-

US indices launched today's trading lower

-

Dow Jones drops and approaches 35,100 pts support zone

-

Qualcomm and Etsy plunge after earnings

Wall Street indices launched today's cash session lower, following a mixed Asia-Pacific session and amid a downbeat trading in Europe, where major indices trade 1% lower. Drops on Wall Street at the beginning of the session were smaller than data but still - S&P 500 and Nasdaq opened around 0.5% lower, Dow Jones dropped 0.3% and Russell 2000 slumped 0.8% at session launch.

Economic calendar for the US session today is light and all important readings that could impact stocks were released already. Final services PMI for July was released at 2:45 pm BST and came in at 52.3 - slightly below 52.4 in flash reading. Services ISM was released at 3:00 pm BST and was expected to show a drop from 53.9 to 53.0 in July. Actual data showed a slightly deeper drop to 52.7, driven by plunge in Employment subindex. EIA will release weekly report on natural gas inventories at 3:30 pm BST but it should not have any impact on equities.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app Source: xStation5

Source: xStation5

Dow Jones was halted on its way back towards all-time highs. Index is pulling back for another day in a row and is closing in on the 35,100 pts support zone, marked with a 78.6% retracement of a drop launched in early-2022. However, even a break below would not change a technical picture, at least for now. The lower limit of a local market geometry can be found around 34,730 pts and a break below would signal a bearish trend reversal. Until then, trend remains bullish and current pullback should be perceived as a correction.

Company News

Qualcomm (QCOM.US) reported fiscal-Q3 (April - June 2023) revenue at $8.44 billion (exp. $8.50 billion) as well as adjusted EPS at $1.87 (exp. $1.81). Company said that it expects $1.80-2.00 EPS in fiscal-Q4 as well as $8.1-8.9 billion in sales. Midpoints show that this was slightly weaker forecast than $1.91 EPS and $8.7 billion in revenue expected by the market. Company said that it continues to expect handset shipments to decline high-single digit this year amid slow recovery in China.

Moderna (MRNA.US) gained following the release of Q2 earnings. Company reported revenue of $344 million (exp. $320 million) and $3.62 loss per share (exp. $4.04). This is a massive plunge from $4.75 billion in sales report in Q2 2023 and was driven by a 94% drop in Covid vaccine sales. Net loss of $1.38 billion was reported in Q2 2023, compared to net income of $2.2 billion a year ago. Nevertheless, stock gains as the company said it expects $6-8 billion in Covid vaccine sales this year, up from previous forecast of $5 billion.

Etsy (ETSY.US) shares slumped after online retailer reported Q2 earnings yesterday after close of market session. Company reported $629 million in sales (exp. $619 million) and adjusted EPS of $0.45 (exp. $0.42). Gross merchandise sales reached $3.01 billion and were higher than $2.98 billion expected. While company managed to beat Q2 expectations, forecasts for Q3 2023 disappointed. Company expects gross merchandise sales to reach $2.95-3.10 billion (exp. $3.08 billion) and revenue to reach $610-645 million (exp. $632 million).

Warner Bros Discovery (WBD.US) reported Q2 2023 revenue at $10.36 billion, below $10.44 billion expected by analysts. Loss per share amounted to $0.51 and was deeper than $0.38 loss expected. While net loss reached $1.24 billion, it was a significant improvement compared to $3.42 billion loss in Q2 2022 ($1.50 per share). Global streaming subscribers dropped by almost 2 million compared to end-Q1 and reached 95.8 million (exp. 96.7 million). Nevertheless, shares gained as the company announced a tender offer to pay down $2.7 billion in debt.

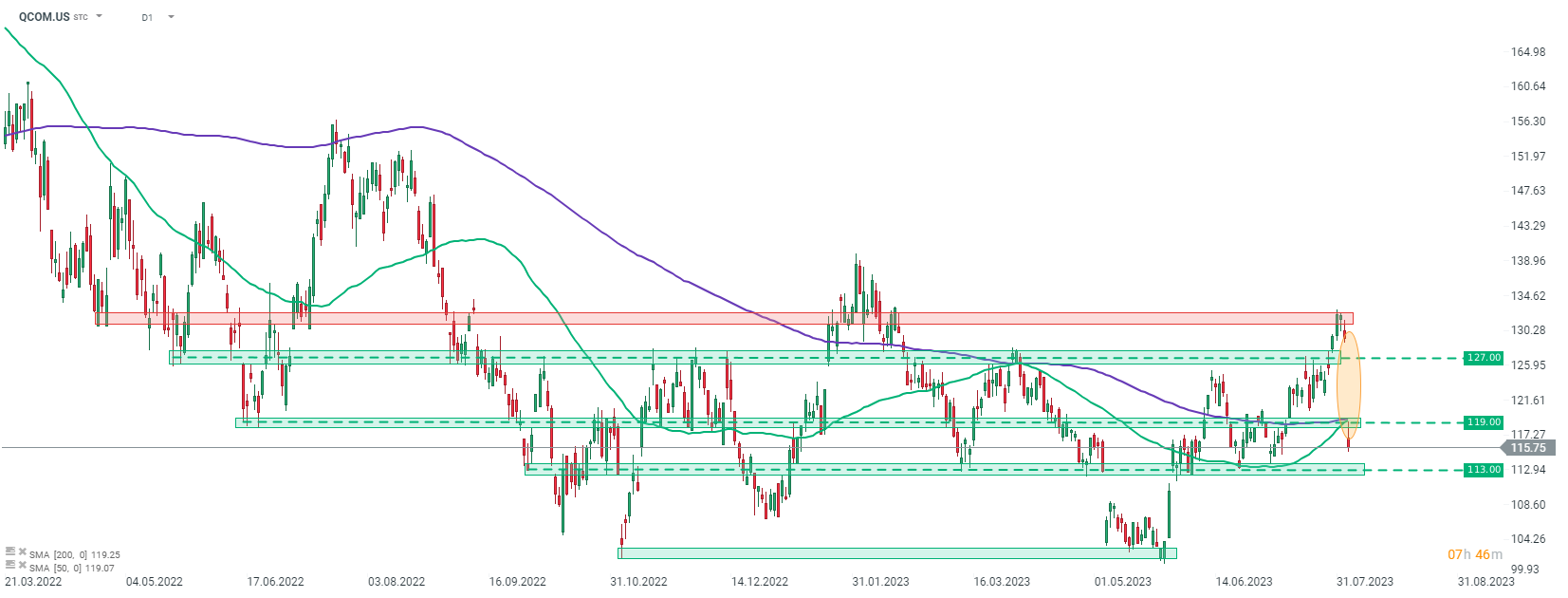

Qualcomm (QCOM.US) slumps over 10% after giving weak guidance for the current quarter. Stock plunged below 50- and 200-session moving average in the $119 area and continues to move lower. The next support zone in-line can be found in the $113 area - slightly more than 2% below current market price. Source: xStation5

Qualcomm (QCOM.US) slumps over 10% after giving weak guidance for the current quarter. Stock plunged below 50- and 200-session moving average in the $119 area and continues to move lower. The next support zone in-line can be found in the $113 area - slightly more than 2% below current market price. Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.