- Yesterday's session on Wall Street ended in negative sentiment. The Nasdaq index lost more than 1.87% intraday, the benchmark S&P500 lost 1.37% and the Russell 2000 lost more than 1.87%. The sell-offs intensified after the JOLTS data reading, which indicated the strength of the U.S. labor market, which may encourage the Fed to make more interest rate hikes.

- The RBNZ left rates unchanged, at 5.5%. The bankers' comments indicated that rates should remain at more restrictive levels for a longer period of time, and that the market still faces the threat of an insufficient decline in economic activity and inflation in the short term. The NZD lost after the decision in the face of a slightly less hawkish stance by the RBNZ than previously expected.

- U.S. political news dominated the pre-morning opening in Tokyo, when House of Representatives Speaker Kevin McCarthy was ousted from office.

- Secretary of State in the Japanese government Matsuno announced that the authorities will continue to take appropriate steps on the FX market. Finance Minister Suzuki and FX department head Kanda declined to comment on whether Japan intervened in the FX market.

- Japan's September services PMI came in at 53.8 (the previous figure was 54.3). What's more, Australia's revised services PMI came in at 51.8 (vs. the previous 47.8).

- Cryptocurrency Ripple received a full payment institution license in Singapore, the cryptocurrency is gaining more than 3% today despite a broad sell-off in the crypto market.

- API data show a much larger drop in US oil inventories than expected. EIA data today at 3:30 pm BST.

- Today's session will bring two speeches by President Lagarde and speeches by her ECB colleagues, Panetta and Guidos.

- The highlights of today's macro calendar are: ADP report (US) and PMI data for services (US, Europe).

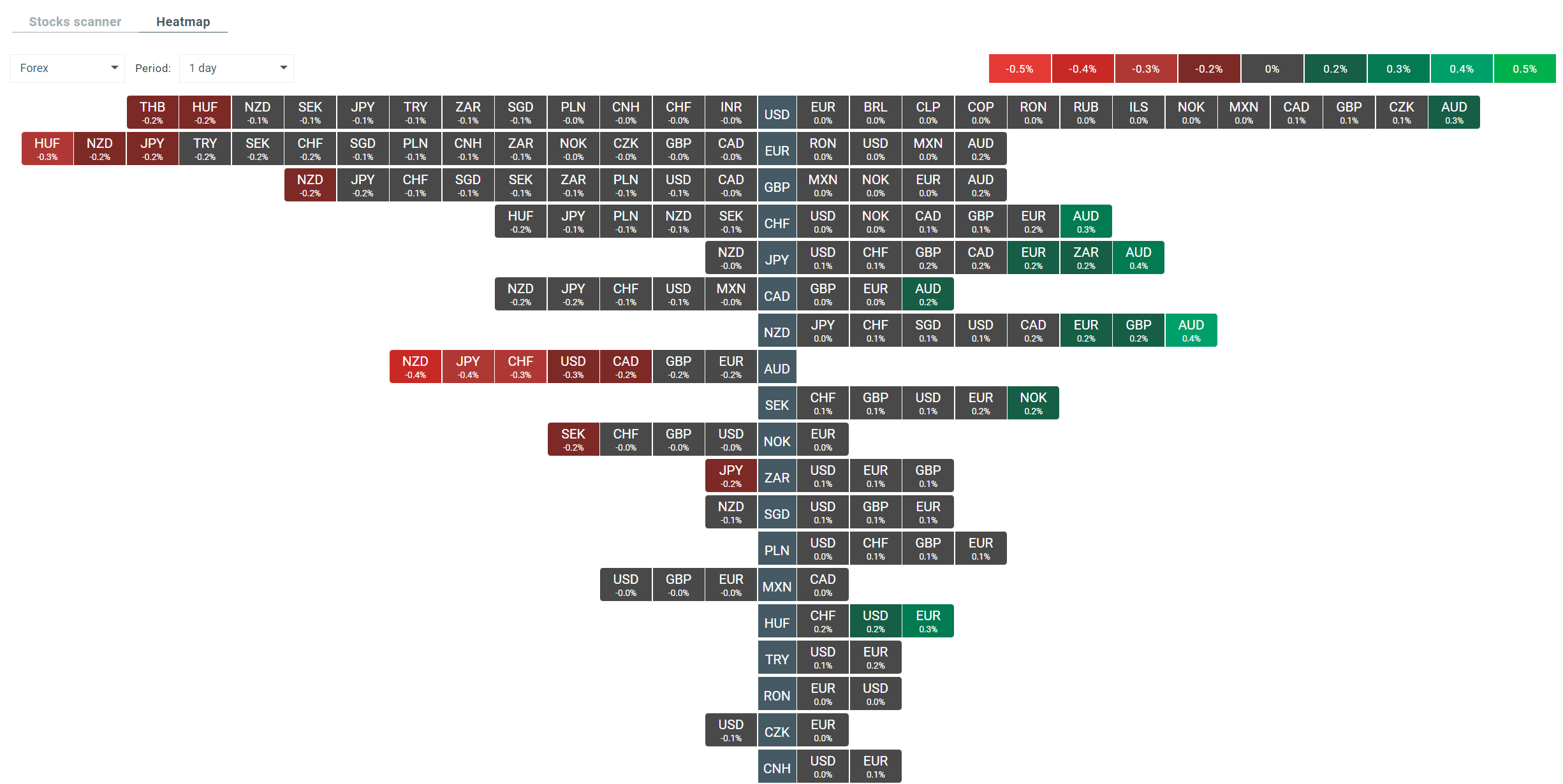

Heatmap of the FX market, which illustrates the volatility on individual currency pairs at the moment. Source: xStation 5