A flight to safety can be spotted on the global financial markets ahead of the weekend. Risk of escalation in the Middle East remains real and investors seem to be positioning for it, or at least are reducing their bets in riskier assets. Stock market indices from Europe and the United States traded lower today with US100 being down over 1% today. At the same time, we can see rather strong gains on the precious metals market, even as yields keep climbing. Gold is up 0.7% on the day while silver rallies almost 2%. Meanwhile, oil is defying pullback in risky assets and is flat on the day what further supports the narrative that moves on the global markets today are driven by fears of Middle East escalation.

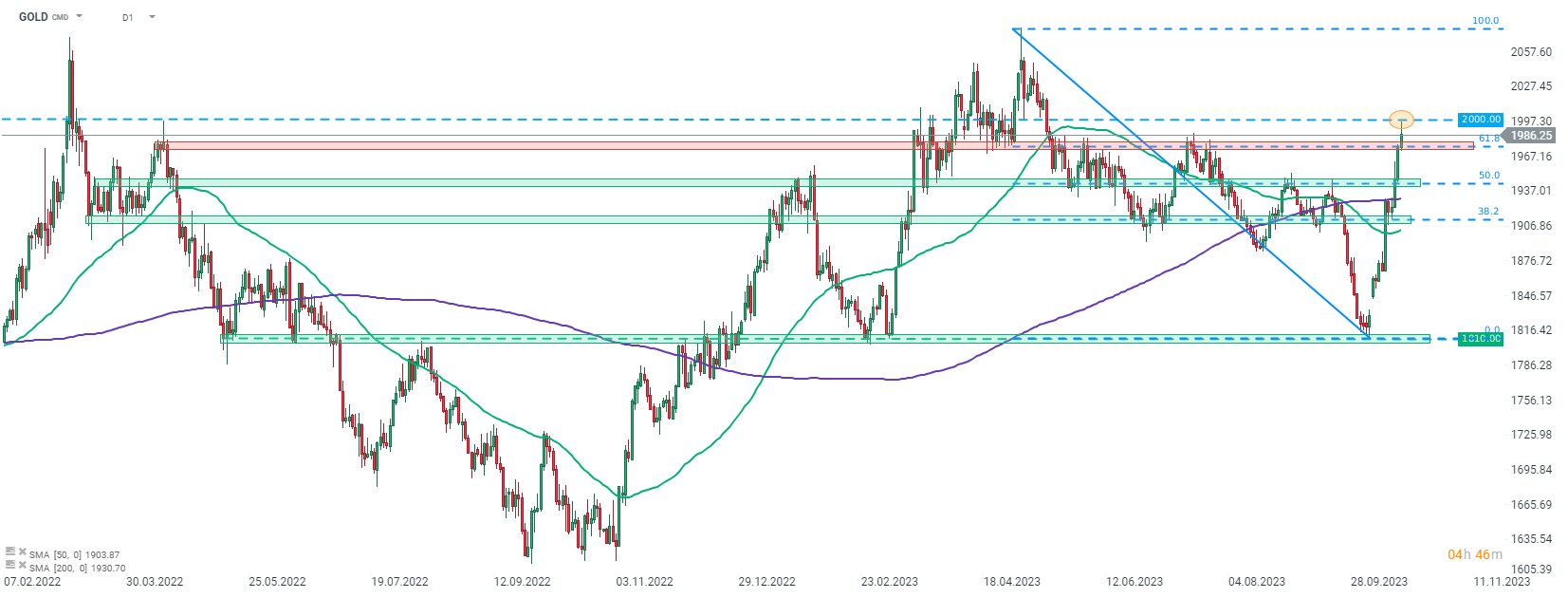

Taking a look at GOLD chart at D1 interval, we can see that the price of this precious metal has almost reached a psychological $2,000 per ounce level earlier today and trades at the highest level since mid-May 2023. Gold price has already jumped around 10% since the beginning of Israel-Hamas war and bulls do not seem to be bothered by today's pick-up in yields. However, around half of today's gains has been erased already and should gold swing to negative by the end of the day, a bearish pin bar pattern would be painted in a important resistance area, marked with 61.8% retracement of the May-October downward move.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app GOLD has almost reached a psychological $2,000 per ounce level earlier today. Source: xStation5

GOLD has almost reached a psychological $2,000 per ounce level earlier today. Source: xStation5