The world's largest uranium producer, Kazakhstan's Kazatomprom (KAP.UK) listed on the London Stock Exchange last week announced that the first batch of AFA 3G ТМ nuclear fuel has been shipped from the Ulba nuclear fuel plant to China. The company's shares are doing slightly better beating the FTSE index average:

- Rail platforms with 34 Kazatomprom shipping containers containing fuel assemblies equivalent to just over 30 tons of enriched uranium under special exhortation have been delivered to China and accepted by China's General Nuclear Power Corp:

"The implementation of the innovative nuclear fuel production project is an example of Kazatomprom's contribution to mitigating the effects of global climate change and achieving the global low-carbon goal. The Ulba plant allowed the company to diversify its production by expanding its composition and producing a high-tech, export-oriented, high-value-added uranium product. The successful delivery of the product to Chinese partners has confirmed Kazatomprom's reputation as a reliable and beneficial supplier to the global nuclear fuel market." - Yerzhan Mukanov, Kazatomprom CEO, commented on the deliveries. "The first delivery of the finished product marks the beginning of regular deliveries, and this is important not only for our companies, but significant for Kazakhstan and China," - the company reported.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app- Kazatomprom, thanks to favorably located raw material deposits in Kazakhstan, mines uranium using the ISR method and processes it in the country, which enables it to reduce logistics costs and sell fuel at the lowest prices on the global nuclear fuel market. The Ulba metallurgical plant is used to process uranium and began operations in November 2021 after, among other things, helping the French company Framatome and obtaining an agreement with the recipient, China's General Nuclear Energy Corporation;

- It is the only plant in Kazakhstan producing nuclear fuel, with contracted supplies 20 years ahead. The plant's current capacity is 200 tons of enriched uranium per year. The massive amount of supplies contracted for the future could enable the company to increase revenues if the spot price of uranium continues to rise as global demand for nuclear-generated power continues to grow;

- China plans to build 150 nuclear reactors in the next 15 years, an amount greater than the number of reactors built in the past 35 years, worldwide. China currently has 51 nuclear power plants, with 20 under construction. Nuclear accounts for about 5% of the energy produced in China with the Middle Kingdom intending to emphasize development toward uranium and nuclear power in the coming decades.

Kazatomprom as the world's largest uranium producer, with access to rich deposits exploited by the efficient in-situ recovery (ISR) method, is likely to be a beneficiary of the long-term trend:

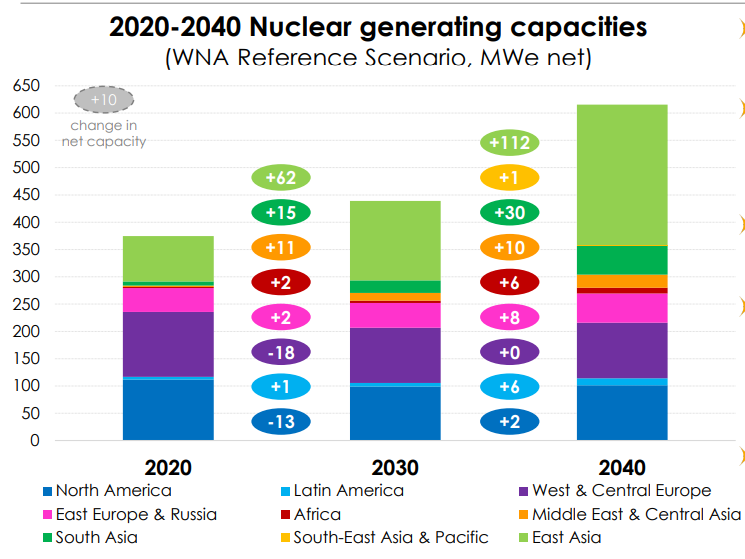

Kazatomprom points out that the reason for the competitiveness of the uranium ore and nuclear fuel it sells is access to the ISR mining method, which significantly reduces operating costs. In addition, it estimates that the supply of uranium will still be significantly lower than demand creating favorable conditions for an increase in the price of the raw material in the future. Since the beginning of the year, faced with the prospect of an economic slowdown, prices per pound of uranium ore have fallen from $50 to around $40 in the fourth quarter of the year. The price drop and geopolitical risks related to Russia's neighborhood have caused the company's shares to reprice from their 2021 valuation. Source: Kazatomprom The company assumes that East Asia's uranium supply needs will grow most significantly compared to other regions of the world, by 2040. However, the forecast comes from Q1 when sentiment around nuclear was still more negative in both Europe and the US. The unfolding energy crisis and deglobalization trends, however, have identified nuclear power as an efficient, zero-carbon energy source and an increasing number of politicians and businesses in the EU and the US are opposing the closure of nuclear power plants. Source: Kazatomprom

The company assumes that East Asia's uranium supply needs will grow most significantly compared to other regions of the world, by 2040. However, the forecast comes from Q1 when sentiment around nuclear was still more negative in both Europe and the US. The unfolding energy crisis and deglobalization trends, however, have identified nuclear power as an efficient, zero-carbon energy source and an increasing number of politicians and businesses in the EU and the US are opposing the closure of nuclear power plants. Source: Kazatomprom

Kazatomprom (KAP.UK) shares, H1 interval. The company's shares are gaining nearly 4% today amid weaker sentiment on the floor of the UK stock exchange. Source: xStation5

Kazatomprom (KAP.UK) shares, H1 interval. The company's shares are gaining nearly 4% today amid weaker sentiment on the floor of the UK stock exchange. Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.