Chinese inflation data was released during the Asian trading session today. Both CPI and PPI inflation data came in much below market expectations.

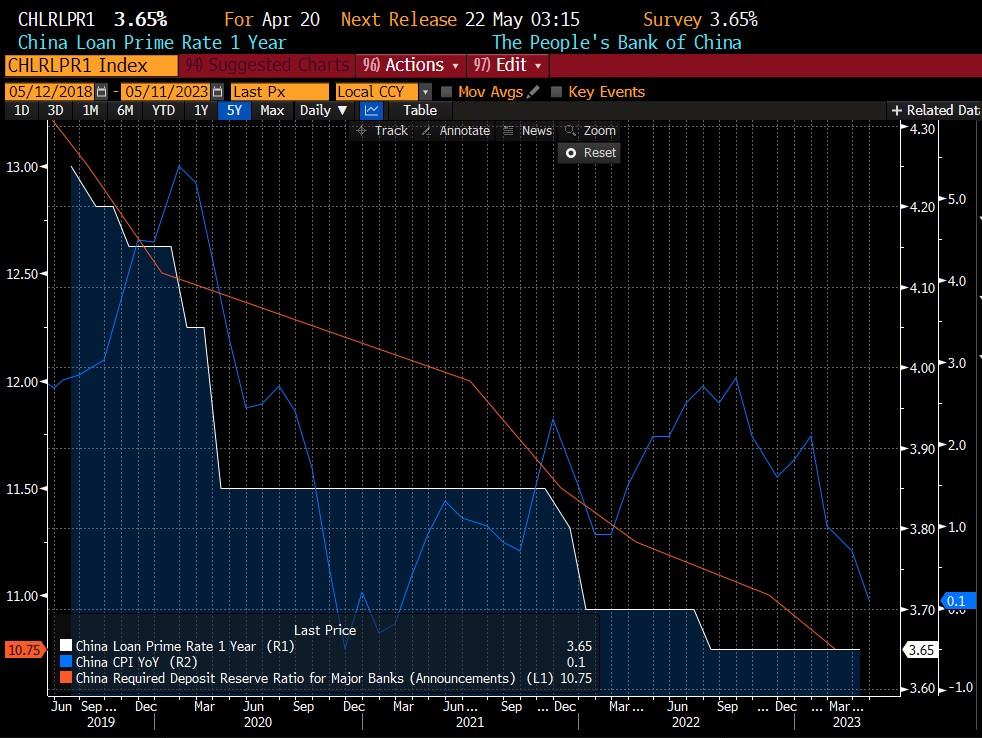

Headline CPI slowed from 0.7% to 0.1% YoY while the market expected it to drop to 0.3% YoY. Meanwhile, PPI inflation dropped further into negative territory, moving from -2.5% to -3.6% YoY (exp. -3.3% YoY).

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appSuch a low price growth give People's Bank of China reasons to ease its policy. PBoC could do so by either lowering the main interest rate or by cutting reserve requirement ratio. While the main interest rate in China sits at 3.65% currently, reserve requirement ratio is at 10.75%, which is very high compared to RRR in developed countries.

In theory, today's Chinese inflation reading is positive news for commodities.

Inflation and interest rates in China. Source: Bloomberg