Shares of one of the leading BigTech companies, Alphabet (GOOGL.US) are climbing nearly 7% higher today ahead of the Wall Street open. Q2 results were very solid across all business segments, with earnings from YouTube rising as well as the company's core business of Google browser advertising and search. Investors were also positive about the impact of AI and Google Cloud. Faced with the prospect of a rebound in the advertising sector, Meta Platforms (META.US, formerly Facebook) also gained today, the company will report results after today's session.

- Revenue of $74.60 billion vs. $72.77 billion forecast and $68.8 billion in Q1.

- Earnings per share (EPS): $1.44 vs. $1.32 forecast and $1.17 in Q1.

- Advertising revenue: $58.14 billion vs $57.45 billion forecast $54.44 billion in Q1.

- Google Cloud: $8.03 billion vs $7.83 billion forecasts and $7.45 billion in Q1.

- Operating margin of 29%, vs. 27.6% of forecasts and 25.35% in Q1.

- YouTube advertising revenue: $7.67 billion vs. $7.41 billion forecast and $6.69 billion in Q1.

- Other income: $8.14 billion vs. $7.17 billion forecasts

- Operating income $21.84 billion, vs. $19.96 billion forecasts

- Investments: $6.89 billion vs. $8.01 billion forecasts

The report definitely beat expectations, which the market perceived as an expression of Google's incredible resilience and dominance as a leading search engine, and at the same time as no significant loss of market share to Microsoft Bing. So the one factor that investors had feared was at least temporarily gone. YouTube ad revenue (4.4% y/y growth) increased, with better momentum in Google Cloud (28% y/y growth, momentum above 26% y/y Microsoft Azure) and positive results from other segments (GooglePlay, YouTube subscriptions). At the same time, it is noteworthy that Google's business segments outside of search represent an increasing percentage of total revenue, which the market also perceives positively as a sign of business diversification.

Ruth Porat with the new, CIO role

Analysts at Truist Securities highlighted the resilience of momentum in Google Cloud and Search and also positive operating leverage, supported by lower costs. The company also announced plans to optimize costs related to office space, which may involve additional evaluation expenses, and a change of chief investment officer - the positions will be taken over by the former CFO, Ruth Porat. Investors have recently questioned the company's ability to keep up with the growing competition in the AI industry, as illustrated by Alphabet's stock's recent rise below the Nasdaq average. Investors are pinning their hopes on the actions of Porat, considered one of Silicon Valley's top executives.

Is it time for AI?

Results showed that the company maintains its hegemonic position in the search and advertising markets. A rebound in the advertising sector could help the company increase spending on generative AI models and further improvements to Google's search capabilities. The largest component of Alphabet's investments in Q2 were servers and AI models. The company is testing how and where to place search ads in a search engine increasingly based on artificial intelligence. According to business director Schindler, up to 80% of advertisers use at least one AI search product. Google wants to integrate generative AI into Gmail and Android. Analysts also expect Google's cloud computing business growth to accelerate in late 2023 (with a bottom in June) if macro uncertainty begins to subside, driving corporate spending.

If Alphabet's (GOOGL.US) stock opens with a 7% gap, it would point to $130 - a level last seen in April 2022. The SMA100 average has proven to be a significant support level. Source: xStation5

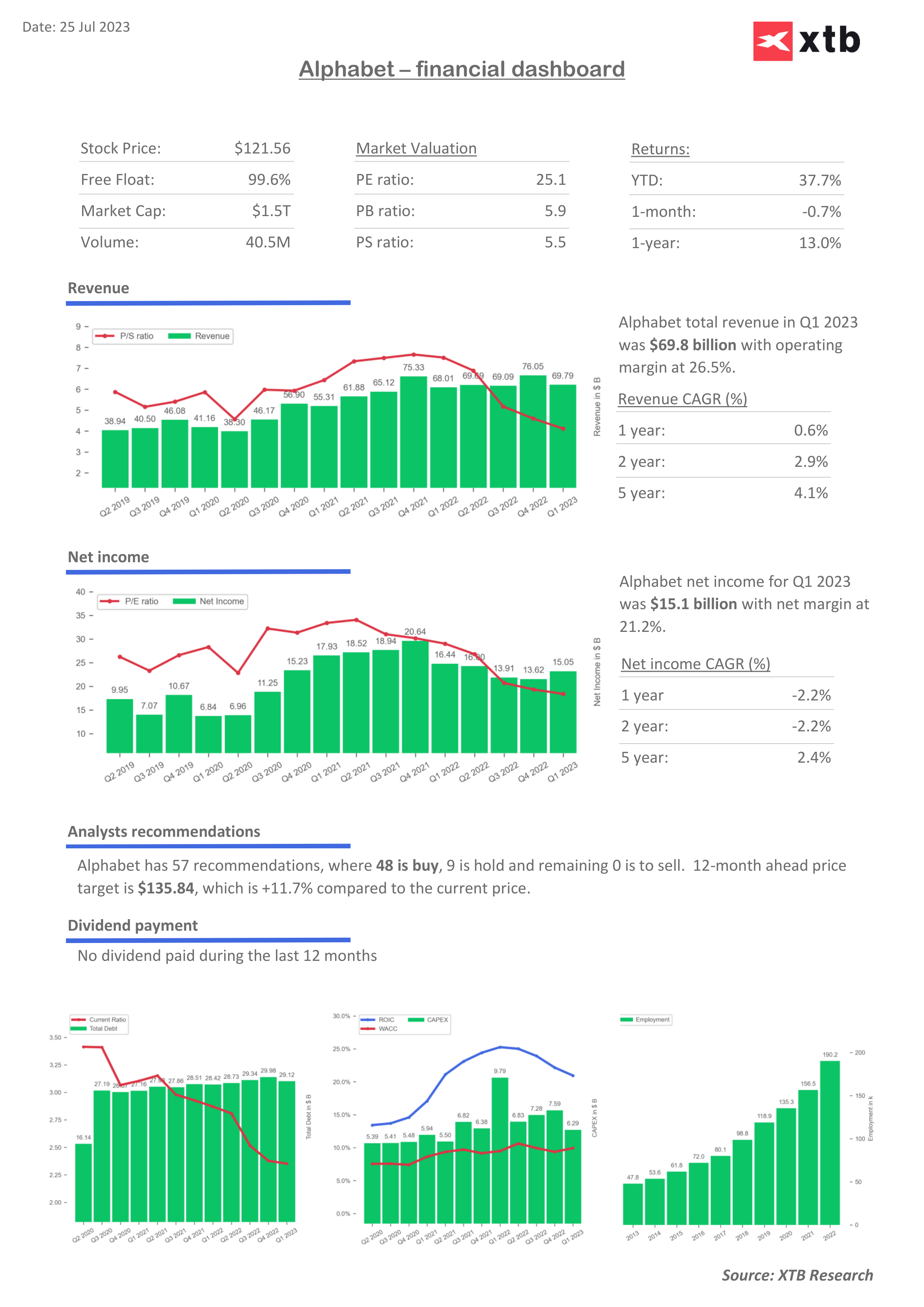

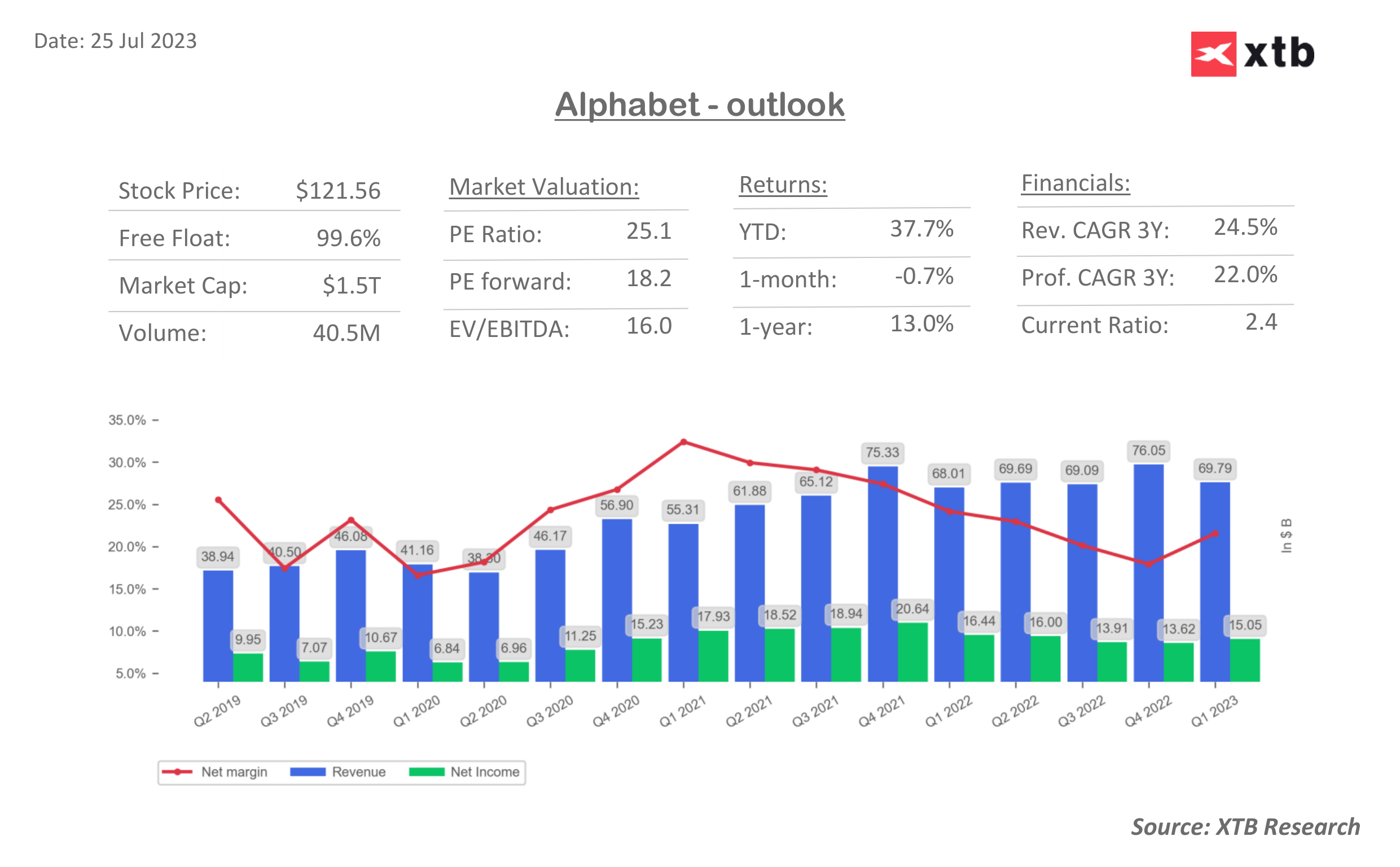

Valuation and forecasts for Alphabet