-

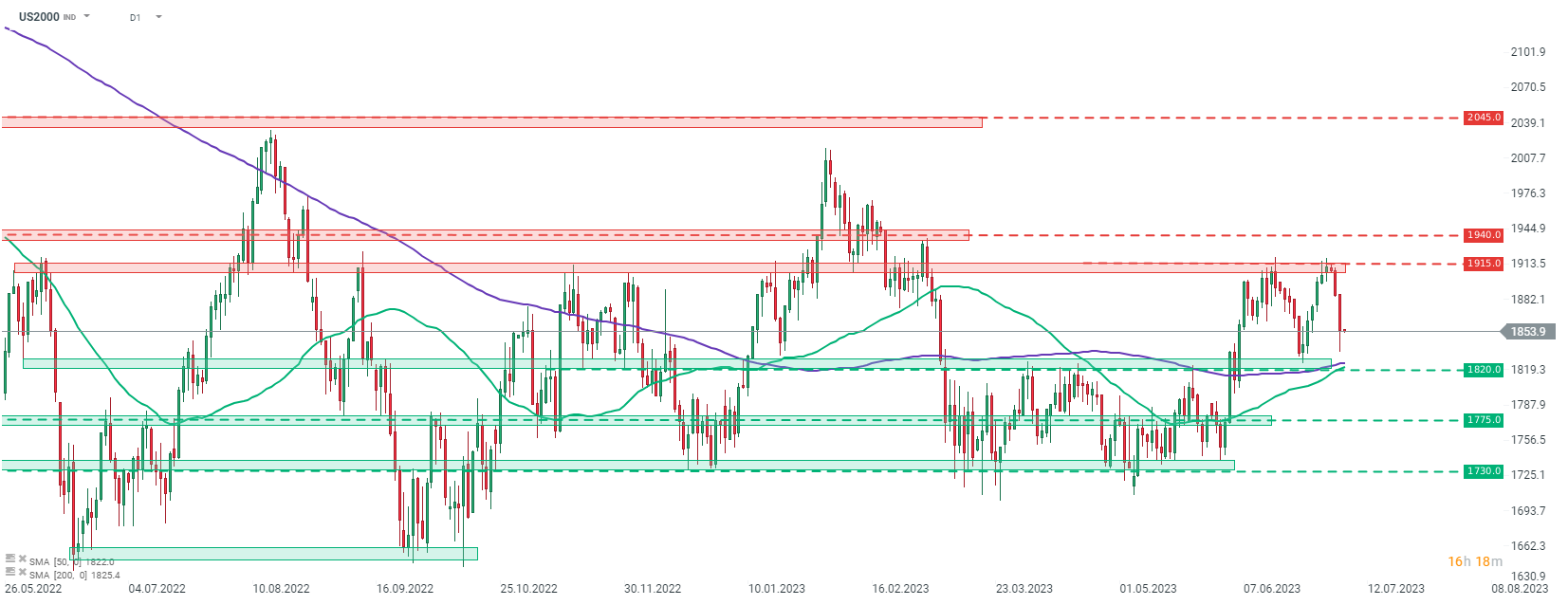

Wall Street indices finished yesterday's trading lower but off the session lows. S&P 500 and Nasdaq dropped 0.8%, Dow Jones declined 1.1% and Russell 2000 plunged almost 1.8%

-

Sell-off was triggered by jump in US yields and strengthening of USD following release of solid data from the US yesterday, especially blockbuster ADP report

-

Indices from Asia-Pacific traded lower today - Nikkei dropped 0.8%, S&P/ASX 200 moved 1.6% lower, Kospi declined 1.3% and Nifty dropped 0.4%. Indices from China traded slightly lower

-

DAX futures point to a more or less flat opening of the European cash session today

-

ECB President Lagarde said that inflation began to decline and it is the initial impact of monetary policy decisions. Nevertheless, she stress that there is still work to do as inflation remains above 2% target

-

Uchida, Bank of Japan Deputy Governor, said that yield curve control programme will be continued for the time being as it helps continue easy monetary conditions

-

World Gold Council said that it expects gold to be solid performer in H2 2023 as well as central banks in developed countries are nearing the end of the tightening cycle and USD weakens

-

According to UBS, investors are overestimating Fed's ability to achieve soft landing for US economy and because of that risk-reward outlook is more promising in fixed income over equities

-

Japanese household spending dropped 4% YoY in May (exp. -2.5% YoY)

-

Threads, Twitter-rival app developed by Meta Platforms, attracted over 50 million users within the first day after launch

-

Major cryptocurrencies are trading mixed - Bitcoin gains 0.1%, Dogecoin drops 0.1%, Ethereum declines 0.7% and Ripple adds 0.5%

-

Energy commodities are trading higher - oil gains 0.5% while US natural gas prices rise 0.1%

-

Precious metals benefit from today's USD weakening - gold gains 0.2%, silver trades 0.1% higher and platinum jumps 0.5%

-

NZD and JPY are the best performing major currencies while CAD and USD lag the most

Small-cap Russell 2000 (US2000) was the worst performing major Wall Street index yesterday. Index deepened recently launched pullback and moved close to the 1,820 pts support zone, which is a neckline of the double top pattern. Source: xStation5

Small-cap Russell 2000 (US2000) was the worst performing major Wall Street index yesterday. Index deepened recently launched pullback and moved close to the 1,820 pts support zone, which is a neckline of the double top pattern. Source: xStation5