Today after the Wall Street session, we will learn the results of the largest US electric car manufacturer, Tesla (TSLA.US). The market will primarily pay attention to gross margins, which are likely to fall as a result of another wave of price cuts for the Model Y and Model 3 in Q3. In addition to margins, investors will also pay attention to market share, which has fallen from 86 to 60% in the US since 2018 now in the face of increasing competition from other automakers. The company's outlook for the final quarter of the year will also be important. A total of as many as 21 analysts recently lowered their earnings-per-share forecast and the final consensus of expectations fell by nearly 50%. Will Tesla manage to positively surprise Wall Street?

Estimated revenue: $24.09 billion vs. $24.92 billion in Q2

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appEstimated earnings per share (EPS): $0.63 vs. $0.91 in Q2

Attention to margins?

- With several consecutive quarters of car price cuts and nearly 6% lower Tesla car prices on the US market in Q3, Wall Street's attention will focus on margins. Consensus is for total gross margins to fall to around 18%

- Automotive-only gross margins at a projected 19% rate (vs 24% previously) may prove to be lower than China's BYD and nearly equal to Toyota's which will put an additional question mark over the premium in valuing Tesla's business.

- On the other hand, however, lower lithium prices may offset the company's pricing to some extent, and Bloomberg expects Q4 margins to rebound above 20% again

- In an environment of weakening demand, Tesla has regularly cut prices of its models. Investors are concerned that these reductions will continue and reduce earnings per share in view of a possible economic recession

- In Q3, deliveries fell 6.7% year-on-year to 435,000 car models - the market invariably fears more sustained muted demand for cars in an environment of high interest rates affecting consumer behavior and wallets

- The recent 49,000 decline in production reversed a five-quarter period of rising inventories. This has caused Musk's estimate of a 50% year-on-year growth rate in shipments to be received with increasing pessimism and appears exaggerated.

- Wall Street is concerned that the de facto year 2021 may have been the last year in which the growth threshold was exceeded, and the consensus is now for the rate to fall below 25% by 2025. At the same time, it must be acknowledged that a year-on-year growth rate of 25% in principle could be still more than satisfactory.

Will future prospects help Tesla again?

- Barclays analysts see the risk of a decline in gross margin to 17.1%, which would be the lowest since Q1 2019. According to the bank, weaker demand and lower car prices will determine margins, with a trace positive impact from lower commodity prices. Some analysts including Wells Fargo see the risk of an even bigger decline in margins - below 16%.

- Piper Sandler, on the other hand, does not expect margins to completely determine the reaction to the results because the market is awaiting an update on the start of Tesla Cybertruck deliveries and the stock market may begin to more quickly price in potential earnings improvements on the horizon, and improvements to the Model 2 autonomous driving model may improve demand. Analysts also expect next year to show strong revenue growth from Tesla's Energy segment

- Tesla has postponed production of the Cybertruck to the last month of the year versus the previously planned production in October. Investors will await an update on this. Some analysts have raised concerns that Tesla is pointing to a slowdown caused by factory shutdowns masking a lack of demand for cars.

- Some analysts point out that the lack of a UAV-like union and the associated risks of a protest by Tesla workers puts the company at an advantage against competitors from Ford (F.US) and General Motors (GM.US), which are bracing for higher costs and must plan for layoffs.

Tesla stock (TSLA.US) D1 interval

Looking at the stock price of the world's second largest electric car manufacturer next to China's BYD, we see that the price remains above the SMA100 average (below which the decline turned out to be a local low in August) and the 23.6 Fibonacci retracement from the fall of 2022 upward wave. A decline below the $252 level could herald a test of the area around $220 per share near the 38.2 Fibo retracement. The key support remains the SMA200 average (red line), which is located at the $213 level. The main resistance zone is located around $270 per share and is marked by local peaks through. Source: xStation5

Looking at the stock price of the world's second largest electric car manufacturer next to China's BYD, we see that the price remains above the SMA100 average (below which the decline turned out to be a local low in August) and the 23.6 Fibonacci retracement from the fall of 2022 upward wave. A decline below the $252 level could herald a test of the area around $220 per share near the 38.2 Fibo retracement. The key support remains the SMA200 average (red line), which is located at the $213 level. The main resistance zone is located around $270 per share and is marked by local peaks through. Source: xStation5

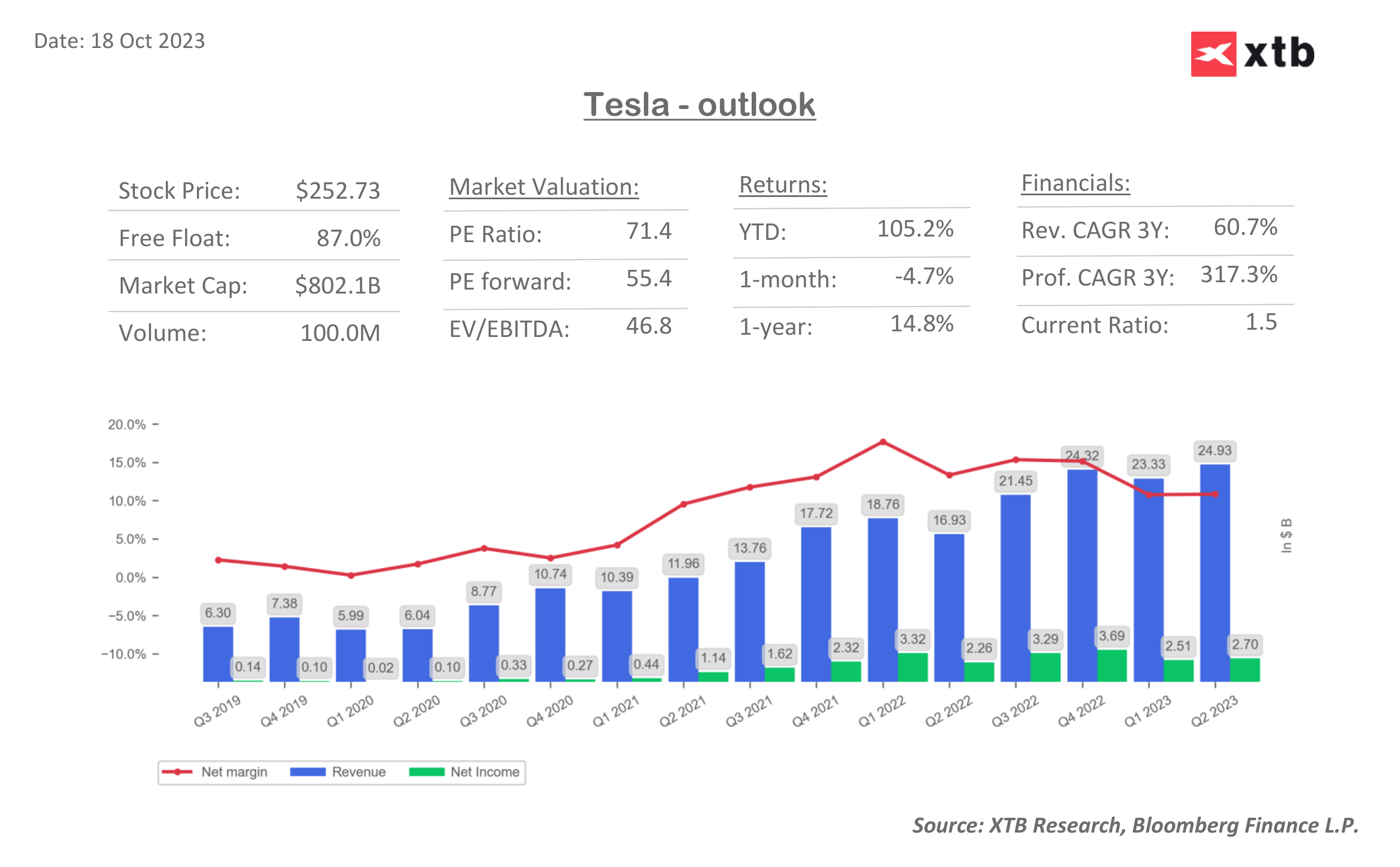

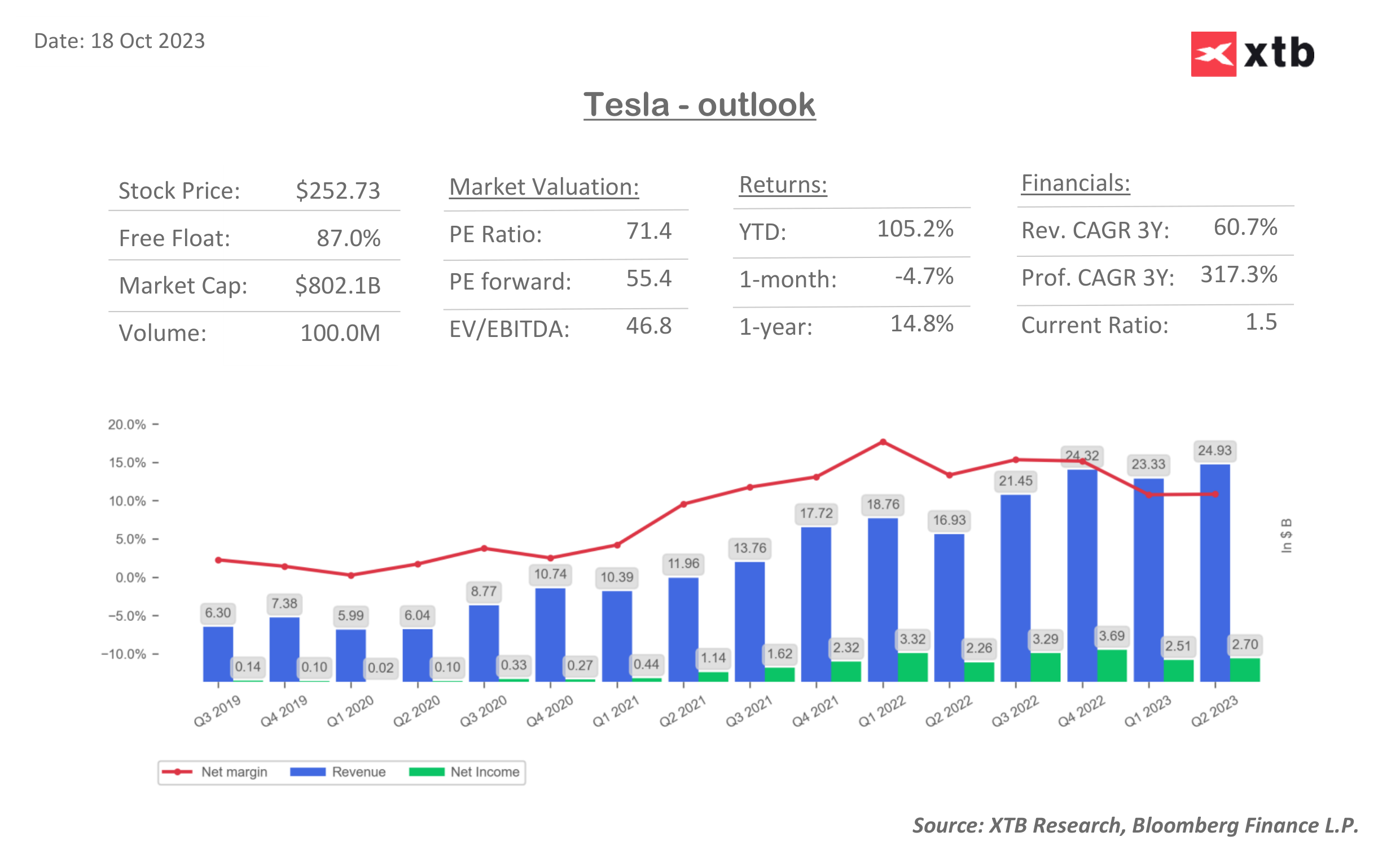

Tesla's outlook and expectations

Source: XTB Research, Bloomberg Financel LP

Source: XTB Research, Bloomberg Financel LP

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.