Major cryptocurrencies are trading lower on Thursday, as yesterday's Fed-induced relief rally ran out of steam and investors try to assess whether central banks' hawkish stance will hit economic growth. Negative sentiment from the stock market has spilled over into digital assets and led to sharp declines, given the fact that major cryptos are still strongly correlated with the US tech sector. Bitcoin fell over 8.0% and broke below support at $37,000, while Litecoin lost more than 7.0% and similar to many other projects erased yesterday gains. Downbeat moods overshadowed recent news regarding the adaptation of digital currencies in everyday life. Italian luxury fashion giant Gucci announced plans to accept payment in ten cryptocurrencies, including Bitcoin, Litecoin and Ethereum in its directly managed stores in North America.

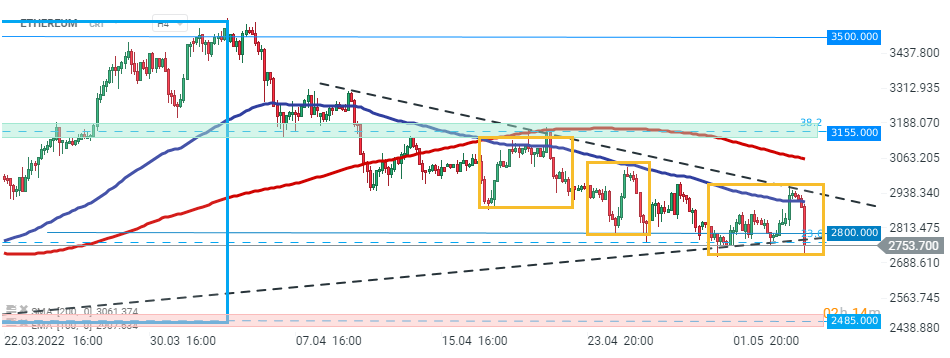

ETHEREUM fell sharply during today's session, however sellers struggle to break below major support around $2800 which coincides with lower limit of the triangle formation, 23.6 Fibonacci retracement of the downward wave and lower limit of the local 1:1 structure. Should break lower occur, downward move may accelerate towards support at $2485 which is marked with previous price reactions. On the other hand, if buyers manage to regain control, then another upward impulse could be launched towards the upper limit of the triangle formation. Source: xStation5