The EUR/JPY currency pair is a frequently traded asset in the foreign exchange market, where traders can speculate on the exchange rate between the Euro and Japanese Yen. To make informed decisions when investing in EUR/JPY, there are several important factors to consider.

It is important to note that the pip value for yen pairs, such as EUR/JPY, is placed at the second decimal place, which means that fluctuations in the exchange rate are more pronounced. This also implies that traders need to be mindful of the risks associated with trading with higher volatility.

The economic data and policy decisions of the countries involved can significantly affect the EUR/JPY exchange rate. For instance, Germany has the highest GDP in the Eurozone, and its economic data and policy decisions can have a significant impact on the Euro. Similarly, the monetary policy decisions of the Bank of Japan can impact the Yen's exchange rate.

Trading the EUR/JPY currency pair through CFDs can provide investors with the opportunity to profit from the fluctuations in exchange rates between these two currencies. However, it is important to note that like any CFD trading, investing carries a degree of risk. Investors should have a thorough understanding of the forex market, technical analysis, and risk management techniques before trading. Additionally, investors should keep up-to-date with relevant news and events that can impact the exchange rate between these two currencies.

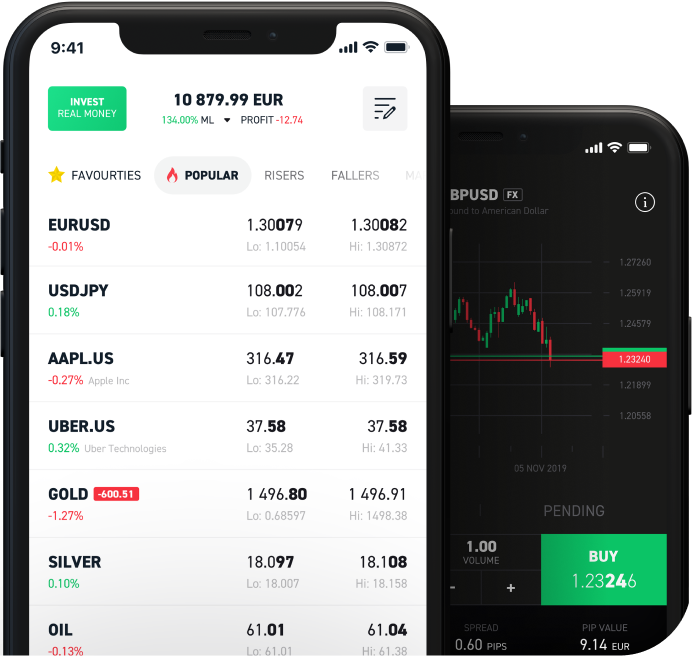

XTB provides CFD trading for the USD/JPY forex pair using our xStation trading platform, which allows you to track near real-time movements.

Recent market events have had an impact on the EUR/JPY exchange rate. For instance, the AUD/USD experienced a surge as the US dollar depreciated, and the Fed increased the amount of money in circulation. Furthermore, the Bank of Japan's monetary policy decisions have also affected the stability of JPY pairs.