- US indices finished yesterday's trading lower - S&P 500 dropped 1.18%, Dow Jones moved 0.76% lower while Nasdaq slumped 1.76%

- US index futures recovered some losses after close of the Wall Street session following release of solid quarterly results by Amazon

- Amazon shares gained over 5% in the after-hours trading after company Q3 reported revenue at $143.1 billion (exp. $141.4 billion) and EPS at $0.94 (exp. $0.58). Company's AWS grew by 12% as growth in cloud business continued to stabilize

- The US military struck two targets used by Iranian-backed groups in Syria overnight. Facilities struck are weapon and ammunition storages

- Pentagon explained that this was a retaliation for strikes against US troops in the region and was not directly linked to Hamas-Israel war

- Indices from Asia-Pacific traded higher today - Nikkei gained 1.2%, S&P/ASX 200 moved 0.2% higher, Kospi added 0,1% and Nifty 50 jumped 0.8%. Indices from China traded 0.5-1.5% higher

- DAX futures point to a more or less flat opening of today's European cash session

- Goldman Sachs expects ECB to begin cutting rates in Q3 2024. Meanwhile, UBS said its too early to consider ECB rate cuts

- According to Chinese state media, People's Bank of China may decide to cut reserve requirement ratio before year's end in order to support economy and government bond issuance

- Australian PPI inflation accelerated from 0.5% QoQ in Q2 2023 to 1.8% QoQ in Q3 2023. On an annual basis, PPI inflation slowed from 3.9% to 3.8% YoY

- CPI inflation in the Japanese Tokyo area accelerated from 2.5 to 2.7% YoY in October (exp. 2.5% YoY)

- Cryptocurrencies are trading lower today - Bitcoin drops 0.4%, Ethereum trades 0.7% lower and Dogecoin slumps 1.5%

- Precious metals trade higher - gold gains 0.1%, silver adds 0.3% and platinum moves 0.5% higher

- Energy commodities trade higher - oil gains 1.1% while US natural gas prices are 0.9% up

- AUD and CAD are the best performing major currencies while CHF and USD lag the most

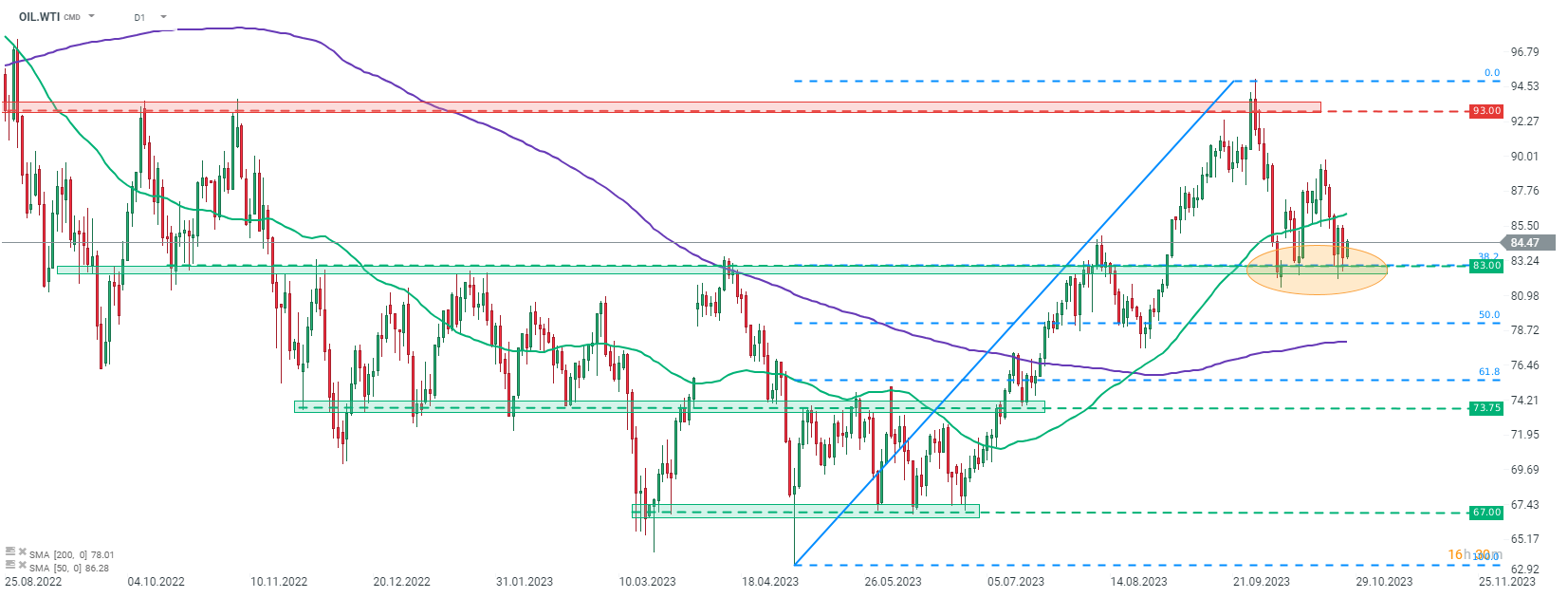

Bulls on WTI (OIL.WTI) managed to once again defend the $83 area, marked with the 38.2% retracement of a recent upward move. However, price remains nearby and another test of this support cannot be ruled out. Source: xStation5

Bulls on WTI (OIL.WTI) managed to once again defend the $83 area, marked with the 38.2% retracement of a recent upward move. However, price remains nearby and another test of this support cannot be ruled out. Source: xStation5