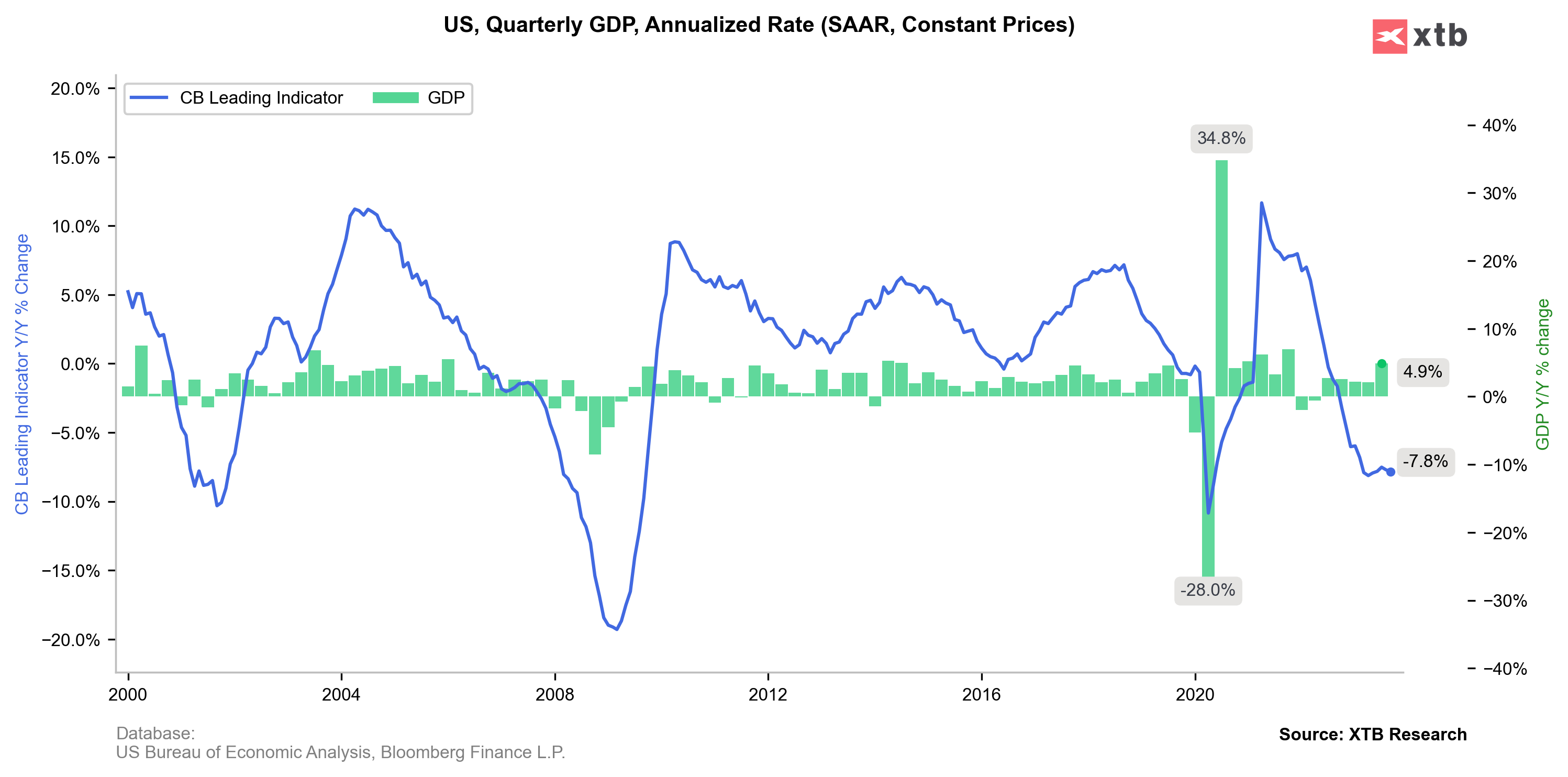

A key US macro report of the week - GDP report for Q3 2023 - has been just released at 1:30 pm BST. Report was expected to show a significant acceleration in annualized GDP growth compared to Q2 2023. Apart from GDP data, a weekly report on jobless claims as well as durable goods orders report for September was released simultaneously.

Actual data showed higher rate of expansion of the US economy in the Q3 2023 as well as higher core PCE for the quarter. When it comes to other data, durable good orders also surprised to the upside, as did jobless claims. Overall, datapack was solid and it should not come as a surprise the USD strengthened in a knee-jerk move. However, it has given up those gains later on. Indices moved higher following the release.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appUS GDP report for Q3 2023

- GDP growth (annualized): 4.9% vs 4.3% expected (2.1% previously)

- Core PCE: 2.4% QoQ vs 2.5% QoQ expected (3.7% QoQ previously)

Durable goods orders report for September

- Headline orders: 4.7% MoM vs 1.7% MoM expected (0.1% MoM previously)

- Ex-transport: 0.5% MoM vs 0.2% MoM expected (0.4% MoM previously)

Jobless claims report

- Initial jobless claims: 210k vs 209k expected (198k previously)

- Continuing claims: 1790k vs 1740k expected (1734k previously)

EURUSD moved lower in a knee-jerk move following US Q3 GDP report release. However, pair failed to break below the short-term support zone in the 1.0530 area and has turned higher later on. Source: xStation5

EURUSD moved lower in a knee-jerk move following US Q3 GDP report release. However, pair failed to break below the short-term support zone in the 1.0530 area and has turned higher later on. Source: xStation5