-

Wall Street follows into footsteps of European peers and opens lower

-

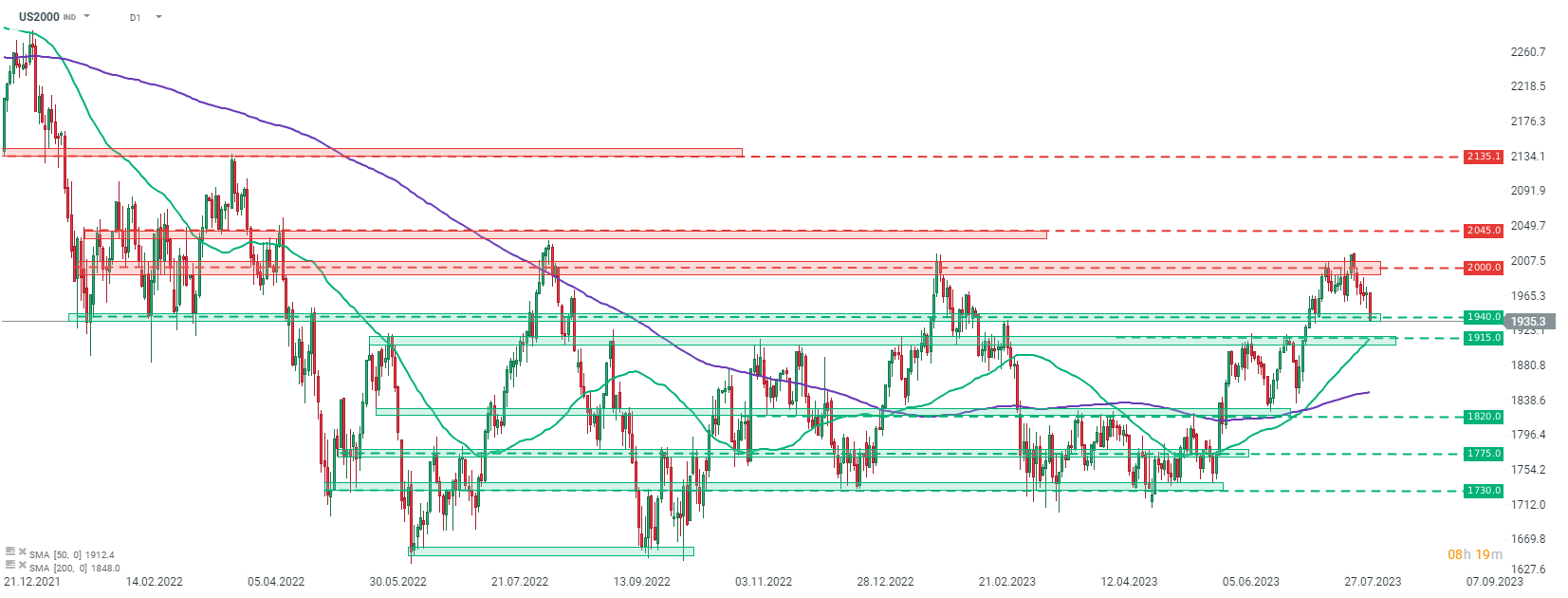

Russell 2000 leads declines on Wall Street

-

Eli Lilly surges to all-time highs after stellar Q2 earnings

Wall Street indices launched today's cash session lower. This comes amid an overall deterioration in risk moods that can be observed today. Weak trade data from China as well as introduction of windfall tax on Italian banks set the mood for the European trading session and those moods are extending into the US trading.

S&P 500 launched today's trading around 0.6% lower, Dow jones dropped 0.7% at the opening while Nasdaq was over 0.8% down. Small-cap Russell 2000 was top laggard with an over 1.5% drop at the opening.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app Source: xStation5

Source: xStation5

Small-cap Russell 2000 (US2000) is the worst performing major US index at the beginning of today's Wall Street cash session. The index is down over 1.5% and is attempting to break below the 1,940 pts support zone. Should bears succeed, declines may deepen towards the next support zone in-line which can be found at 1,915 pts. This zone is marked with previous price reaction as well as 50-session moving average (green line) and should offer some support for the price.

Company News

Eli Lilly (LLY.US) reported an 85% YoY jump in Q2 net income, to $1.76 billion. Adjusted EPS reached $2.11 (exp. $1.98) while revenue was 28% YoY higher at $8.31 billion (exp. $7.58 billion). Results were driven by strong sales of Eli Lilly's drugs and encouraged the company to lift forecast. Eli Lilly now expects full year revenue to reached $#33.4-33.9 billion, up from previous guidance of $31.2-31.7 billion, and adjusted EPS to reach $9.70-9.90 range, up from previous forecast of $8.65-8.85.

Tilray (TLRY.US) shares jumped after the company announced that it will buy 8 craft beer and beverage brands from Anheuser-Busch (BUD.US). Deal includes acquisition of breweries, brewpubs as well as current employees. The acquisition will make Tilray the fifth largest craft beer brewer in the US with 5% market share and is expected to result in pro-form revenue increase of around $300 million annually. Financial details were not disclosed.

International Flavors & Fragrances (IFF.US) slumped after reporting disappointing Q2 results. EPS slumped 44% YoY to $0.86 while the market expected $1.10. Revenue dropped 11.4% YoY to $2.93 billion (exp. $3.1 billion). Company also cut full-year revenue guidance from $12.3 billion to $11.3-11.6 billion. Full-year adjusted operating EBITDA is expected in the $1.85-2.0 billion range, down from "approximately $2.34 billion".

Eli Lilly (LLY.US) surged after solid Q2 earnings and full-year forecast upgrade. Shares are up over 13% on the day, trading at fresh all-time highs above $500! Source: xStation5

Eli Lilly (LLY.US) surged after solid Q2 earnings and full-year forecast upgrade. Shares are up over 13% on the day, trading at fresh all-time highs above $500! Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.