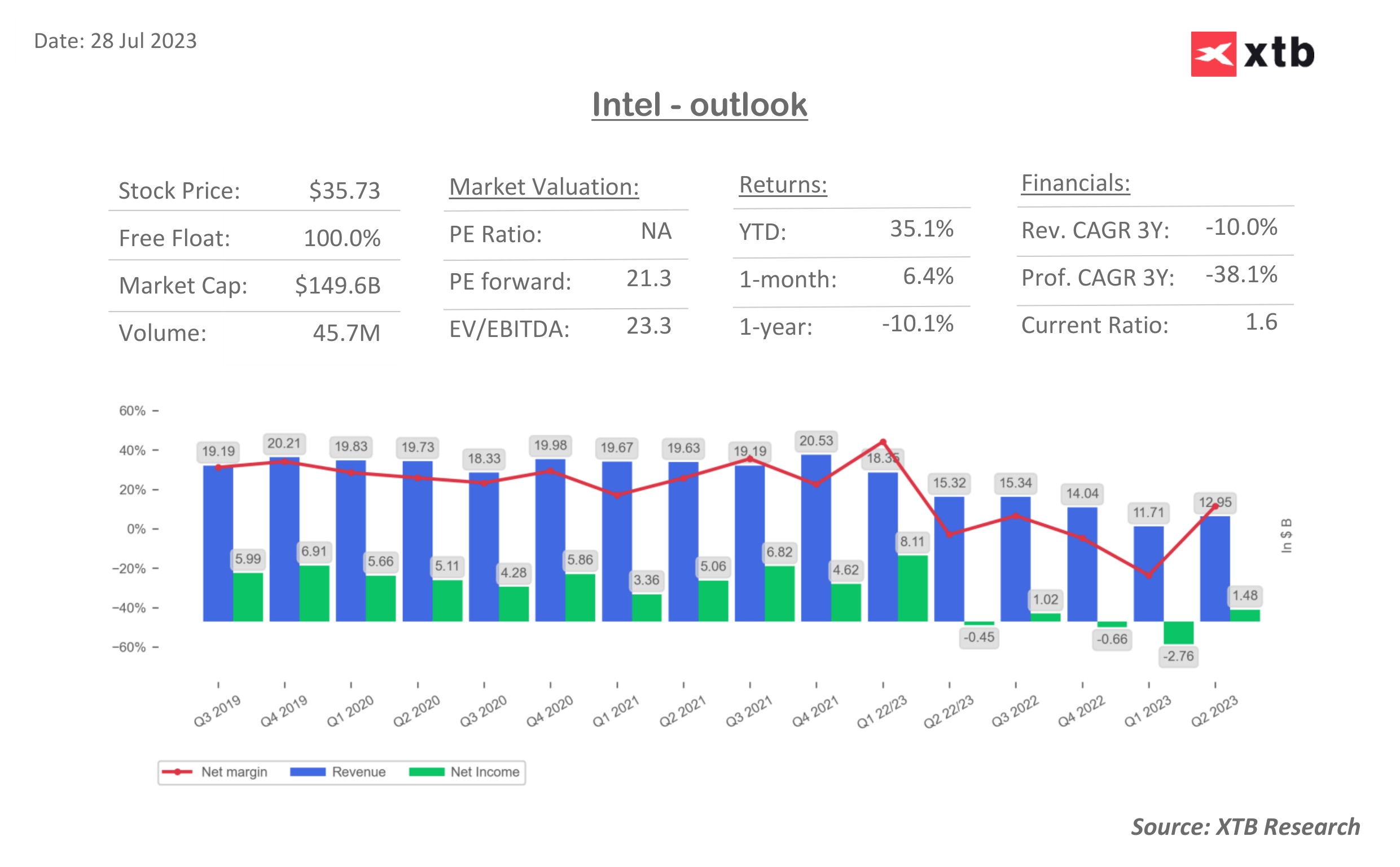

Intel's (INTC.US) shares rose over 7% following a strong quarterly report, indicating a potential reversal in the company's fortune after struggling with declining PC sales and intense competition in the data center market. The company's unexpected second-quarter profit, along with robust earnings and margin forecasts, suggested that the slump in the personal computer market could be nearing its end. This positive projection triggered a surge in Intel's stock and boosted the broader chip sector.

Key points:

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app- Revenue: $12.9 billion, which is down 15% year over year (YoY).

- EPS non-GAAP: $0.13, versus $-0.3$ expected

- The company is forecasting Q3 2023 revenue of approximately $12.9 billion to $13.9 billion.

- Expecting Q3 2023 non-GAAP EPS attributable to Intel of $0.20.

- Gross Margin was down 0.7% points from 36.5% in Q2 2022 to 35.8% in Q2 2023.

- Business Unit Revenue and Trends Q2 2023 vs. Q2 2022:

- Client Computing Group (CCG): $6.8 billion, down 12%

- Data Center and AI (DCAI): $4.0 billion, down 15%

- Network and Edge (NEX): $1.4 billion, down 38%

- Mobileye: $454 million, down 1%

- Intel Foundry Services (IFS): $232 million, up 307%

Intel's CEO, Pat Gelsinger comments:

- AI Opportunity: In Q2, Intel began to see real benefits from their accelerating AI opportunity. They believe they are in a unique position to drive the best possible TCO (total cost of ownership) for their customers at every node on the AI continuum.

- Investments in Manufacturing Capacity: Intel is strategically investing in manufacturing capacity to further advance their IDM 2.0

- AI and Semiconductor Sectors: Intel sees the surging demand for AI products and services as expanding the pipeline of business engagements for their accelerator products

- Quantum Computing: Intel shipped their test chip “Tunnel Falls” a 12-qubit, silicon-based quantum chip which uniquely leverages decades of transistor design and manufacturing investments and expertise

Despite being a leading player in the American chip industry, Intel had fallen behind competitors like Taiwan's TMSC and Nvidia, in terms of both margins and market value. The downturn in the PC market and stiff competition in the data center market had severely impacted its business. Intel's shares have rallied by 30% this year after a challenging 2022, but this increase pales in comparison to the over three-fold rise in Nvidia, which became the first chipmaker with a trillion-dollar market value in May. The AI market, which Intel has missed out on due to its minimal presence in graphics-processing units and other AI specialist chips, largely facilitated this monumental rise.

Intel (INTC.US), D1 interval, source xStation 5