Declines on Wall Street accelerate. Russell 2000 loses more than 2%! 📉

After 7 PM BST we can observe increased activity from the supply side on Wall Street. However, there have been no reports in the market so far to suggest this move, so the current decline can be explained by today's inflation data from the US, where the main index came in slightly above expectations, which may support the scenario of another 25bp Fed rate hike. The Russell 2000 index, which groups small-cap companies, lost the most heavily today. On the other hand, the scale of the daily discount on the Dow Jones, S&P500 and Nasdaq 100 indexes is not large, and reaches 0.7% at the moment. Nevertheless, looking at least at the chart of the US500, there was a complete erasure of yesterday's upward move, which could have a negative impact on tomorrow's session. Closing the day below the support at 4370 points could result in a deepening of the sell-off even towards the October 4 lows

US500 defends 4380 level zone where we can see SMA100. Source: xStation5

US500 defends 4380 level zone where we can see SMA100. Source: xStation5

Start investing today or test a free demo

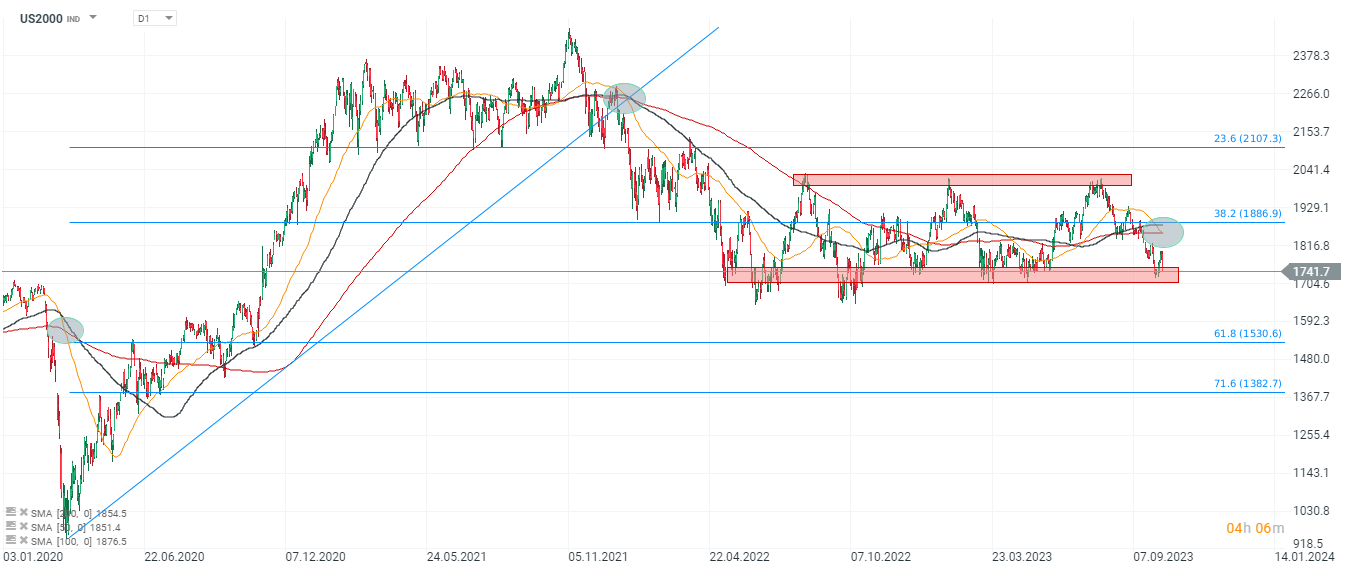

Open real account TRY DEMO Download mobile app Download mobile app Looking at US2000 we can see that SMA200 (red line) and SMA (50) formed bearish 'death cross' formation. Source: xStation5

Looking at US2000 we can see that SMA200 (red line) and SMA (50) formed bearish 'death cross' formation. Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.