- US indices finished yesterday's trading higher with major Wall Street benchmarks booking significant gains. S&P 500 gained 1.06%, Dow Jones moved 0.93% higher and Nasdaq jumped 1.20%. Russell 2000 rallied over 1.5%

- Indices from Asia-Pacific traded higher today, although the scale of gains was smaller than on Wall Street. Nikkei gained 1%, S&P/ASX 200 moved 0.4% higher, Kospi added 1% and Nifty 50 traded 0.5% higher. Indices from China traded 0.1-0.6% higher

- DAX futures point to a more or less flat opening of the European cash session today

- Fed's Harker has once again said that rates in the US have likely peaked. Harker said that Fed should keep rates steady unless a turn in the data occurs

- RBA minutes showed Australian central bankers considering a 25 bp rate hike or holding rates steady at the October meeting, before deciding on the latter. It was noted that upside risks to inflation remain concern and further tightening cannot be ruled out

- US President Joe Biden will travel to Israel on Wednesday to meet with Israeli leaders. Biden will then travel across the region to meet with leaders of Egypt, Jordan and Palestine

- Russian President Vladimir Putin will travel China today to meet with Chinese President Xi Jinping

- New Zealand CPI inflation reached 1.8% QoQ in Q3 2023 (exp. 2.0% QoQ). On an annual basis, CPI inflation slowed from 6.0% YoY in Q2 2023 to 5.6% YoY in Q3 2023 (exp. 5.9% YoY)

- Cryptocurrencies trade slightly lower - Bitcoin drops 0.8%, Ethereum declines 0.1% and Ripple is down 1.3%. News of spot Bitcoin ETF approval yesterday, that triggered spike on cryptocurrency market, turned out to be fake

- Energy commodities are pulling back - oil drops 0.7% while US natural gas prices are down 0.3%

- Precious metals drop amid USD strengthening - gold trades 0.2% lower, silver drops 0.6% and platinum trades 0.4% down

- AUD and USD are the best performing major currencies while CAD and CHF lag the most

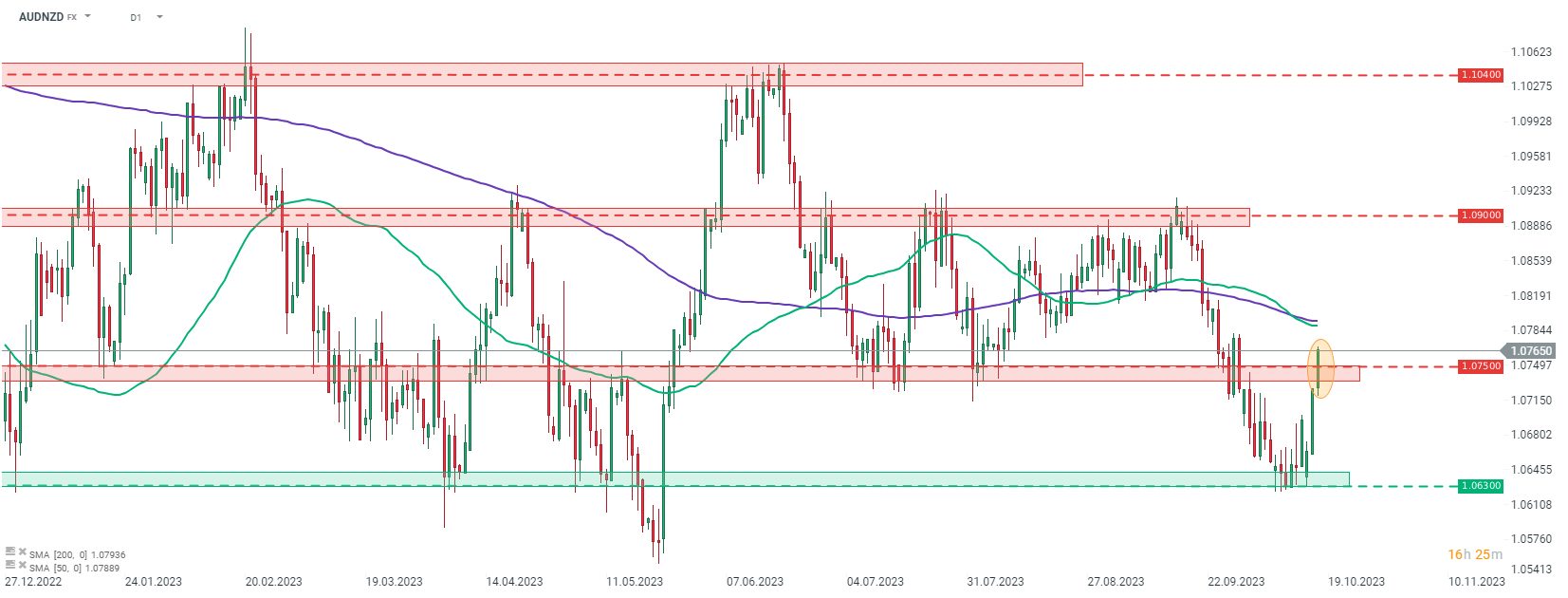

AUDNZD gains after RBA minutes turned out to be more hawkish than expected. The pair broke above the 1.0750 resistance zone today and is approaching 50- and 200-session moving averages in the 1.0795 area. Source: xStation5