Cryptocurrency and blockchain-related stocks, including Riot Blockchain (RIOT.US), Microstrategy (MSTR.US) and Coinbase (COIN.US), plunged over 10.0% as bitcoin tumbled more than 15% amid a wider market selloff. Also several industry related news weigh on investors moods. Major cryptocurrency lender Celsius announced on Sunday it would pause "all withdrawals, Swap, and transfers between accounts," citing "extreme market conditions," without specifying further. Today Binance, the world's largest cryptocurrency exchange, has temporarily suspended client withdrawals of Bitcoin due to a "stuck transaction,"Chief Executive Changpeng Zhao informed via Twitter. Additionally Binance received a lawsuit from a U.S. investor who claims the company falsely marketed Terra USD as a safe asset ahead of the so-called stablecoin's collapse in value last month. The sentiment is extremely bearish towards the sector, which on the one hand may lead to further declines. On the other hand, such negative attitudes of investors in the past often created interesting investment opportunities for long-term buyers.

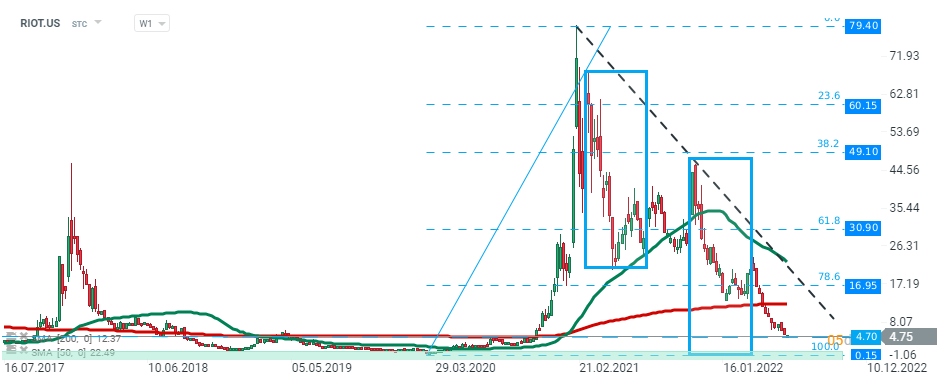

Riot Blockchain (RIOT.US) stock fell nearly 95.0% from 2021 high and is currently testing local support at $4.70. However if sellers manage to uphold current momentum, support at $0.15 may be at risk. This level is marked with previous price reactions and lower limit of the 1:1 structure. Source: xStation5