- Wall Street opens slightly higher at the beginning of the week

- Williams indicates interest rates cuts in the next year

Stocks are trending upwards in Wall Street's early trading, regaining some momentum after a slight decrease in the previous week. The S&P 500 reported a 0.5% increase, rebounding from its first losing week in the last four. At the market open the Dow Jones rose 0.6% and the Nasdaq 100 also up by 0.4%. Berkshire Hathaway experienced a significant 1.6% rise after reporting stronger results than anticipated by analysts. Other major contributors this week include notable media companies such as The Walt Disney Co. and Fox, who are expected to release their quarterly earnings later this week. Furthermore, markets are also waiting for crucial CPI figures that are scheduled to be released this Thursday.

Interest rate cuts are coming?

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appIn an interview with the New York Times, Williams from the New York Fed indicated that he sees chances for interest rate cuts next year. He emphasized that while inflation has fallen as hoped, he still perceives potential for a worsening job market situation, which could cool the economy and continue to limit inflation. Any cuts will naturally depend on the data, with a key factor being a decrease in inflation towards the target. The first cuts are expected by the market in March/May next year, while there's a chance by the end of next year for a reduction of around 150 basis points.

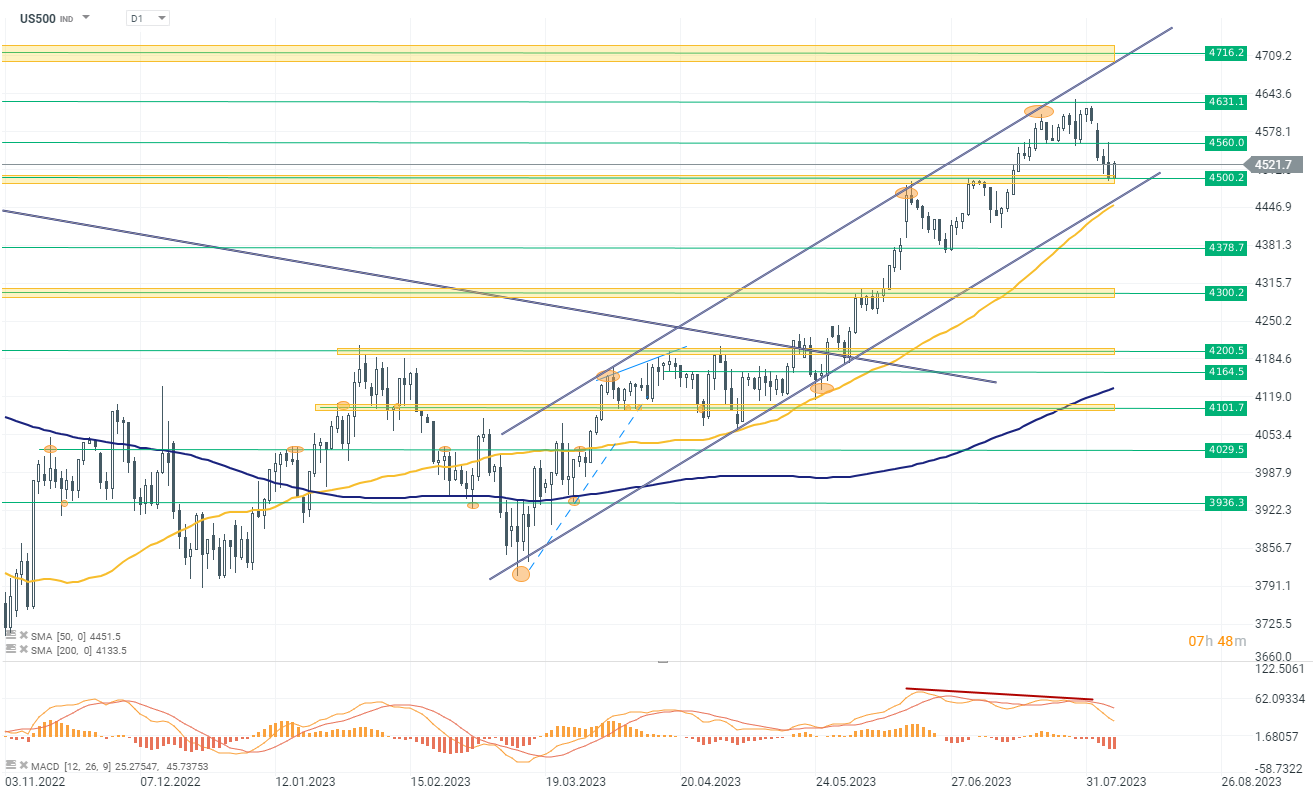

The SP500 index (US500) currently stands at 4510, showing a modest gain of 0.30% for the day. However, over the past week, the index experienced a notable cooldown with four consecutive days of declines. Today, a slight reversal occurred as the index managed to hold on to the crucial support line at 4500 and is now approaching the lower band of an ascending channel. This situation suggests the possibility of buyers entering the market, which could trigger an upward movement in the index. Conversely, if the 4500 support level is broken down along with the lower line of the ascending channel, it could indicate further downside potential, potentially leading the index to reach lower levels around 4400-4430.

Company News:

-

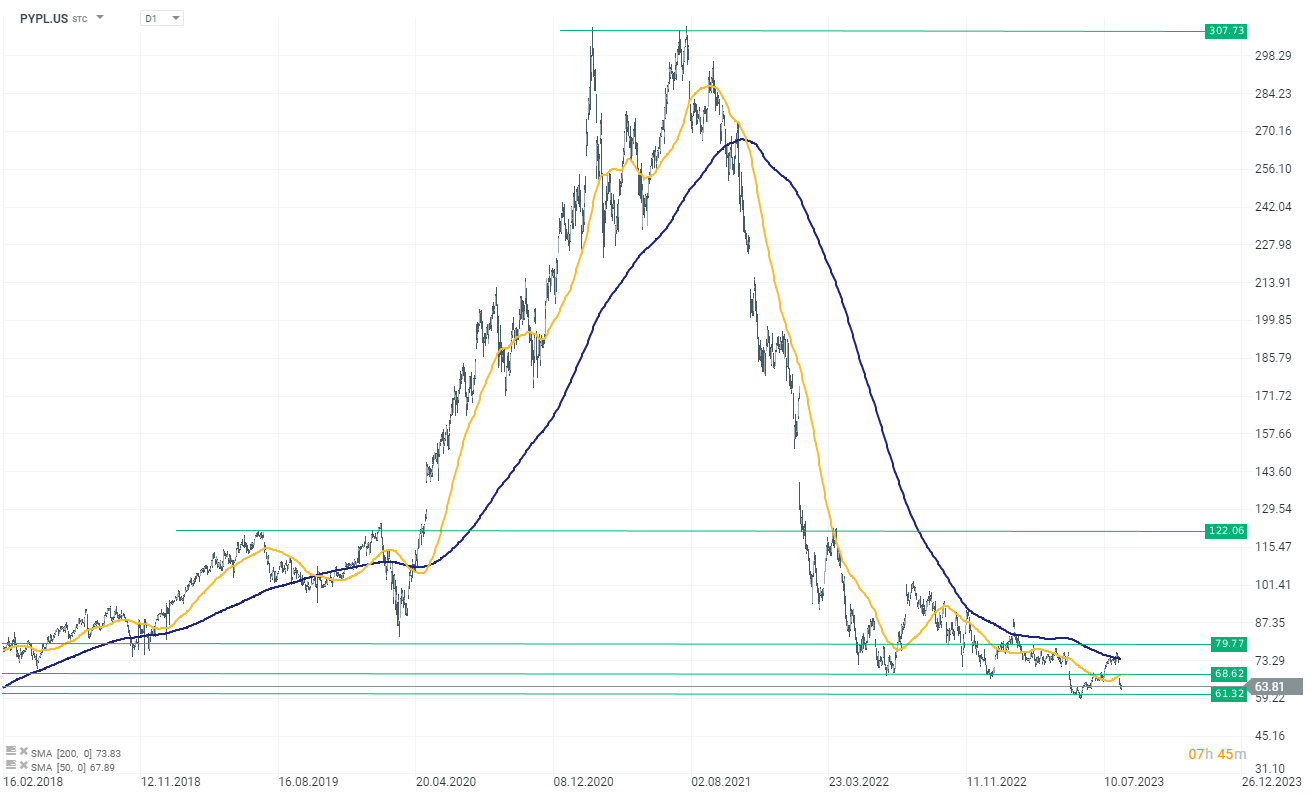

PayPal (PYPL.US) launches its first stablecoin, PayPal USD (PYUSD), backed by US dollar deposits and cash equivalents issued by Paxos Trust, aiming to boost the adoption of digital tokens for payments, and CEO Dan Schulman sees it becoming a part of the overall payments infrastructure. Stablecoins have been used primarily by traders, but their consumer payment sector remains limited with approximately $126 billion worth of stablecoins in circulation, with Tether's USDT being the largest.

PYPL.US D1 interval, source: xStation 5

-

Tesla's (TSLA.US) Chief Financial Officer, Zachary Kirkhorn, has unexpectedly stepped down after a 13-year career at the company, and Chief Accounting Officer Vaibhav Taneja has been appointed as the new CFO in addition to his current role. Kirkhorn will remain with the company until the end of the year to ensure a smooth transition. Following the announcement, Tesla's shares decline 2.90% today.

-

Elanco (ELAN.US) share are gaining 6.90% after the company reported better-than-expected financial results for Q2 2023, with revenue of $1,057 million, adjusted net income of $90 million, and adjusted EBITDA of $222 million (21.0% of Revenue). They raised their full-year 2023 guidance and received positive news on the continued registration of Seresto from the EPA. CEO Jeff Simmons expressed satisfaction with the company's performance and strategic advancements.

-

Sage Therapeutics (SAGE.US) shares slump 47% after being downgraded by RBC Capital Markets and Oppenheimer as the US FDA approved the company’s Zurzuvae drug for treating postpartum depression but rejected it for major depressive disorder, which is seen to have greater commercial prospects. Sage also reported second-quarter total revenue that missed analyst estimates.