Traders will be offered rate decisions from two Antipodean central banks this week - Reserve Bank of Australia and Reserve Bank of New Zealand. RBA will be the first one to make an announcement, with rate decision scheduled for Tuesday, 4:30 am BST. Let's take a quick look at what the market expects from Australian central bankers this week.

Since last RBA meeting...

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appThe latest RBA rate decision was announced on Tuesday, September 5 and it was a decision to keep rates unchanged. It was the third 'hold' from RBA in a row, following a cumulative 400 basis points of rate hikes since May 2022. RBA noted in a decision statement that inflation is past its peak and continues to decline but prices of many services continue to rise and rent inflation remains elevated. Uncertainty in the economic outlook was cited as the main reason behind the decision to hold.

Data from Australia released since the previous meeting has been generally hawkish. Jobs report for August came in strong with strong pick-up in employment as well as participation rate. CPI inflation picked up from 4.9% in July to 5.2% in August. Job vacancies data for August showed a big drop, signaling tightness of the labour market.

What market expects from RBA?

While developments in the Australian economy since the last RBA decision were rather hawkish, neither money markets, nor economists are expecting the central bank to hike rates tomorrow.

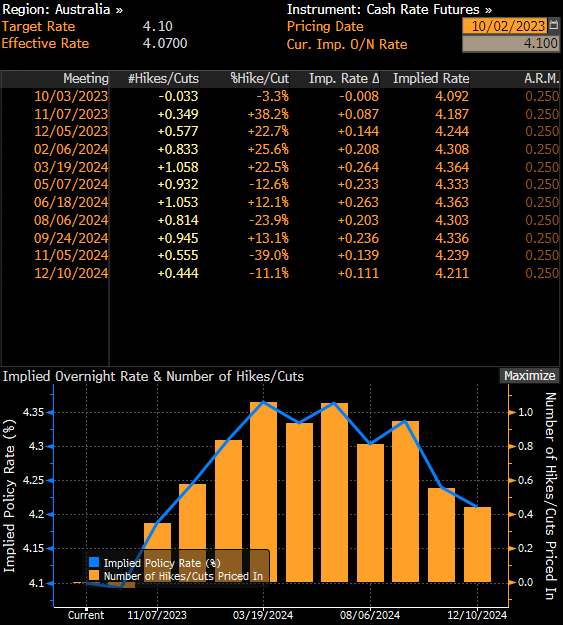

Out of over 20 economists surveyed by Bloomberg, only one expects the Reserve Bank of Australia to deliver a 25 basis point rate hike tomorrow. Others are expecting the RBA to keep rates unchanged with the official cash rate staying at 4.10%. Money markets do not expect a change either but it should be noted that a 25 basis point rate hike is priced-in for Q1 2024.

The most likely scenario seems to be a decision to hold rates unchanged while keeping a hawkish bias in the statement. However, should Australian data continue to come in hawkish, it cannot be ruled out that RBA will decide to deliver a hike quicker than market expects - possibly before year's end. Nevertheless, any clear guidance on this is highly unlikely tomorrow.

Money markets expect the RBA to keep the cash rate unchanged at 4.10% tomorrow. Source: xStation5

A look at AUDUSD

Taking a look at AUDUSD chart at D1 interval, we can see that the pair has been trading sideways recently between 0.6350 support and 0.6500 resistance. Pair has recently failed to break above the 50-session moving average (green line) near the midpoint of the range and is pulling back towards the lower limit of the range today. A failure to deliver at least a slightly hawkish message in the light of recent data from Australia may trigger weakness on AUD market and a potential break below the lower limit. In such a scenario the textbook range of the downside breakout would suggest a possibility of a move to as low as 0.6200.

Source: xStation5

Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.