- Wall Street opens higher

- Intel, Chevron and Exxon Mobil quarterly results

- Lower PCE data fuels market optimism

Wall Street's main indexes started the day on a positive note. The easing inflation pressures indicated in the data added to the optimism that the Federal Reserve's policy tightening was coming to an end. Additionally, chip stocks surged as Intel reported an unexpectedly better quarterly report. The Dow Jones Industrial Average opened 0.46% higher. The S&P 500 also opened higher, rising by 42 points +0.1% and the Nasdaq 100 index experienced significant gains, increasing by 1.46%.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appPCE report

The US Bureau of Economic Analysis reported that inflation, measured by the PCE Price Index, declined to 3% on a yearly basis in June, lower than the market expectation of 3.1% and down from 3.8% in May. The Core PCE Price Index, the Federal Reserve's preferred inflation gauge, also decreased to 4.1% on a yearly basis, below the market forecast of 4.2% and down from 4.6% in May. The incoming data from the USA regarding PCE inflation and employment costs suggests that labor market pressures are starting to slow down slightly, which might encourage the Federal Reserve (FED) to make less hawkish decisions at the next FOMC meeting in September. However, on the other hand, consumer spending remains high, which somewhat limits the bullish reaction following the data release.

The US100 index is currently trading at 15820 points, representing a 1.50% increase. This surge in price comes after the tech stocks, including Alphabet, reported strong quarterly results, boosting positive sentiment in the Nasdaq index. Moreover, the macro data indicating easing inflation after PCE is further fueling the index's momentum. From a technical perspective, the index is approaching the upper line of an ascending channel that has been respected since November 2022. Traders should closely monitor key levels in the US100 index, with an upper resistance level around 16000 points and a lower support level in the range of 15100-15300 points.

Company News:

- Coursera (COUR.US) shares rally 15% after the online educational company’s second-quarter revenue beat expectations, leading it to raise guidance for the year. Analysts highlighted strength in its Consumer and Degrees segments, outweighing weakness in Enterprise which is being hit by a tough macro backdrop.

- Ford (F.US) shares drop 1.4% after the automaker said it now expects to see losses from electric vehicles hit $4.5 billion this year. While Ford’s other segments performed well, Morgan Stanley sees major changes to the EV strategy possibly being necessary.

- Chevron (CVX.US) shares are declining 0.5% after company reported quarterly earnings. Despite decline, company reported better-than-expected earnings of $3.08 per share, beating the estimate of $2.95. However, this is down from $5.82 per share a year ago. Revenues for the quarter were $48.9 billion, missing the estimate of $51.3 billion. The stock has declined 11.1% this year, while the S&P 500 gained 18.2%. The future outlook depends on management's earnings call commentary.

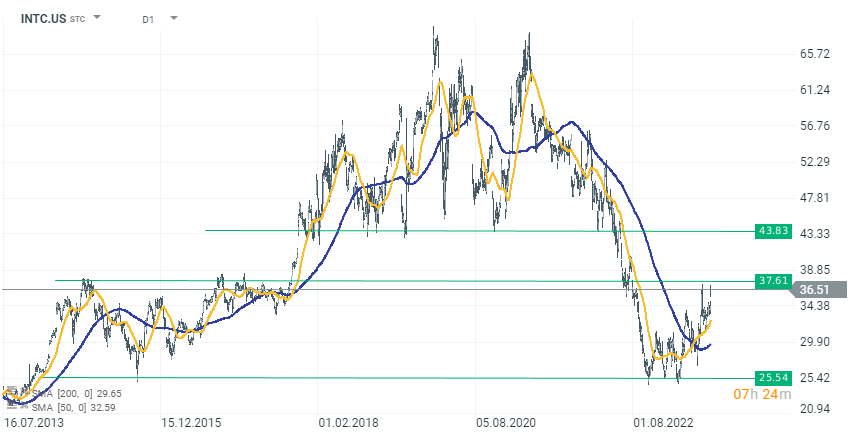

- Intel (INTC.US) shares are gaining over 6% after the company reported better than expected quarterly results. Intel exceeded Refinitiv consensus expectations with adjusted earnings per share of 13 cents, while Refinitiv expected a loss of 3 cents. The company's revenue reached $12.9 billion, surpassing Refinitiv's estimate of $12.13 billion. Looking ahead to the third quarter, Intel forecasts adjusted earnings of 20 cents per share on revenue of $13.4 billion at the midpoint, compared to analyst expectations of 16 cents per share on $13.23 billion in sales. Despite these positive results, Intel CEO Pat Gelsinger noted persistent weakness in all business segments until year-end, with server chip sales not expected to recover until the fourth quarter.

Intel (INTC.US), source xStation 5

Intel (INTC.US), source xStation 5