- Wall Street indices open little changed

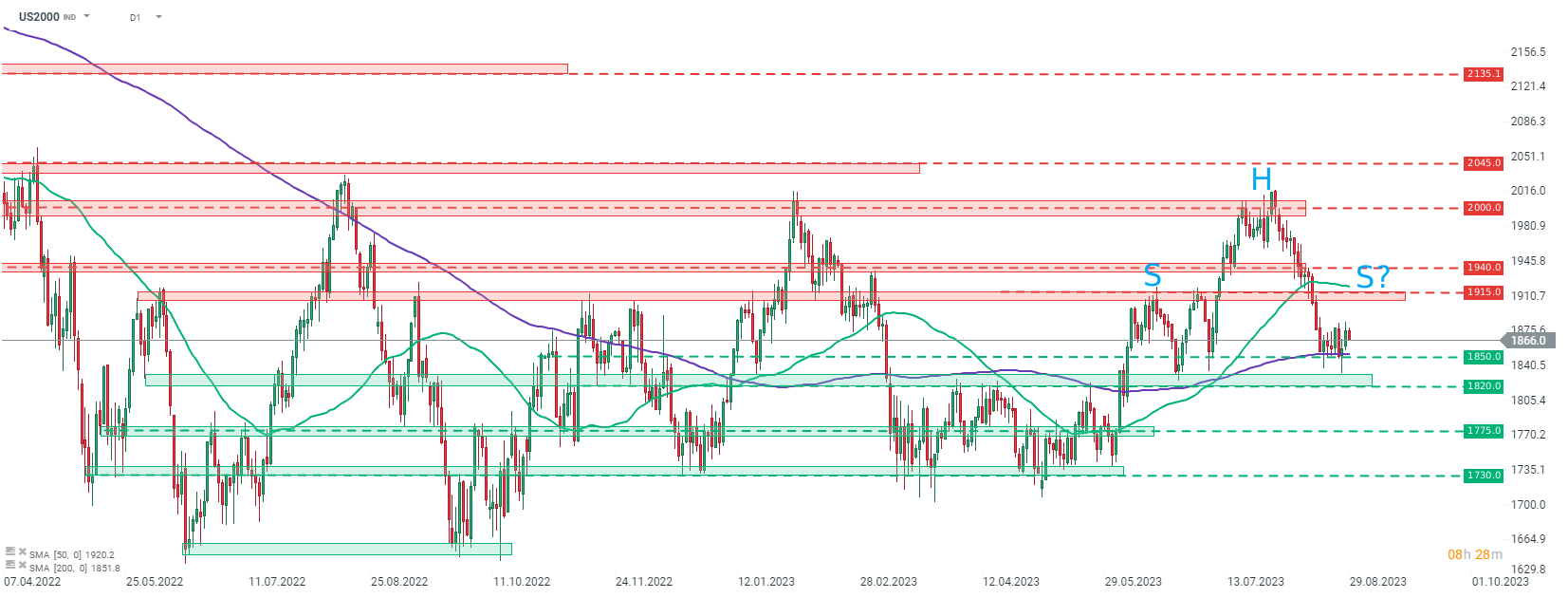

- Potential head and shoulders pattern on US2000

- Best Buy reports solid fiscal-Q2 earnings

Wall Street indices launched today's trading little changed. S&P 500 was flat at the opening, Dow Jones and Nasdaq traded 0.1% down and Russell 2000 opened 0.2% lower. Economic calendar for today is light. Traders will be offered Conference Board consumer confidence reading for August at 3:00 pm BST. Expectations are for a drop to 116.1 from 117.00 reported in July.

Source: xStation5

Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appUS2000 is trading slightly lower today. Index has recently bounced off the 1,850 pts support zone, marked with previous price reactions as well as the 200-session moving average (purple line) but bulls struggle to extend rebound. However, if the index catches a bid the 1,915 pts area should be on watch. A failure to break above this zone could mean that the right should of a head and shoulders pattern is being painted and may herald that a bigger drop is looming. However, in such a scenario a drop below the aforementioned 1,850 pts area would be needed as it would be the neckline of this potential technical setup.

Company News

Nio (NIO.US) reported a $835.1 million net loss in the second quarter, more than double of last year's loss. Adjusted loss per share reached $0.45, compared to -$0.33 expected. Revenue came in at $1.21 billion (exp. $1.27 billion). Gross margin on vehicles dropped from 16.7% in Q2 2022 to 6.2% now. Nevertheless, the company is optimistic about the future and expects solid growth in deliveries in the second half of 2023. Q3 deliveries target is now 55,000-57,000, up from 31.6 thousand delivered in Q3 2022. Q3 revenue is expected at $2.61-2.69 billion, up from $1.83 billion a year ago.

Best Buy (BBY.US) is trading higher after reporting earnings for fiscal-Q2 (calendar May-July 2023). Company reported revenue at $9.58 billion (exp. $9.52 billion) and adjusted EPS of $1.22 (exp. $1.06). Company said that slump in sales of electronics and household appliances is showing signs of easing and that next year should bring stabilization. Full-year revenue outlook was narrowed to $43.8-44.5 billion from $43.8-45.2 billion. Full-year adjusted EPS is seen at $6.00-6.40, compared to previous guidance of $5.70-6.50.

Analysts' actions

- AT&T (T.US) was upgraded to 'buy' at Citi. Price target set at $17.00

- Verizon Communications (VZ.US) was upgraded to 'buy' at Citi. Price target set at $40.00

- Oracle (ORCL.US) was upgraded to 'buy' at UBS. Price target set at $140.00

Best Buy (BBY.US) gained in the premarket after the release of fiscal-Q2 earnings but erased all of those gains before the cash session was launched. Stock bounced off the $72.50 support yesterday and should this rebound extend, a test of the $78.30 resistance zone may come next. Source: xStation5