Solid results do not impress investors, but Netflix has a few aces up its sleeve

We already know the financial results of the largest company in the streaming industry in the world, Netflix. Recently, the movie industry has been going through some struggles due to the screenwriters' strike, which previously halted many productions, and the recent Hollywood actors' strike. To a large extent, the strikes have been caused by the changing working conditions imposed by the booming streaming business. But can the Hollywood strike be an opportunity for Netflix? It turns out it could!

Solid results, disappointment for investors

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appThe company presented a very strong net result, as the earnings per share were $3.29, compared to an expected $2.86. Moreover, a significant year-on-year drop was expected from $3.2 per share, but thanks to improved margins, a good financial result was achieved that other streaming platforms would like to boast about. On the other hand, the revenues were received negatively by the market: they amounted to $8.2 billion, which was a 3% year-on-year increase, while a 4-5% increase was expected. However, what's more important from the investors' perspective, the company itself said that it expects strong growth in revenues in the second half of the year, but a potential result of $8.5 billion for Q3 is a target lower than what the market sees at $8.7 billion. Hence, the 8% drops in post-session listings after the publication of the financial report. At the same time, it's worth noting that the shares have recently been making strong gains, so this may simply be a realization of profits, taking advantage of high liquidity.

Netflix's financial results. Although revenues were record-breaking and margins improved, investors are cashing in after recent increases. Source: Bloomberg, XTB

Netflix has shown that it can favor its own fortune. The company reported an increase in paying users by 5.9 million people, which was more than twice as many as the expected 2-2.6 million people. Netflix has long been trying to monetize users who have so far used the courtesy of sharing their passwords with their families or acquaintances. Netflix has banned such practice in 100 of its markets (in the US since May), and now plans to implement this in all markets. Netflix had previously stated that there might be even 100 million "hidden" users. It now reports that it earns more from increasing the number of accounts than from those who resign and may be switching to competition. In addition, Netflix also offers a "cheap" ad-supported option and is removing the previous basic ad-free version in the US, replacing it with an ad-supported account. If Netflix is successful in this field, despite Netflix being criticized many times for this course of action, it seems that the potential user growth could be quite large, at least in the near future.

Hollywood strike an opportunity for Netflix?

The screenwriters' strike began in early May, and in mid-July, the actors went on strike in the US. This means that many productions could be delayed, which could pose a problem for Netflix, but also for other streaming platforms. However, Netflix has content that can be published for many more months, and it is also returning to its earlier strategy of buying productions from competitors. This is happening, among others, by purchasing series and movies from HBO. It should also be remembered that the actors' strike mainly affects Hollywood, and Netflix also uses the services of actors from other associations, not to mention that productions are also conducted in other countries, so new productions are constantly coming. Netflix itself, however, says that it is constantly negotiating with the strikers and hopes for a quick resolution of the conflict.

Netflix earns more, but is highly valued for it

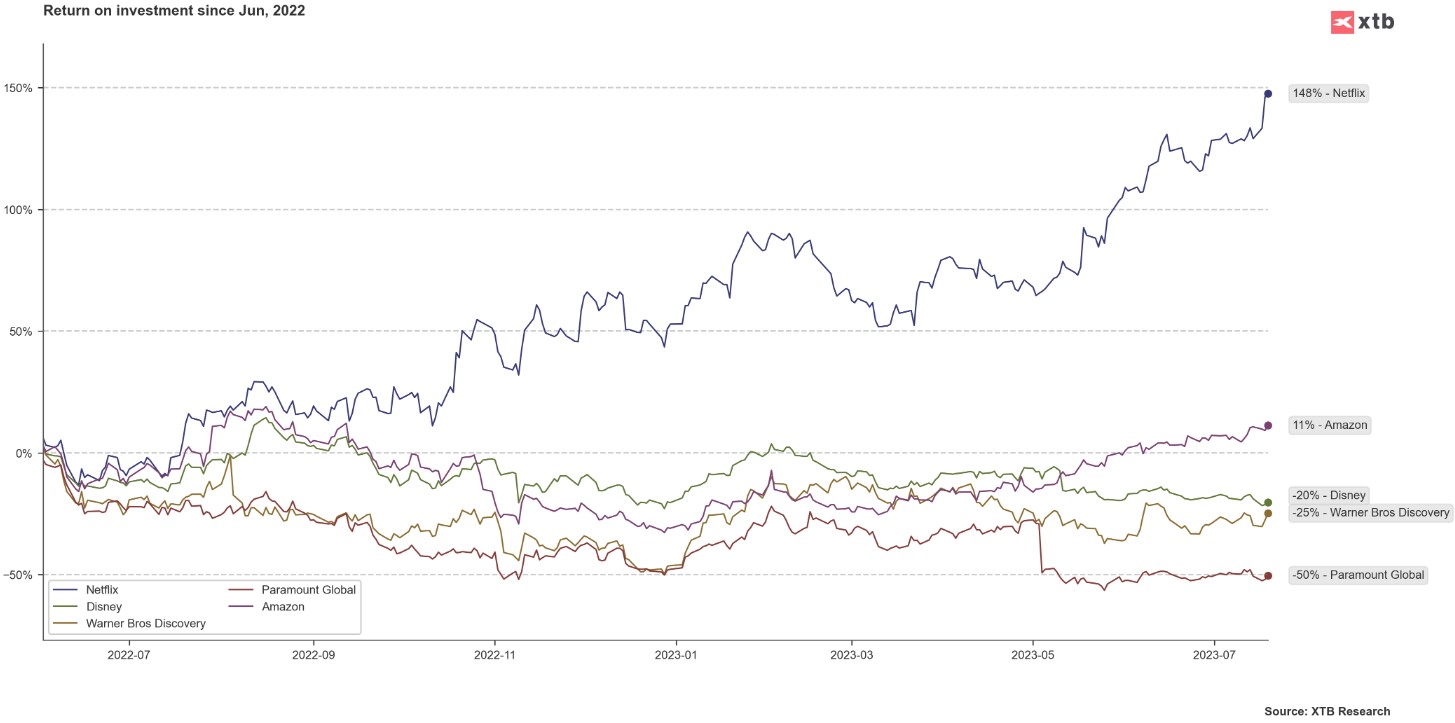

Companies like Paramount or Disney may not necessarily boast positive financial results from their streaming operations. However, after a fairly difficult 2022 with a decline in the number of users, Netflix is doing better and better. Investors also see this and the company's shares have rebounded almost 150% over the course of one year and about 60% since the beginning of this year! This means that Netflix is the most expensive company among those engaged in streaming, excluding Amazon, whose price-to-earnings ratio remains at an extremely high level, but at the same time, streaming is just a drop in the ocean of the company's revenue sources.

Over the course of the year, Netflix had no equal in terms of stock price growth. However, it is still about 50% off its historic highs. Source: Bloomberg, XTB.

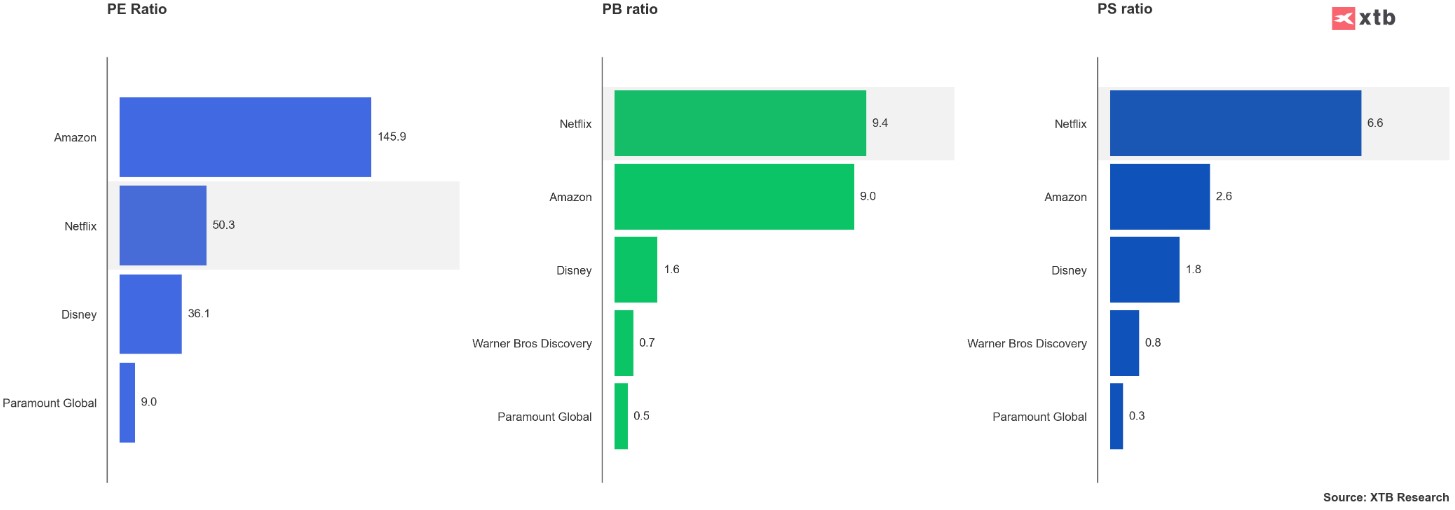

Looking at the indicators, Netflix is a fairly expensive company compared to its competition. Source: Bloomberg, XTB

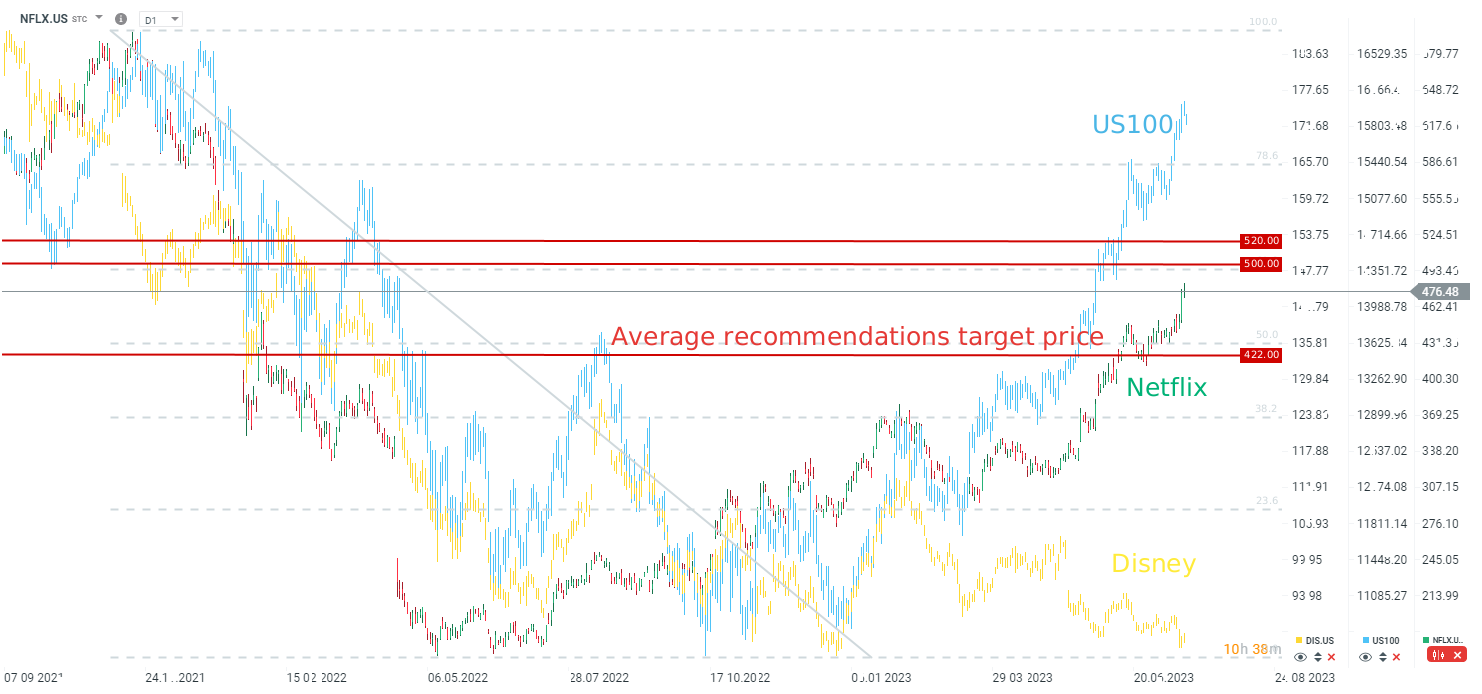

Netflix has about 50% potential growth to its historic highs and has been doing much worse over the past few months than the technology index Nasdaq 100. However, it's doing much better than Disney. Although investors received Q2 results rather poorly, these numbers should still be seen as solid and the prospects for this year should be viewed rather optimistically. Of course, at some point, the "content" may run out, so a prolonged strike could also be another ticking time bomb for the company, just as it was last year when a significant number of users were lost.

Netflix shares may drop this week, but if sentiment remains positive on tech companies, there will be a chance to chase the main Nasdaq 100 index. Source: xStation5