- Netflix reported Q3 2023 earnings yesterday after market close

- Stock surged 12% in after-hours trading

- The biggest subscriber gain since Q2 2020

- Company announces price hikes in US, UK and France

- Guidance for a strong subscriber growth in Q4 as well

- Shares expected to open above 200-session moving average

Netflix (NFLX.US) surged 12% in the after-hours trading following the release of the Q3 2023 earnings report. There are good reasons behind the surge as the report turned out to be stellar, especially when it comes to new subscriber additions. Let's take a look at the release!

Sales in-line with expectations, huge subscriber gain

Start investing today or test a free demo

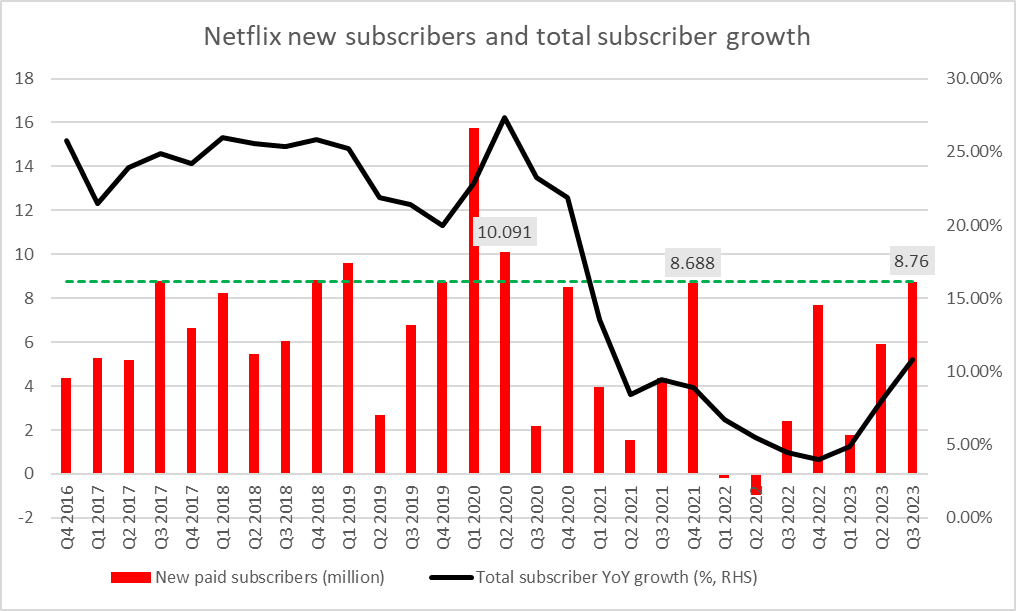

Open real account TRY DEMO Download mobile app Download mobile appNetflix reported a 7.8% YoY jump in Q3 revenue, to $8.54 billion, which was more or less in-line with market expectations. EPS at $3.73 was higher than $3.49 expected and higher than $3.10 reported a year ago. However, attention was mostly on Netflix subscriber additions as investors were eager to see whether crackdown on password sharing led to a pick-up in new paid memberships. Expectations were high and pointed to a 6.7 million new subscriber addition in July - September 2023 period. However, the report showed an addition of 8.76 million subscribers during the period, driven by gains in the United States & Canada as well as EMEA markets! Not only this is a massive beat but also it is the biggest subscriber gain since Q2 2020, when company added 10.09 million subscribers thanks to a pandemic stay-at-home trend.

Netflix reported the highest subscriber gain since Q2 2020, when the company enjoyed a pandemic boom. Source: Bloomberg Finance LP, XTB

Netflix reported the highest subscriber gain since Q2 2020, when the company enjoyed a pandemic boom. Source: Bloomberg Finance LP, XTB

Price hikes are coming!

An important thing to note about Netflix is that, unlike its peers, it is profitable. Netflix has a strong position in the industry and the latest strong subscriber gain highlights it. It should not come as a surprise that the company has decided to hike prices for its basic and premium plans in US, UK and France by 10-20%, especially as such a move was rumored to happen should the company's password-sharing crackdown succeed. Netflix's rivals like Disney+, Hulu or Peacock have already hiked prices for its streaming services in recent months. However, Netflix has decided to leave the price of its ad-supported plans unchanged. Such a move may encourage customers to opt for cheaper ad-supported plans and is in-line with Netflix's goal of increasing ad-tier revenue. Ad-support plans saw a 70% QoQ increase in Q3 2023.

Netflix remains upbeat on the future

Apart from releasing a solid Q3 earnings report, Netflix has also issued an upbeat guidance for the current quarter. While Q4 revenue guidance at $8.69 billion and EPS guidance at $2.15 were both slightly weaker than expected by analysts, Netflix said that it expects subscriber gain in Q4 2023 to be of similar size as it was in Q3 2023! This puts the company on track to add 20 million of new subscribers in full-2023, what would be the strongest annual subscriber gain since 2020, when the company added 36.5 million members thanks to a pandemic boom.

Netflix also said that it has repurchased own stock worth $2.5 billion during Q3 2023 and has authorized an increase in buybacks by $10 billion.

Netflix earnings summary

Q3 2023 results

- Revenue: $8.54 billion vs $8.53 billion expected (+7.8% YoY)

- Streaming paid memberships: 247.15 million vs 244.41 million (+11% YoY)

- Streaming paid memberships net change: +8.76 million vs +6.20 million expected

- United States & Canada: +1.75 million vs +1.22 million expected

- EMEA: +3.95 million vs +2.22 million expected

- LATAM: +1.18 million vs +1.15 million expected

- APAC: +1.88 million vs +1.41 million expected

- EPS: $3.73 vs $3.49 expected ($3.10 a year ago)

- Operating income: $1.92 billion vs $1.9 billion expected (+25% YoY)

- Operating margin: 22.4% vs 22.1% expected (19.3% a year ago)

- Free cash flow: $1.89 billion vs $1.27 billion expected

Q4 2023 forecasts

- Revenue: $8.69 billion vs $8.76 billion expected

- EPS: $2.15 vs $2.17 expected

- Operating margin: 13.3% vs 14.0%

Full-year forecast

- Free cash flow: $6.5 billion vs $5.27 billion expected

- Operating margin: 20% vs 19.8% expected

A look at the chart

Taking a look at Netflix (NFLX.US) chart at D1 interval, we can see that the stock has been underperforming as of late. However, taking into account an over-12% gain the stock is making in premarket today, situation may change. Should those gains be maintained until Wall Street cash session launch at 2:30 pm BST, we will see a return of the price above the 200-session moving average as well as a move to levels not seen since late-September. Two near-term resistance levels to watch can be found at $415 and $445 - limits of a recent short-term trading range.

Source: xStation5

Source: xStation5