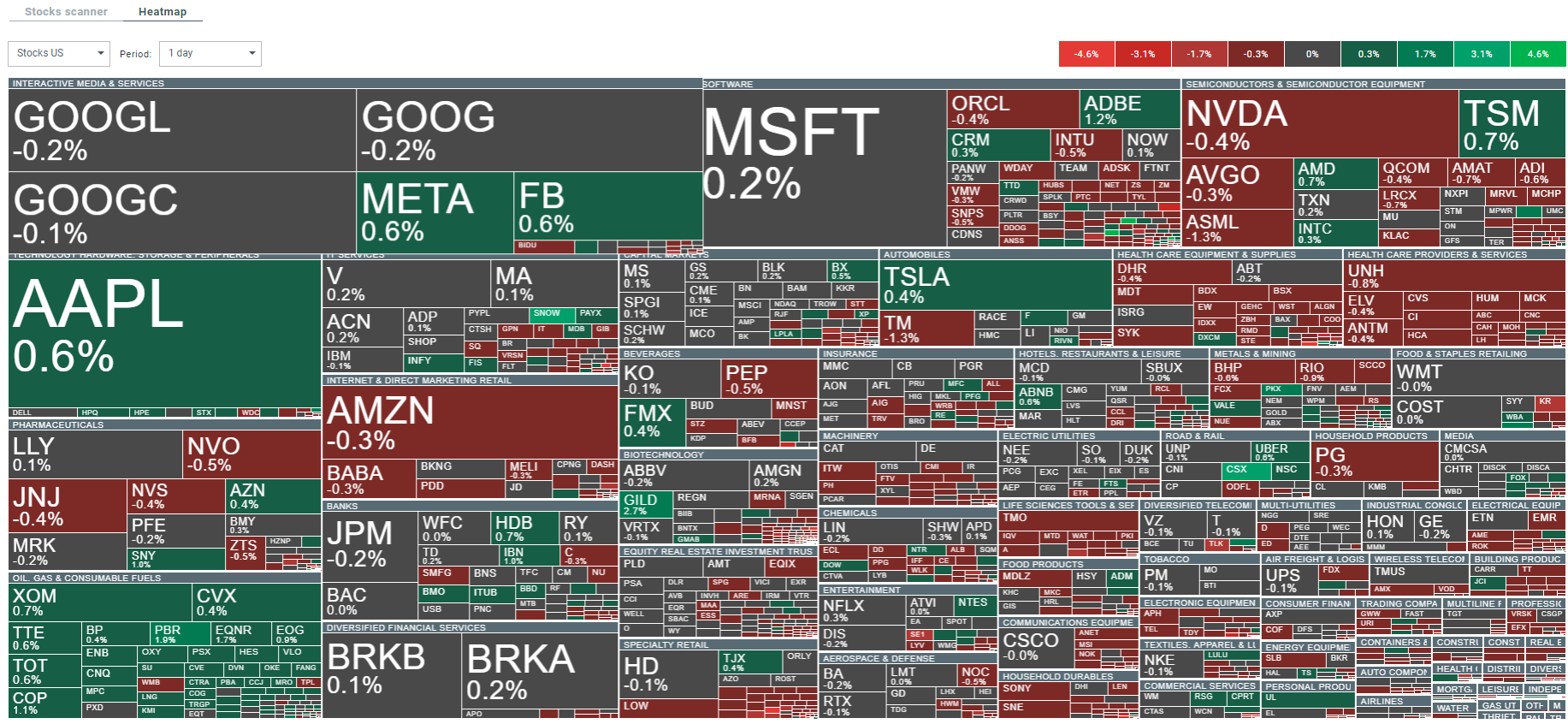

US companies categorised by sector and industry. Size indicates market capitalisation. Source: xStation5

US companies categorised by sector and industry. Size indicates market capitalisation. Source: xStation5

The US100 index is gaining close to 0.25 per cent at the start of today's session and is trading between the support set by the 50-day exponential moving average (blue curve) and the resistance set by the 78.6% Fibo measure of the downward wave initiated in November 2021. Source: xStation 5

News

- Apple (AAPL.US) continues to attract the most attention from investors, gaining nearly 0.3% at the start of today's session despite further restrictions in China. The country's government employees may be banned from using the US company's devices, adding to concerns that Apple products could be part of rising tensions between China and the US. It is worth remembering that China (plus Hong Kong and Taiwan) accounts for a combined 18% of the company's total revenue.

Source: xStation 5

- Planet Labs (PL.US) stock is showing downward momentum early in today's session after the satellite imaging company reported a weaker-than-expected quarterly report. Net loss per share reached 14 cents against an expected 8 cents. Moreover, the outlook for the rest of the year itself fell short of market expectations.

- Shares of the Kroger (KR.US) shop chain lost nearly 3% following a mixed Q2 report. Although earnings per share alone beat analysts' expectations (96 cents vs. a forecast of 91 cents), revenue levels failed to beat forecasts (USD 33.85 billion vs. USD 34.13 billion). What's more, the company agreed to pay US$1.2 billion to settle claims that the company fuelled an opioid addiction 'epidemic' by loosely overseeing the sale of opioid drugs in the US.

ANALYSTS' RECOMMENDATION

- Apple Inc (AAPL.US): JPMorgan is lowering its target price to $230 from $235, as the bank believes the current valuation and risks associated with restrictions in China could have a negative impact on the company's stock price in the second half of the year.

- C3.Ai Inc (AI.US): Piper Sandler is lowering its price target to $28 from $29 after the company lowered its margin guidance due to increased spending on generative AI.

- First Solar (FLSR.US): Deutsche Bank raised its rating on the company's stock to Buy from an earlier Hold. The target price was increased by 30% to $235 per share.

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.