NZDUSD loses 1.6% and bond yields slide to 6-month lows in the face of the decision to end the hike cycle 🏛

In the FX market, in addition to the pound reacting to higher-than-expected inflation data from the UK, the New Zealand dollar played a dominant role today, sinking under the strain of today's RBNZ decision and comments from central bankers. A key view throughout the meeting was that rate hikes would no longer be necessary to combat inflation, so the RBNZ was the first of the world's major central banks to halt the rate hike cycle.

New Zealand's central bank raised interest rates by a quarter of a percentage point to 5.5% (as expected). The central bank's forecasts show that the OFR has already peaked, with reductions starting in the third quarter of 2024. Following the news, two-year NZD yields fell by the most in six months.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app"The committee is confident that, with interest rates held at restrictive levels for some time, consumer price inflation will return to the target range of 1-3% per annum," the - The RBNZ said. "Inflation is expected to continue to decline from its peak, and with it inflation expectations indicators." Inflation slowed to 6.7% in the first quarter, and the central bank expects it to return to the target range by the third quarter of next year. Today's decision was voted in a 5-2 structure (5 members in favour of a hike; 2 in favour of maintaining rates). The commentary following the decision added that the Committee is confident. that the hike cycle has captured inflationary pressures.

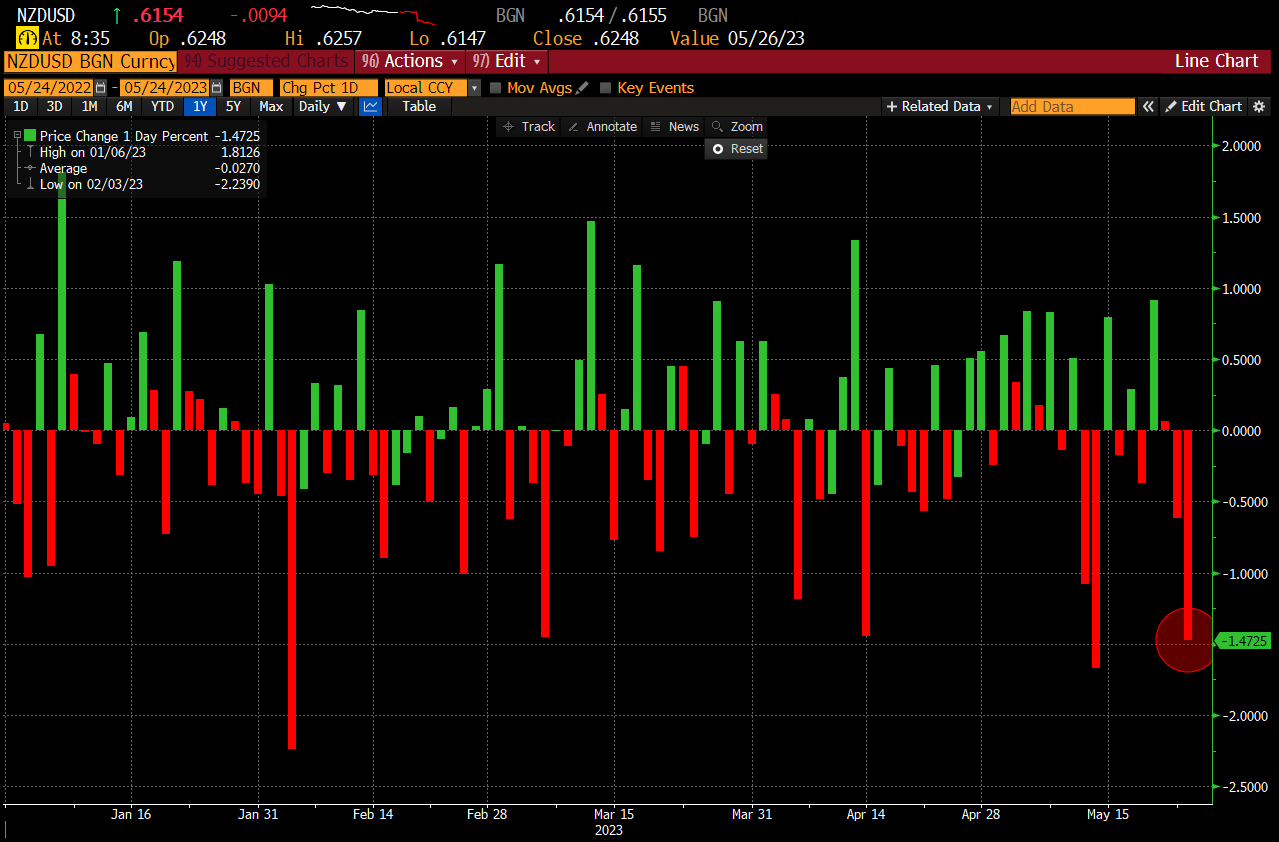

The magnitude of today's sell-off is huge, nevertheless declines of similar magnitude have already been recorded in this one. Source: Bloomberg

The magnitude of today's sell-off is huge, nevertheless declines of similar magnitude have already been recorded in this one. Source: Bloomberg The NZDUSD pair is currently losing more than 1.7% amid news of the end of New Zealand's rate hike cycle. The pair is currently testing support set by the March and April 2023 minima, which is further reinforced by the 50-day exponential moving average (blue curve). Source: xStation5

The NZDUSD pair is currently losing more than 1.7% amid news of the end of New Zealand's rate hike cycle. The pair is currently testing support set by the March and April 2023 minima, which is further reinforced by the 50-day exponential moving average (blue curve). Source: xStation5