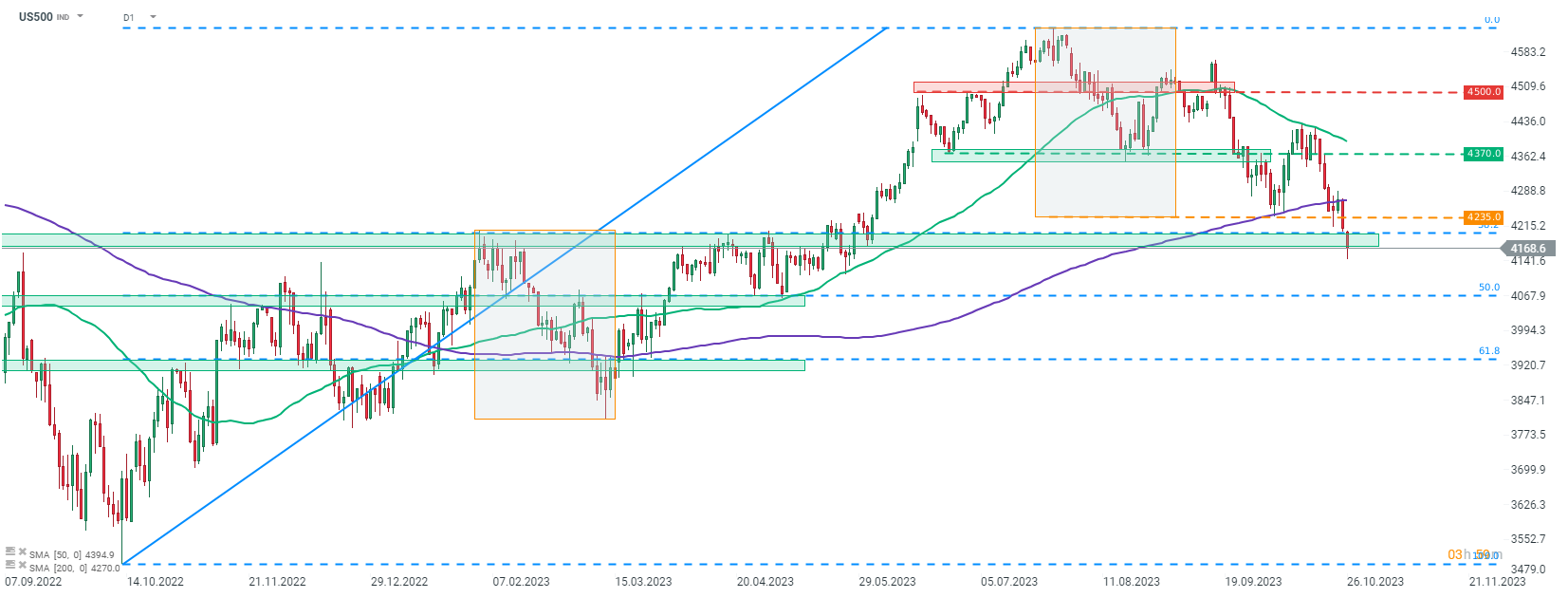

- Wall Street indices deepened ongoing downward move today after key support levels on major US indices were breached yesterday

- S&P 500 drops 1%, Nasdaq is down 1.6% and Dow Jones trades 0.6% lower at press time

- Reports from 2 major US tech companies are scheduled to be released today after Wall Street session close - Amazon and Intel

- European stock market indices traded lower today with German DAX dropping 1.1%, UK FTSE 100 taking a 0.8% hit and French CAC40 moving 0.4% lower

- US GDP report for Q3 2023 surprised to the upside showing annualized growth accelerating from 2.1% to 4.9% (exp. 4.3%)

- US Treasury Secretary Yellen said she wouldn't be surprised if the US economy grew by 2.5% in full-2023. She said that it looks US economy is having a soft landing

- ECB left interest rates unchanged today, in-line with market expectations. ECB President Lagarde said that it is now time to hold rates steady and analyze incoming data. However, Lagarde refused to confirm whether rate peak was reached

- CBRT delivered a 500 basis point rate hike today, pushing the 1-week repo rate from 30.00% to 35.00%. Decision was in-line with expectations

- US headline durable goods orders were 4.7% MoM higher in September (exp. +1.7% MoM) while core orders were 0.5% MoM higher (0.2% MoM)

- US pending home sales increased 1.1% in September (exp. -1.9% MoM)

- US trade balance for September came in at -$85.78 billion (exp. -$86.2 billion)

- US jobless claims came in at 210k, slightly above 209k expected

- EIA report showed a 74 billion cubic feet build in US natural gas inventories, less than 82 bcf expected by analysts

- Cryptocurrencies traded lower today with Bitcoin dropping 1.9% while Ethereum and Litecoin are trading 0.4% lower

- Energy commodities are trading mixed - oil drops 2.5-3.5% while US natural gas prices climb 2.5%

- Precious metals trade mixed as well - gold gains 0.4%, palladium trades 0.5% higher while silver and platinum drop 0.2% each

- AUD and NZD are the best performing major currencies while CHF and CAD lag the most

S&P 500 futures (US500) continued to move lower after breaking below the lower limit of the Overbalance structure yesterday. Source: xStation5

S&P 500 futures (US500) continued to move lower after breaking below the lower limit of the Overbalance structure yesterday. Source: xStation5