Netflix (NFLX.US), US video streaming company, is scheduled to report Q3 2023 earnings today after the close of the Wall Street session. Company has recently launched a successful crackdown on password sharers and it is expected to help fuel subscriber growth in the coming quarters. On top of that, rumors intensify that Netflix may decide on price hikes. Let's take a quick look at what markets expect from Netflix Q3 results!

What does the market expect from Netflix?

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appQ3 2023 expectations

- Revenue: $8.53 billion (+7.7% YoY)

- Streaming paid memberships: 244.4 million

- Streaming paid memberships net change: +6.2 million

- United States and Canada: +1.18 million

- EMEA: +2.22 million

- LATAM: +1.15 million

- APAC: +1.41 million

- Operating income: $1.89 billion (+59% YoY)

- Operating margin: 22.1%

- Net Income: $1.582 billion (+37% YoY)

- EPS: $3.49 (+11.1% YoY)

- Free cash flow: $1.23 billion

Q4 2023 forecasts

- Revenue: $8.76 billion

- EPS: $2.17

- Operating margin: 14%

Full-2024 forecasts

- Free cash flow: $5.27 billion

- Operating margin: 19.8%

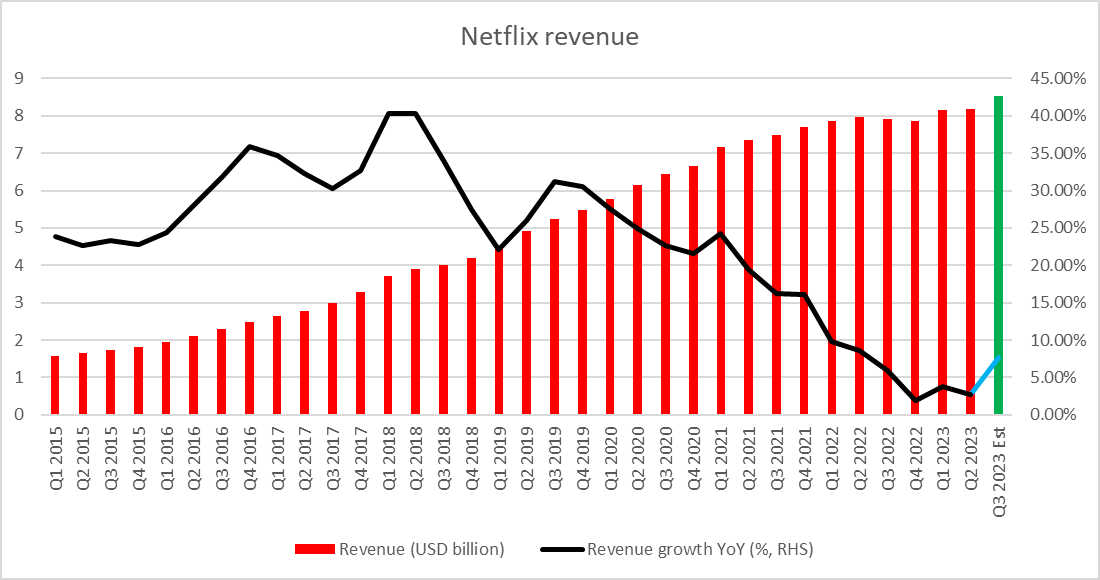

Netflix is expected to report a record high quarterly revenue and a strong uptick in growth dynamics. Source: Bloomberg Finance LP, XTB

Netflix is expected to report a record high quarterly revenue and a strong uptick in growth dynamics. Source: Bloomberg Finance LP, XTB

Successful crackdown on password sharing

Netflix has recently embarked on a successful password sharing crackdown that is said to have impacted 100 million viewers that were using the company's streaming services without subscription. Crackdown on password sharers is said to be one of the main factors driving expectations for a strong 6.2 million subscriber growth during the quarter. This is also expected to support company' subscriber growth in the coming quarters and allow Netflix to focus on other issues.

Investors expect Netflix to report 6.2 million in new paid subscribers in Q3 2023 - above company's guidance of 6.0 million. Source: Bloomberg Finance LP, XTB

Investors expect Netflix to report 6.2 million in new paid subscribers in Q3 2023 - above company's guidance of 6.0 million. Source: Bloomberg Finance LP, XTB

Price hikes coming?

Unlike its rival Disney+, Netflix has not decided to hike prices of its streaming services this year. However, there are some signs suggesting that Netflix may be readying a price hike. Netflix rolled out ad-free plans last year but they saw a rather muted start. However, as the company has managed to combat password sharers and writer's strike in Hollywood is heading to an end, it may be a good opportunity to announce price hikes of its ad-free plans. Such a move could boost the number of subscribers opting for a basic plan that includes ads, and it is expected to drive strong growth in Netflix ad-tier revenue in 2024 and 2025.

A look at the chart

Taking a look at Netflix (NFLX.US) chart at D1 interval, we can see that the company has been trading under pressure for around 3 months now. Price started to pull back after a local high was reached in mid-July and has dropped over 25% since. A break below the lower limit of the Overbalance structure at $391 per share has, at least in theory, signaled a bearish trend reversal. Bearish outlook was supported further with a break below the 200-session moving average and 38.2% retracement of the November 2021 - May 2022 plunge.

Source: xStation5

Source: xStation5