- US indices opened lower

- Declines deepened after unexpected jump in services ISM

- Roku jumps after announcing lay-offs

Wall Street indices launched today's trading lower with S&P 500, Dow Jones and Nasdaq trading 0.3-0.4% lower at the opening. Interestingly, the small-cap index Russell 2000 bucked the trend and is traded around 0.4% higher at the start of today's cash session. However, declines deepened after session launch and Russell 2000 erased its gains.

US services ISM data for August was released at 3:00 pm BST. Report was expected to show a downtick in the headline index from 52.7 to 52.5. However, actual data showed an unexpected jump to 54.5! Prices Paid subindex jumped from 56.8 to 58.9, Employment subindex moved from 50.7 to 54.7 and New Orders subindex jumped from 55.0 to 57.5. USD gained following the release as hawkish Fed bets in money markets increased. Hawkish reaction was also seen on Wall Street with indices moving lower.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app Source: xStation5

Source: xStation5

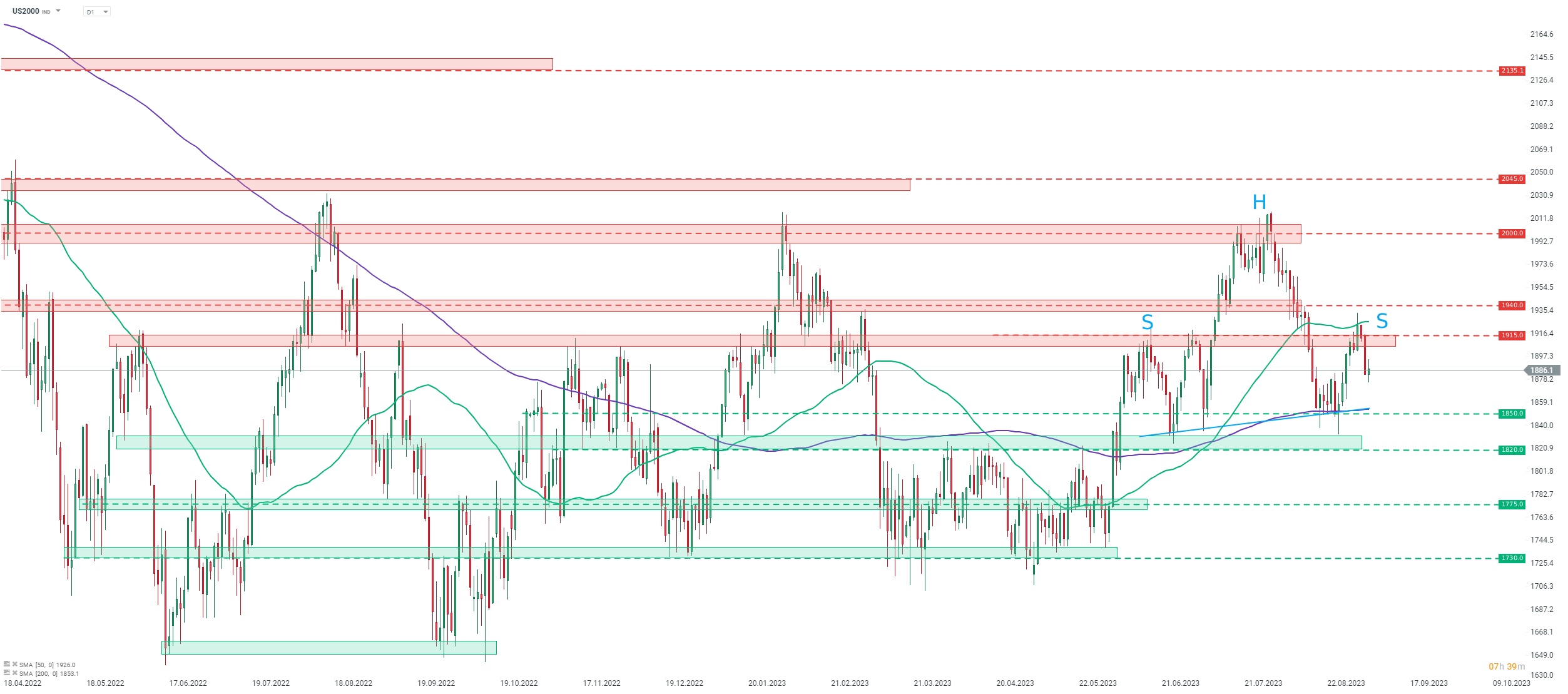

Small-cap Russell 2000 (US2000) is the best performing US index today. However, gains on US2000 were erased after release of the better-than-expected services ISM data for August. Taking a look at US2000 at D1 interval, we can see that the head and shoulders pattern on the index is still in play and the right shoulder has been painted recently. A key zone to watch should index continue to drop can be found in the 1,850 pts area, marked with previous price reactions, 200-session moving average (purple line) and neckline of the SHS pattern. A break below may trigger a deeper decline with a textbook range of around 170 points.

Company News

Roku (ROKU.US) is trading higher today following the announcement of lay-off plans. Company said that it plans to cut around 10% of its workforce as it tries to lower operating expenses. Lay-offs are expected to be completed by the end of Q4 2023. Apart from the lay-off announcement, Roku also boosted Q3 guidance and now expected net revenue to reach $835-875 million, up from previous guidance of $815 million, and adjusted EBITDA between -$40 million and -$20 million.

GitLab (GTLB.US) gains after reporting better-than-expected fiscal-Q2 2024 (May - July 2023). Revenue jumped 38% YoY to $139.6 million (exp. $129.9 million) while adjusted EPS came in at $0.01 (exp. -$0.03). Company also issued upbeat forecasts for the current quarter as well as the whole fiscal-2024. GitLab expects fiscal-Q3 revenue to reach $140-141 million (exp. $138.2 million) and adjusted loss per share to reach $0.01-0.02. Full year revenue is seen at $555-557 million, up from previous guidance of $541-543 million.

Analysts' actions

- ResMed (RMD.US) upgraded to 'buy' at Needham. Price target set at $180.00

- Toast (TOST.US) upgraded to 'buy' at UBS. Price target set at $30.00

- Olin (OLN.US) downgraded to 'neutral' at Goldman Sachs. Price target set at $57.00

- Block (SQ.US) downgraded to 'neutral' at UBS. Price target set at $65.00

Roku (ROKU.US) launched today's trading with a big bullish price gap, following announcement of lay-offs and release of Q3 forecasts. Stock continued to move higher after the opening but has later on given up those gains and is trading near the opening price again. The near-term resistance can be found ranging below the $100.00 area. Source: xStation5