Flash PMIs for May were highlights in today's economic calendar for the European morning session. Data turned out to be very mixed. French release showed in-line manufacturing print and a miss in services data, German release showed weaker-than-expected manufacturing data and a much better-than-expected services reading while data from the United Kingdom disappointed in case of both sectors.

Nevertheless, the general view across Europe is similar - the manufacturing sector continues to contract while the services sector continues to expand. Divergence between services and manufacturing sectors is said to be unusual but is reasoned with strong-than-expected consumer spending that supports services and a slump in Chinese manufacturing activity in Q2 2023 that weighs on manufacturing in Europe as well. Nevertheless, such a mix points to persisting inflation pressures and may lead to a need for more monetary policy tightening.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appManufacturing PMIs for May

- France: 46.1 vs 46.0 expected (45.6 previously)

- Germany: 42.9 vs 45.0 expected (44.5 previously)

- Euro area: 44.6 vs 46.2 expected (45.8 previously)

- United Kingdom: 46.9 vs 47.9 expected (47.8 previously)

Services PMIs for May

- France: 52.8 vs 54.2 expected (54.6 previously)

- Germany: 57.8 vs 55.5 expected (56.0 previously)

- Euro area: 55.9 vs 55.5 expected (56.2 previously)

- United Kingdom: 55.1 vs 55.5 expected (55.9 previously)

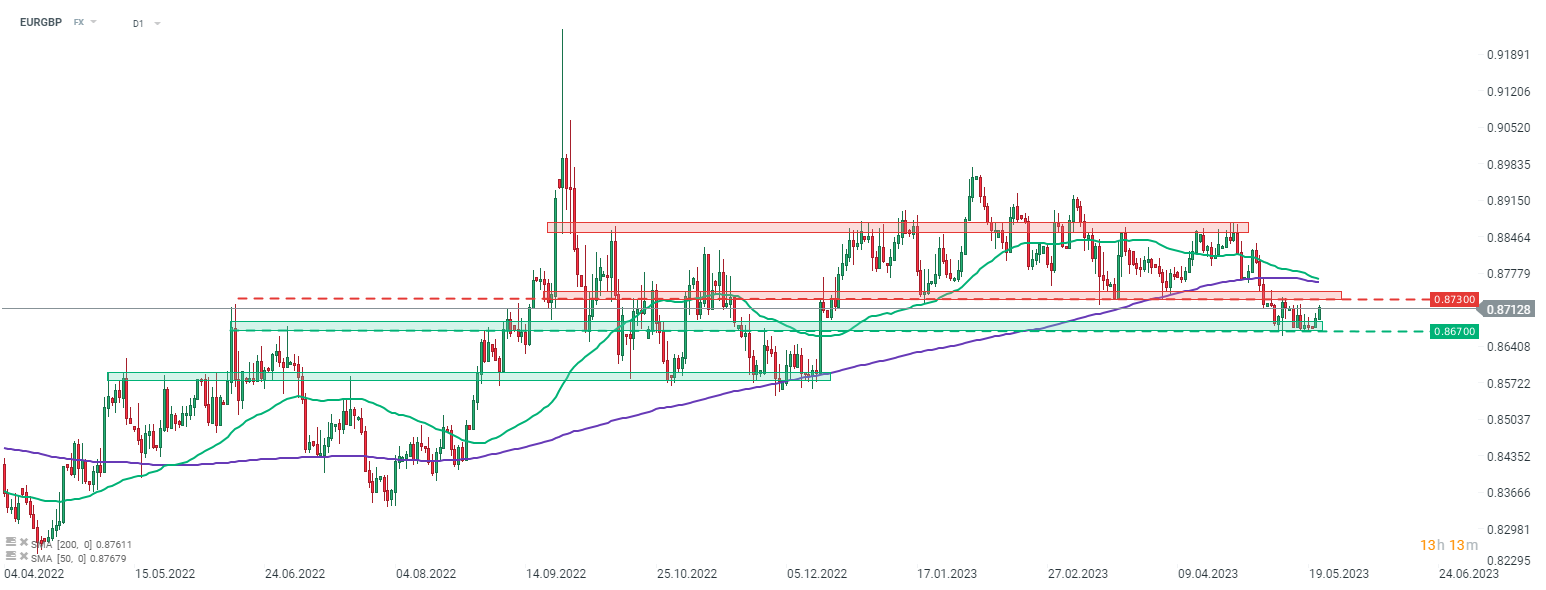

In spite of a mixed PMIs from France and Europe, EUR managed to hold quite firm and did not see any major price reaction. On the other hand, GBP took a hit following a double miss in UK PMIs. As a result, a rather strong upward move on EURGBP can be spotted today. Taking a look at EURGBP chart at D1 interval, we can see that the pair continues a bounce triggered after a failure to break below the 0.8670 support zone. Should the current sentiment prevail, an attempt to break back above the 0.8730 resistance zone may be made soon.

Source: xStation5

Source: xStation5