Summary:

- SP500 (US500) comes back to the support

- Oil prices affected by many factors

- Has the TRY’s decline come to an end?

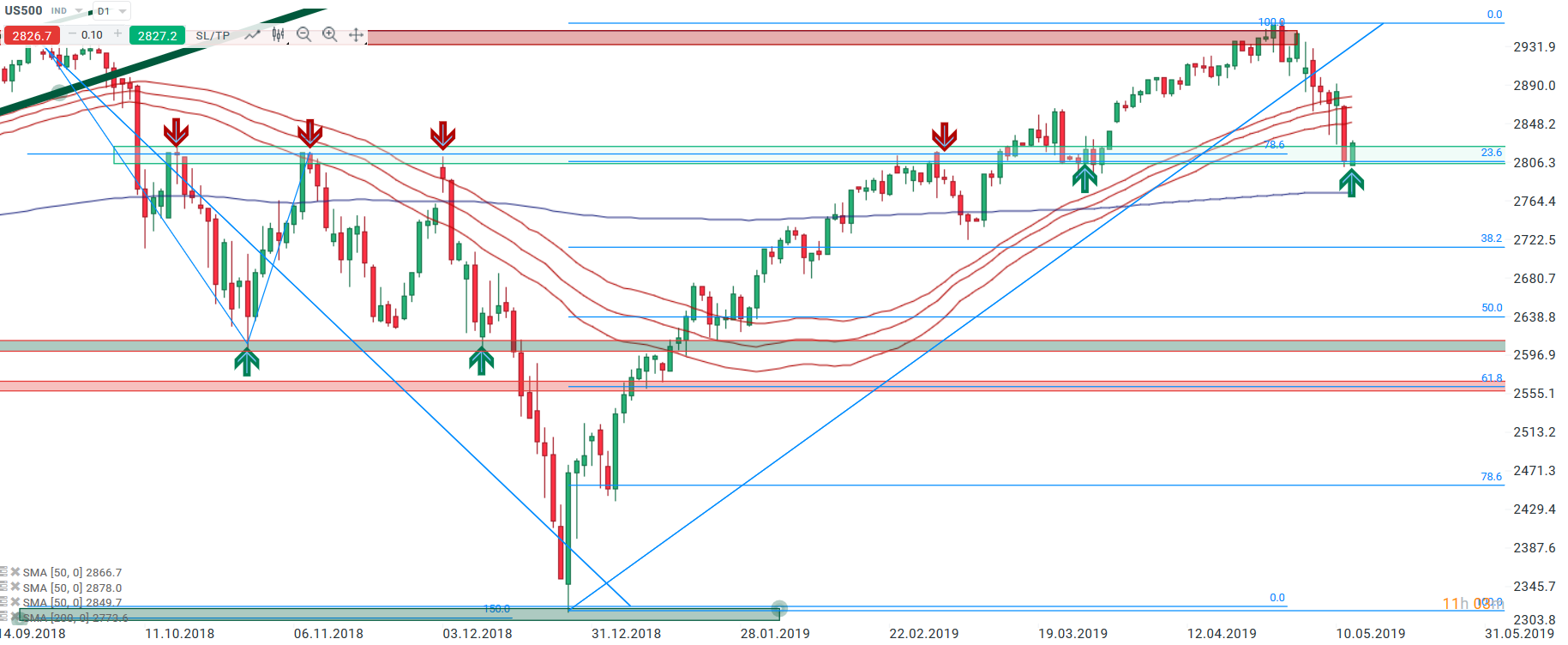

The beginning of the new week has brought elevated volatility across global equity markets. Of course, the ongoing trade dispute between the US and China keeps playing the major role, and having in mind that this thread is unlikely to be resolved any time soon, one may have rather a gloomy outlook for stock markets. Yesterday, the SP500 declined to around 2800 points, the significant technical level supporting bulls in the past. This level is also underpinned by the 23.6% retracement of the latest upward movement. Looking further, 2775 points may be also the interesting point to watch as it coincides with the 200DMA. As a result, from a pure technical view bulls may hope for a rebound in the nearest future.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app Source: xStation5

Source: xStation5

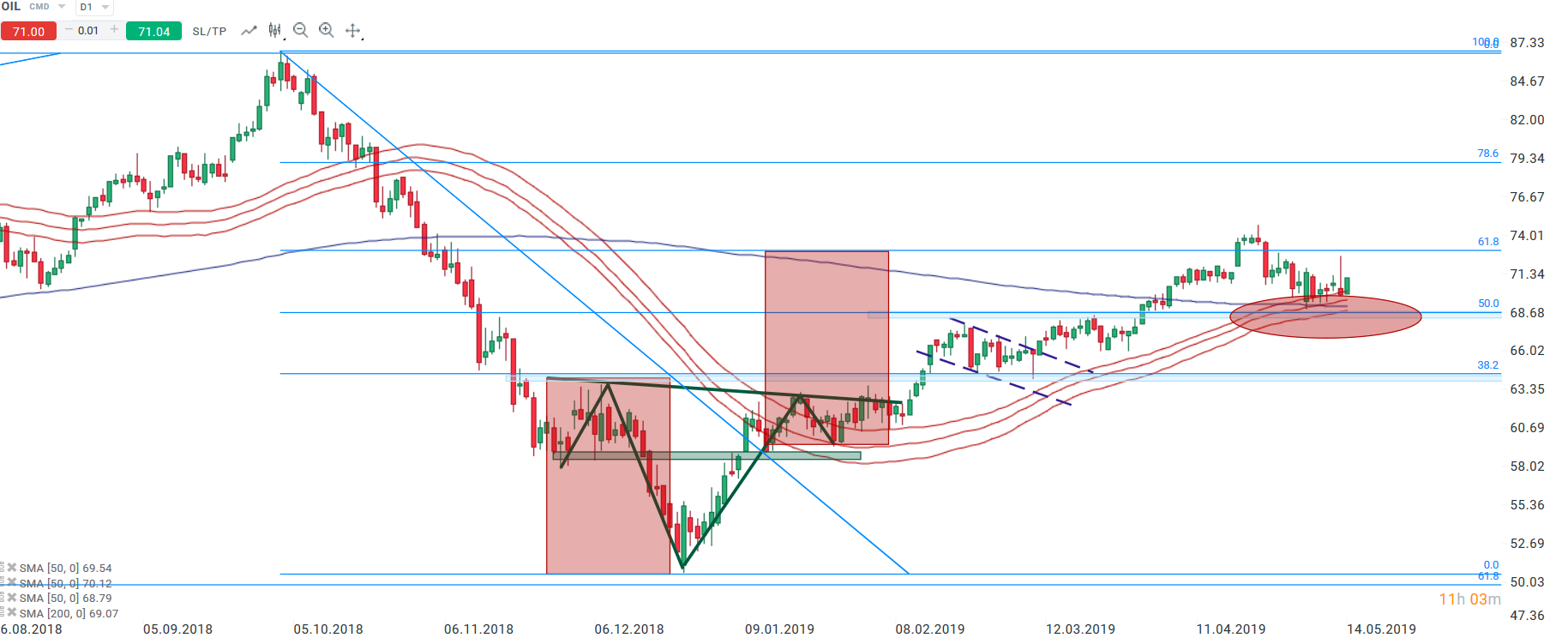

Oil is another market we would like to look at today. The prime factor for oil prices’ performance is speculation regarding possible sanctions imposed on Iran by the US. On top of that, oil prices are also affected by a fulfilment of production limits by OPEC countries, supply disruptions in Venezuela and developments on the trade front. The latter may affect global economic growth and thereby lessen demand for oil. Technically oil prices keep trading in the vicinity of the support, hence a bounce to the upside is on the cards. In turn, should the price break below this area it could be a bearish signal for traders.

Source: xStation5

Source: xStation5

The Turkish lira is the last market under consideration. The TRY has sped up its downtrend after the authorities in Istanbul decided to cancel the elections’ outcome in the Turkish capital where the Erdogan’s AKP failed to win. In the meantime, the central bank suspended one-week repo funding for commercial banks in an effort to prevent a further lira’s slide. As a result, the EURTRY has already reached the 50% retracement of the bearish move since August 2018. If this level is smashed, then the TRY may be under increased downward pressure. From a technical standpoint, the current levels in the EURTRY may be viewed as interesting to enter a short position.

Source: xStation5

Source: xStation5