-

The first session on Wall Street this week brings gains in the major stock market benchmarks. Market sentiment is improving on a wave of strong financial results from Palo Alto Networks (PANW.US) and rising shares of Nvidia (NVDA.US), which was supported by a recommendation from HSBC. The company will present its Q2 financial report and Thursday's earnings report, and has already been boosted today by investment banks upgrading ratings on the company's shares.

-

Companies from Europe mostly ended today's session higher. The DAX added 0.19% and the Euro Stoxx 50 added over 0.29%.

-

Tesla (TSLA.US) shares gained more than 5.5% on Monday, breaking a six-session wave of declines after brokerage Baird Equity Research added Tesla shares to its 'best ideas' list.

-

Declines in shares of electric car maker Nikola (NKLA.US) are accelerating today from the open on Wall Street and are already above 14% as the company announced an additional $325 million bond issue and a recall of all 209 'semi-truck' EVs produced due to a potential design flaw.

-

The People's Bank of China cut the one-year lending rate from 3.55% to 3.45% and kept the five-year rate unchanged at 4.20%. The decision was a disappointment as the market had expected cuts of 15 basis points in both cases to support the weakening Chinese economy

-

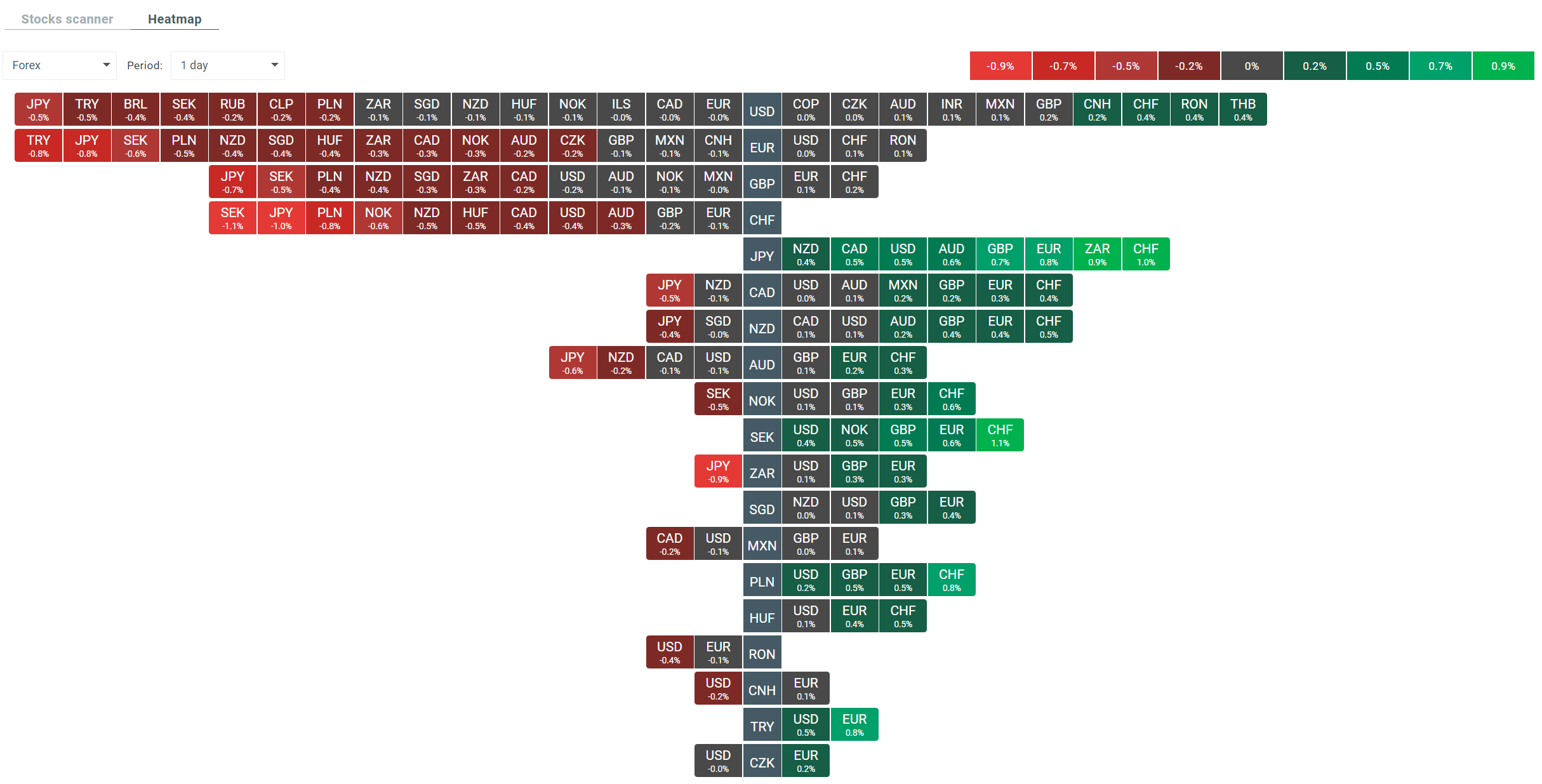

In the FX market, the Swiss franc and the euro are currently the best performers. The Japanese yen is seeing massive declines in the broad markets. The EURJPY pair is climbing to levels not seen since 2008.

-

Yields on treasuries have started to rise again, 30-year bonds have approached 2011 highs and '10-years' have reached their highest level since November 2007 as investors price in a possible scenario of the Fed keeping interest rates higher for longer

-

UBS lowered its forecast for China's real GDP growth in 2023 to 4.8 per cent from 5.2 per cent, and Goldman Sachs analysts recently supported the dollar by rallying higher than expected 2 per cent US GDP growth in 2023.

-

Energy commodities are trading mixed, with oil losing 0.6% and US gas prices rising 2.1%.

-

Very good sentiment is seen in precious metals. Gold is gaining 0.3% and silver is adding over 2.4%.

-

Cryptocurrencies failed to rebound after last week's falls. Bitcoin is still trading at USD 26,000

Source: xStation 5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app