- Jerome Powell spoke at the Jackson Hole Symposium

- Data from the University of Michigan

- Higher recommendations for Netflix (NFLX.US), better results for GAP (GPS.US)

The first part of today's session on Wall Street was marked by variable sentiments driven by the speech of Fed Chair Jerome Powell at the Jackson Hole Symposium in Wyoming. Initially, major US indices opened with a slight uptick. The gains continued after the start of Fed Chair's speech at 16:05. However, during the speech, a hawkish tone emerged. Indices reacted with sudden drops, and the dollar strengthened. Currently, we observe a continuation of subdued sentiments, albeit in a calmer tone than after the speech. US100 is trading 0.20% below, and US500 is trading around opening levels.

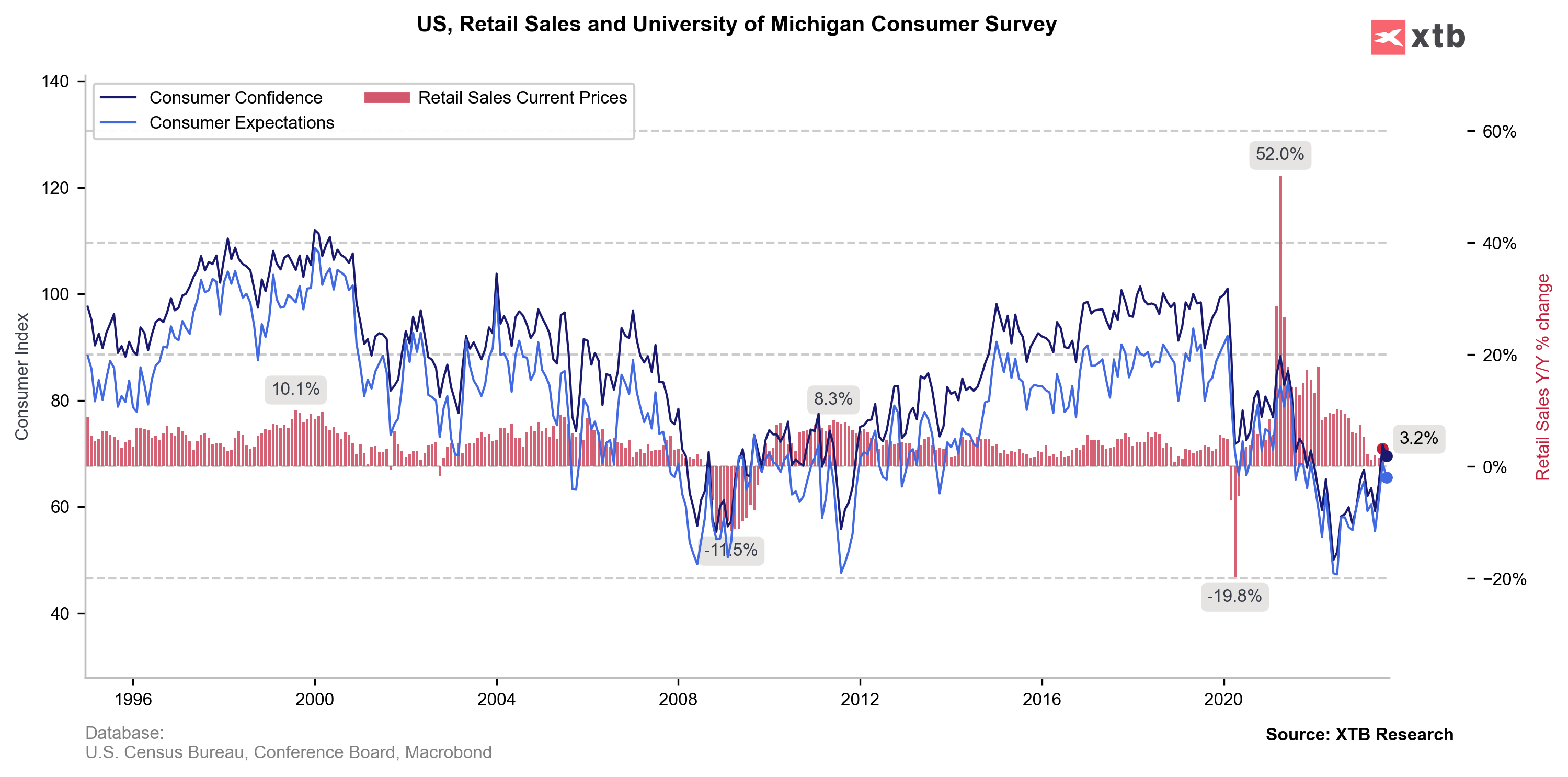

Meanwhile, data from the University of Michigan regarding consumer sentiment and expected inflation was also released. The data didn't bring significant surprises. Inflation expectations increased slightly, with a year-ahead expectation of 3.5% and a 5-year expectation of 3.05%. Consumer sentiment fared somewhat worse, falling short of expectations at 69.5 compared to an expected 71.2. Further deterioration in consumer sentiment could imply a continued decline in retail sales, which had been performing exceptionally well thus far.

Meanwhile, data from the University of Michigan regarding consumer sentiment and expected inflation was also released. The data didn't bring significant surprises. Inflation expectations increased slightly, with a year-ahead expectation of 3.5% and a 5-year expectation of 3.05%. Consumer sentiment fared somewhat worse, falling short of expectations at 69.5 compared to an expected 71.2. Further deterioration in consumer sentiment could imply a continued decline in retail sales, which had been performing exceptionally well thus far.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app US100 is quite volatile today. The index exhibited strong gains two days ago, re-entering an upward trendline. The following day, significant declines indicated that negative sentiment still dominated. Today, US100 cannot decisively determine its direction. However, the fact of the rebound from the upward trendline could signify a sideways trend or a deepening of lows in the coming days. In such a case, the next support level would be around 14600 points. On the other hand, resistance for bulls might emerge around 15200 points.

US100 is quite volatile today. The index exhibited strong gains two days ago, re-entering an upward trendline. The following day, significant declines indicated that negative sentiment still dominated. Today, US100 cannot decisively determine its direction. However, the fact of the rebound from the upward trendline could signify a sideways trend or a deepening of lows in the coming days. In such a case, the next support level would be around 14600 points. On the other hand, resistance for bulls might emerge around 15200 points.

Company News

- GAP (GPS.US) - the company's shares are up by 2.80% today despite not-so-optimistic results from the previous day. The company reported a decline in sales across all its brands, cautioning about weakening consumer demand. GAP is the latest in a line of companies highlighting weakening consumer sentiment in their quarterly reports. In the second fiscal quarter, the company witnessed an 8% sales drop to $3.55 billion, with a net income of $117 million, in contrast to the previous year's loss. The rise in the company's stock is attributed to better-than-expected EPS of 34 cents (adjusted), although revenues were slightly below the anticipated $3.57 billion. The company's management expresses concerns about a "weak apparel environment" and a "volatile consumer market." The sales decline is attributed to financial pressure on consumers, high inflation, interest rates, and the impending resumption of student loan repayments.

- Netflix (NFLX.US) gained 0.7% today after Loop Capital Markets upgraded its recommendation for the company from "neutral" to "accumulate," citing improving Netflix fundamentals.

- DigitalOcean (DOCN.US) is down by 6% after the cloud data processing company announced that Yancey Spruill will step down as CEO upon the appointment of a successor. Yancey Spruill had been the CEO for over 4 years.

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.